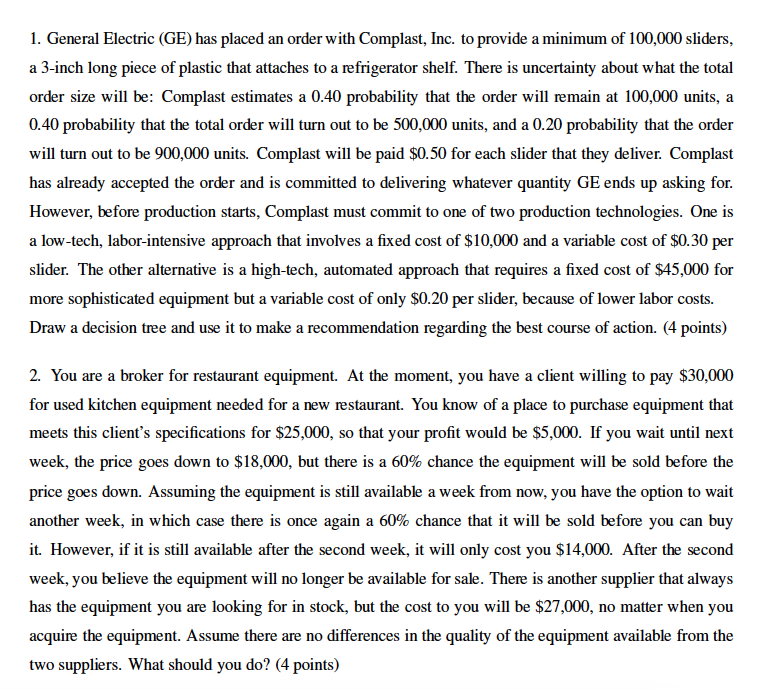

Question: General Electric ( GE ) has placed an order with Complast, Inc. to provide a minimum of 1 0 0 , 0 0 0 sliders,

General Electric GE has placed an order with Complast, Inc. to provide a minimum of sliders,

a inch long piece of plastic that attaches to a refrigerator shelf. There is uncertainty about what the total

order size will be: Complast estimates a probability that the order will remain at units, a

probability that the total order will turn out to be units, and a probability that the order

will turn out to be units. Complast will be paid $ for each slider that they deliver. Complast

has already accepted the order and is committed to delivering whatever quantity GE ends up asking for.

However, before production starts, Complast must commit to one of two production technologies. One is

a lowtech, laborintensive approach that involves a fixed cost of $ and a variable cost of $ per

slider. The other alternative is a hightech, automated approach that requires a fixed cost of $ for

more sophisticated equipment but a variable cost of only $ per slider, because of lower labor costs.

Draw a decision tree and use it to make a recommendation regarding the best course of action. points

You are a broker for restaurant equipment. At the moment, you have a client willing to pay $

for used kitchen equipment needed for a new restaurant. You know of a place to purchase equipment that

meets this client's specifications for $ so that your profit would be $ If you wait until next

week, the price goes down to $ but there is a chance the equipment will be sold before the

price goes down. Assuming the equipment is still available a week from now, you have the option to wait

another week, in which case there is once again a chance that it will be sold before you can buy

it However, if it is still available after the second week, it will only cost you $ After the second

week, you believe the equipment will no longer be available for sale. There is another supplier that always

has the equipment you are looking for in stock, but the cost to you will be $ no matter when you

acquire the equipment. Assume there are no differences in the quality of the equipment available from the

two suppliers. What should you do points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock