Question: G.67Assessing Risk through Data Analysis. Technology tools like IDEA can also be used to help audit teams identify items with potentially higher risks within an

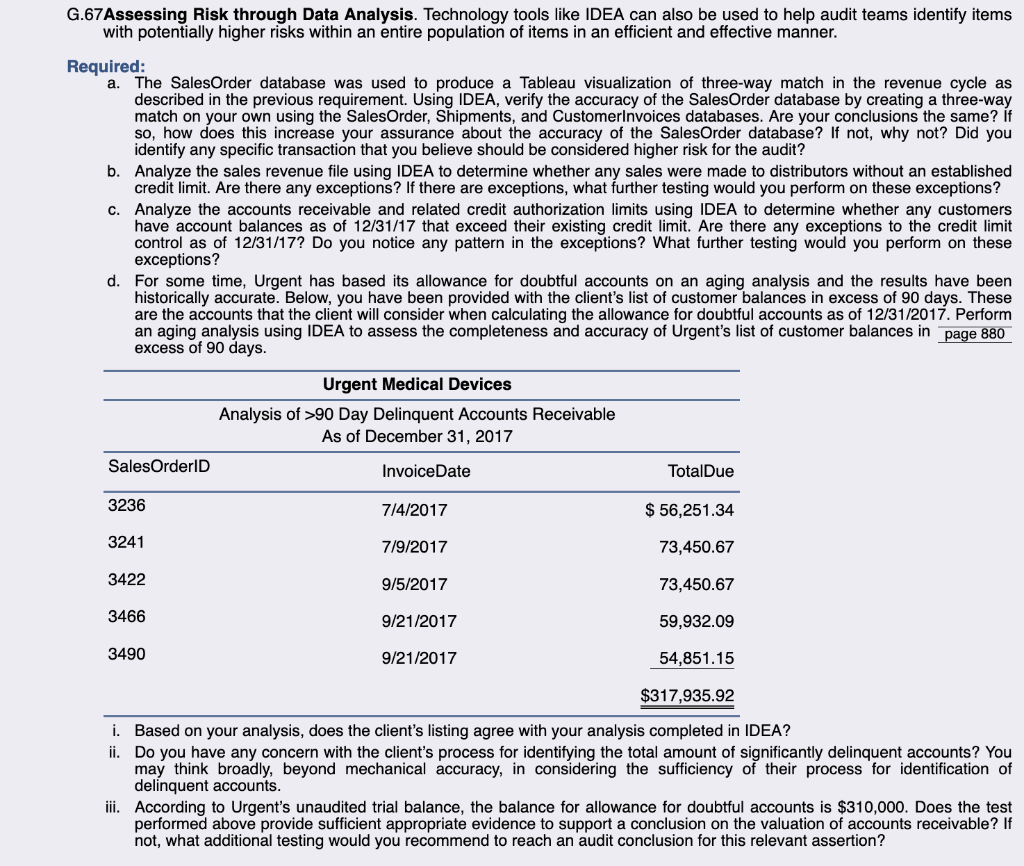

G.67Assessing Risk through Data Analysis. Technology tools like IDEA can also be used to help audit teams identify items with potentially higher risks within an entire population of items in an efficient and effective manner. Required: a. The SalesOrder database was used to produce a Tableau visualization of three-way match in the revenue cycle as described in the previous requirement. Using IDEA, verify the accuracy of the Sales Order database by creating a three-way match on your own using the Sales Order, Shipments, and Customerinvoices databases. Are your conclusions the same? If so, how does this increase your assurance about the accuracy of the SalesOrder database? If not, why not? Did you identify any specific transaction that you believe should be considered higher risk for the audit? b. Analyze the sales revenue file using IDEA to determine whether any sales were made to distributors without an established credit limit. Are there any exceptions? If there are exceptions, what further testing would you perform on these exceptions? c. Analyze the accounts receivable and related credit authorization limits using IDEA to determine whether any customers have account balances as of 12/31/17 that exceed their existing credit limit . Are there any exceptions to the credit limit control as of 12/31/17? Do you notice any pattern in the exceptions? What further testing would you perform on these exceptions? d. For some time, Urgent has based its allowance for doubtful accounts on an aging analysis and the results have been historically accurate. Below, you have been provided with the client's list of customer balances in excess of 90 days. These are the accounts that the client will consider when calculating the allowance for doubtful accounts as of 12/31/2017. Perform an aging analysis using IDEA to assess the completeness and accuracy of Urgent's list of customer balances in page 880 excess of 90 days. Urgent Medical Devices Analysis of >90 Day Delinquent Accounts Receivable As of December 31, 2017 Sales OrderID Invoice Date TotalDue 3236 7/4/2017 $ 56,251.34 3241 7/9/2017 73,450.67 3422 9/5/2017 73,450.67 3466 9/21/2017 59,932.09 3490 9/21/2017 54,851.15 $317,935.92 i. Based on your analysis, does the client's listing agree with your analysis completed in IDEA? ii. Do you have any concern with the client's process for identifying the total amount of significantly delinquent accounts? You may think broadly, beyond mechanical accuracy, in considering the sufficiency of their process for identification of delinquent accounts. iii. According to Urgent's unaudited trial balance, the balance for allowance for doubtful accounts is $310,000. Does the test performed above provide sufficient appropriate evidence to support a conclusion on the valuation of accounts receivable? If not, what additional testing would you recommend to reach an audit conclusion for this relevant assertion? G.67Assessing Risk through Data Analysis. Technology tools like IDEA can also be used to help audit teams identify items with potentially higher risks within an entire population of items in an efficient and effective manner. Required: a. The SalesOrder database was used to produce a Tableau visualization of three-way match in the revenue cycle as described in the previous requirement. Using IDEA, verify the accuracy of the Sales Order database by creating a three-way match on your own using the Sales Order, Shipments, and Customerinvoices databases. Are your conclusions the same? If so, how does this increase your assurance about the accuracy of the SalesOrder database? If not, why not? Did you identify any specific transaction that you believe should be considered higher risk for the audit? b. Analyze the sales revenue file using IDEA to determine whether any sales were made to distributors without an established credit limit. Are there any exceptions? If there are exceptions, what further testing would you perform on these exceptions? c. Analyze the accounts receivable and related credit authorization limits using IDEA to determine whether any customers have account balances as of 12/31/17 that exceed their existing credit limit . Are there any exceptions to the credit limit control as of 12/31/17? Do you notice any pattern in the exceptions? What further testing would you perform on these exceptions? d. For some time, Urgent has based its allowance for doubtful accounts on an aging analysis and the results have been historically accurate. Below, you have been provided with the client's list of customer balances in excess of 90 days. These are the accounts that the client will consider when calculating the allowance for doubtful accounts as of 12/31/2017. Perform an aging analysis using IDEA to assess the completeness and accuracy of Urgent's list of customer balances in page 880 excess of 90 days. Urgent Medical Devices Analysis of >90 Day Delinquent Accounts Receivable As of December 31, 2017 Sales OrderID Invoice Date TotalDue 3236 7/4/2017 $ 56,251.34 3241 7/9/2017 73,450.67 3422 9/5/2017 73,450.67 3466 9/21/2017 59,932.09 3490 9/21/2017 54,851.15 $317,935.92 i. Based on your analysis, does the client's listing agree with your analysis completed in IDEA? ii. Do you have any concern with the client's process for identifying the total amount of significantly delinquent accounts? You may think broadly, beyond mechanical accuracy, in considering the sufficiency of their process for identification of delinquent accounts. iii. According to Urgent's unaudited trial balance, the balance for allowance for doubtful accounts is $310,000. Does the test performed above provide sufficient appropriate evidence to support a conclusion on the valuation of accounts receivable? If not, what additional testing would you recommend to reach an audit conclusion for this relevant assertion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts