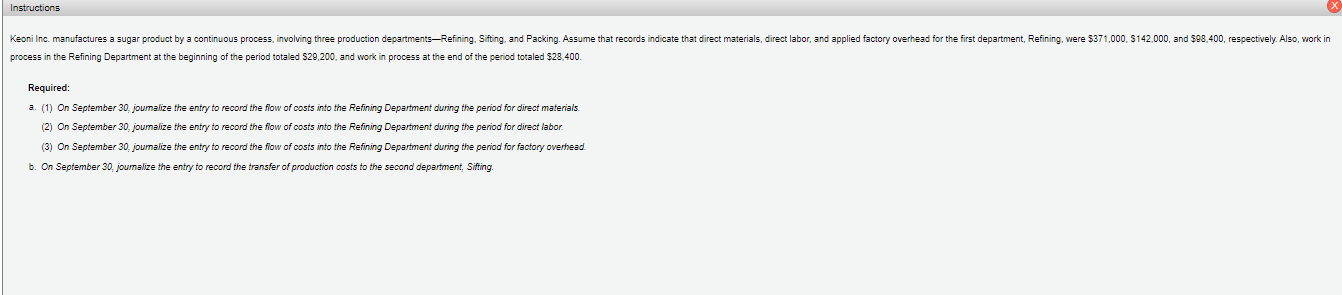

Question: General Journal Instructions a ( 1 ) . On September 3 0 , journalize the entry to record the flow of costs into the Refining

General Journal Instructions

a On September journalize the entry to record the flow of costs into the Refining Department during the period for direct materials.

PAGE

JOURNALACCOUNTING EQUATION

DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY

a On September journalize the entry to record the flow of costs into the Refining Department during the period for direct labor.

PAGE

JOURNALACCOUNTING EQUATION

DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY

a On September journalize the entry to record the flow of costs into the Refining Department during the period for factory overhead.

PAGE

JOURNALACCOUNTING EQUATION

DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY

b On September journalize the entry to record the transfer of production costs to the second department, Sifting.

PAGE

JOURNALACCOUNTING EQUATION

DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY Instructions process in the Refining Department at the beginning of the period totaled $ and work in process at the end of the period totaled $

Required:

On September joumalize the entry to record the flow of costs into the Refining Department during the period for divect materials.

On September joumalize the entry to record the flow of costs into the Refining Department during the period for divect labor.

On September joumalize the entry to record the flow of costs into the Refining Department during the period for factory overhead.

b On September joumalize the entry to record the transfer of production costs to the second department, Sifting. Chart of Accounts

General Ledger

ASSETS

Cash

Accounts Receivable

Notes Receivable

Interest Receivable

Materials

Work in ProcessRefining Department

Work in ProcessSifting Department

Work in ProcessPacking Department

Factory OverheadRefining Department

Factory OverheadSifting Department

Factory OverheadPacking Department

Finished Goods

Supplies

Prepaid Insurance

Prepaid Expenses

Land

Factory

Accumulated DepreciationFactory

LIABILITIES

Accounts Payable

Utilites Payable

Notes Payable

Interest Payable

Wages Payable

EQUITY

Common Stock

Retained Earnings

Dividends

REVENUE

Sales

Interest Revenue

EXPENSES

Cost of Goods Sold

Wages Expense

Selling Expenses

Insurance Expense

Utilities Expense

Supplies Expense

Administrative Expenses

Depreciation ExpenseFactory

Miscellaneous Expense

Interest Expense On September journalize the entry to record the flow of costs into the Refining Department during the period for factory overhead.

b On September journalize the entry to record the transfer of production costs to the second department, Sifting. a On September journalize the entry to record the flow of costs into the Refining Department during the period for direct labor.

a On September journalize the entry to record the flow of costs into the Refining Department during the period for factory overhead.

PAGE

b On September journalize the entry to record the transfer of production costs to the second department, Sifting.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock