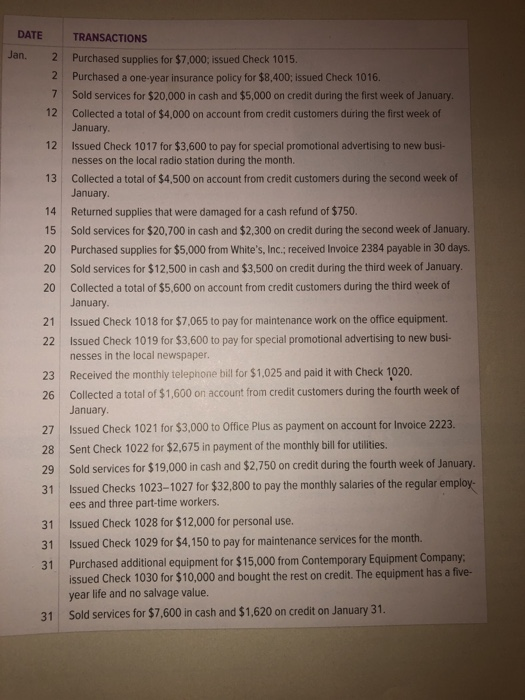

Question: general journal? how would you turn this into a general journal? 13 DATE TRANSACTIONS Jan. 2 Purchased supplies for $7,000, issued Check 1015. Purchased a

13 DATE TRANSACTIONS Jan. 2 Purchased supplies for $7,000, issued Check 1015. Purchased a one-year insurance policy for $8,400; issued Check 1016. Sold services for $20,000 in cash and $5,000 on credit during the first week of January Collected a total of $4,000 on account from credit customers during the first week of January Issued Check 1017 for $3,600 to pay for special promotional advertising to new busi nesses on the local radio station during the month. Collected a total of $4,500 on account from credit customers during the second week of January 14 Returned supplies that were damaged for a cash refund of $750. 15 Sold services for $20,700 in cash and $2,300 on credit during the second week of January 20 Purchased supplies for $5,000 from White's, Inc., received Invoice 2384 payable in 30 days 0 Sold services for $12.500 in cash and $3,500 on credit during the third week of January Collected a total of $5,600 on account from credit customers during the third week of January 21 Issued Check 1018 for $7,065 to pay for maintenance work on the office equipment. 22 Issued Check 1019 for $3.600 to pay for special promotional advertising to new nesses in the local newspaper. 23 Received the monthly telephone bill for $1,025 and paid it with Check 1020. 26 Collected a total of $1,600 on account from credit customers during the fourth week of January 27 Issued Check 1021 for $3,000 to Office Plus as payment on account for Invoice 2223. 28 Sent Check 1022 for $2,675 in payment of the monthly bill for utilities 29 Sold services for $19,000 in cash and $2,750 on credit during the fourth week of January 31 Issued Checks 1023-1027 for $32,800 to pay the monthly salaries of the regular employ- ees and three part-time workers. Issued Check 1028 for $12,000 for personal use. 31 Issued Check 1029 for $4,150 to pay for maintenance services for the month. 31 Purchased additional equipment for $15,000 from Contemporary Equipment Company issued Check 1030 for $10,000 and bought the rest on credit. The equipment has a five year life and no salvage value. 31 Sold services for $7,600 in cash and $1,620 on credit on January 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts