Question: General Forge Inc. is a machine tools manufacturing firm. You run a regression of monthly stock returns (for General Forge) against returns on the

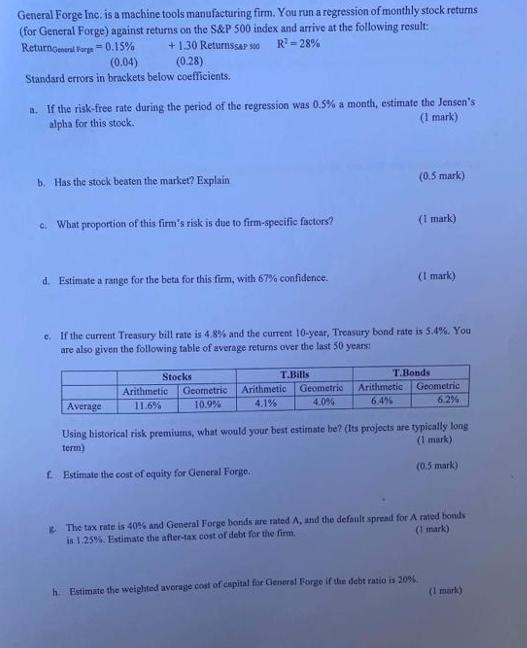

General Forge Inc. is a machine tools manufacturing firm. You run a regression of monthly stock returns (for General Forge) against returns on the S&P 500 index and arrive at the following result: ReturnGeneral Forge 0.15% + 1.30 Returns S&P 500 R=28% (0.28) (0.04) Standard errors in brackets below coefficients. n. If the risk-free rate during the period of the regression was 0.5% a month, estimate the Jensen's alpha for this stock. (1 mark) b. Has the stock beaten the market? Explain c. What proportion of this firm's risk is due to firm-specific factors? d. Estimate a range for the beta for this firm, with 67% confidence. Average Stocks e. If the current Treasury bill rate is 4.8% and the current 10-year, Treasury bond rate is 5.4%. You are also given the following table of average returns over the last 50 years: Arithmetic 11.6% Geometric 10.9% T.Bills Arithmetic Geometric 4.0% 4.1% (0.5 mark) (1 mark) Arithmetic 6.4% (1 mark) T.Bonds Geometric 6.2% Using historical risk premiums, what would your best estimate be? (Its projects are typically long term) (1 mark) f. Estimate the cost of equity for General Forge. (0.5 mark) The tax rate is 40% and General Forge bonds are rated A, and the default spread for A rated bonds is 1.25%. Estimate the after-tax cost of debt for the firm. (1 mark) h. Estimate the weighted average cost of capital for General Forge if the debt ratio is 20%. (1 mark)

Step by Step Solution

There are 3 Steps involved in it

a To estimate Jensens alpha for the stock we need to compare the actual return of the stock with the expected return based on the Capital Asset Pricing Model CAPM Jensens alpha is calculated as the ex... View full answer

Get step-by-step solutions from verified subject matter experts