Question: Gate 1: ? Gate 2: ? Gate 3: ? Using a future worth analysis with a MARR of 20%/year, determine the preferred gate. The management

Gate 1: ?

Gate 1: ?

Gate 2: ?

Gate 3: ?

Using a future worth analysis with a MARR of 20%/year, determine the preferred gate.

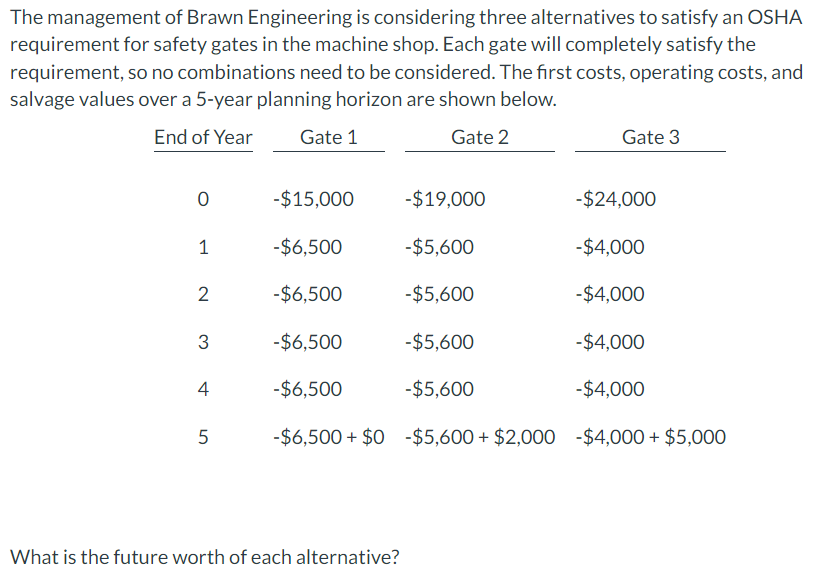

The management of Brawn Engineering is considering three alternatives to satisfy an OSHA requirement for safety gates in the machine shop. Each gate will completely satisfy the requirement, so no combinations need to be considered. The first costs, operating costs, and salvage values over a 5-year planning horizon are shown below. End of Year Gate 1 Gate 2 Gate 3 o -$15,000 -$19,000 -$24,000 1 -$6,500 -$5,600 -$4,000 2 N -$6,500 -$5,600 -$4,000 3 -$6,500 -$5,600 -$4,000 4 -$6,500 -$5,600 -$4,000 5 5 -$6,500 + $0 $5,600 + $2,000 $4,000 + $5,000 What is the future worth of each alternative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts