Question: Ganesh is a sales director has deciding whether to implement a new computer-based contact management and sales processing system for 4 years. His department has

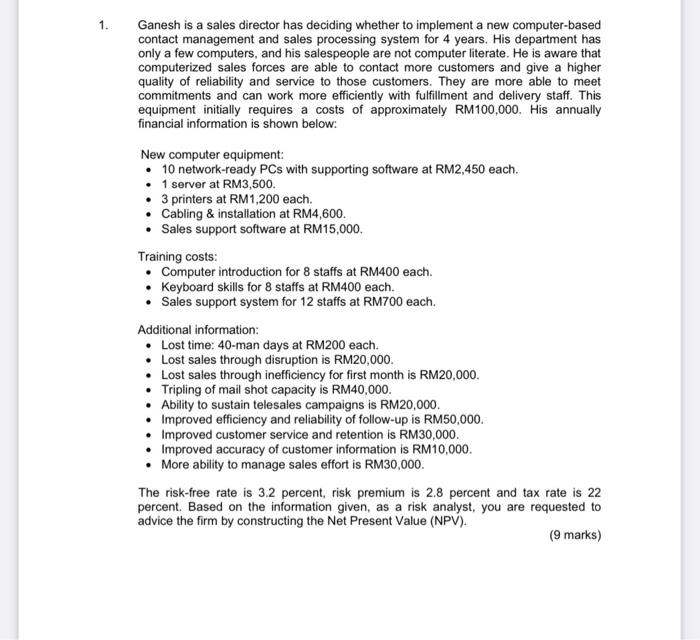

1. Ganesh is a sales director has deciding whether to implement a new computer-based contact management and sales processing system for 4 years. His department has only a few computers, and his salespeople are not computer literate. He is aware that computerized sales forces are able to contact more customers and give a higher quality of reliability and service to those customers. They are more able to meet commitments and can work more efficiently with fulfillment and delivery staff. This equipment initially requires a costs of approximately RM100,000. His annually financial information is shown below: New computer equipment: 10 network-ready PCs with supporting software at RM2,450 each. 1 server at RM3,500. 3 printers at RM1,200 each. Cabling & installation at RM4,600. Sales support software at RM15,000. Training costs: Computer introduction for 8 staffs at RM400 each. Keyboard skills for 8 staffs at RM400 each. Sales support system for 12 staffs at RM700 each. Additional information: Lost time: 40-man days at RM200 each. Lost sales through disruption is RM20,000. Lost sales through inefficiency for first month is RM20,000 Tripling of mail shot capacity is RM40,000. Ability to sustain telesales campaigns is RM20,000. Improved efficiency and reliability of follow-up is RM50,000. Improved customer service and retention is RM30,000. Improved accuracy of customer information is RM10,000. More ability to manage sales effort is RM30,000. The risk-free rate is 3.2 percent, risk premium is 2.8 percent and tax rate is 22 percent. Based on the information given, as a risk analyst, you are requested to advice the firm by constructing the Net Present Value (NPV). (9 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts