Question: Technology tools like IDEA can also be used to help audit teams identify items with potentially higher risks within an entire population of items in

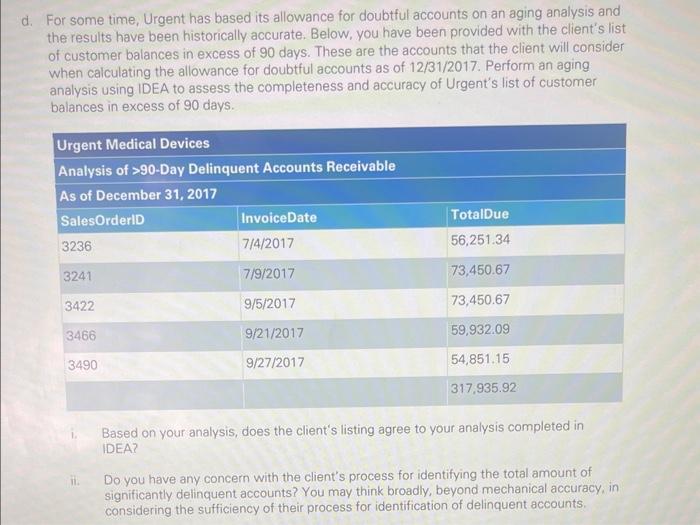

Technology tools like IDEA can also be used to help audit teams identify items with potentially higher risks within an entire population of items in an efficient and effective manner. With this in mind, complete the following steps. a. The SalesOrder database was used to produce a Tableau visualization of three-way match in the revenue cycle as described in the previous requirement. Using IDEA, verify the accuracy of the SalesOrder database by creating a three-way match on your own using the SalesOrder, Shipments, and Customerinvoices databases. Are your conclusions the same? If so, how does this increase your assurance about the accuracy of the SalesOrder database? If not, why not? Did you identify any specific transaction that you believe should be considered higher risk for the audit? b. Analyze the sales revenue file using IDEA to determine whether any sales were made to distributors without an established credit limit. Are there any exceptions? If there are exceptions, what further testing would you perform on these exceptions? c. Analyze the accounts receivable and related credit authorization limits using IDEA to determine whether any customers have account balances as of 12/31/17 that exceed their existing credit limit. Are there any exceptions to the credit limit control as of 12/31/17 ? Do you notice any pattern in the exceptions? What further testing would you perform on these exceptions? For some time, Urgent has based its allowance for doubtful accounts on an aging analysis and the results have been historically accurate. Below, you have been provided with the client's list of customer balances in excess of 90 days. These are the accounts that the client will consider when calculating the allowance for doubtful accounts as of 12/31/2017. Perform an aging analysis using IDEA to assess the completeness and accuracy of Urgent's list of customer balances in excess of 90 days. 1. Based on your analysis, does the client's listing agree to your analysis completed in IDEA? ii. Do you have any concern with the client's process for identifying the total amount of significantly delinquent accounts? You may think broadly, beyond mechanical accuracy, in considering the sufficiency of their process for identification of delinquent accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts