Question: General Meter is considering two mergers. The first is with Firm A in its own volatile industry; the second is a merger with Firm B

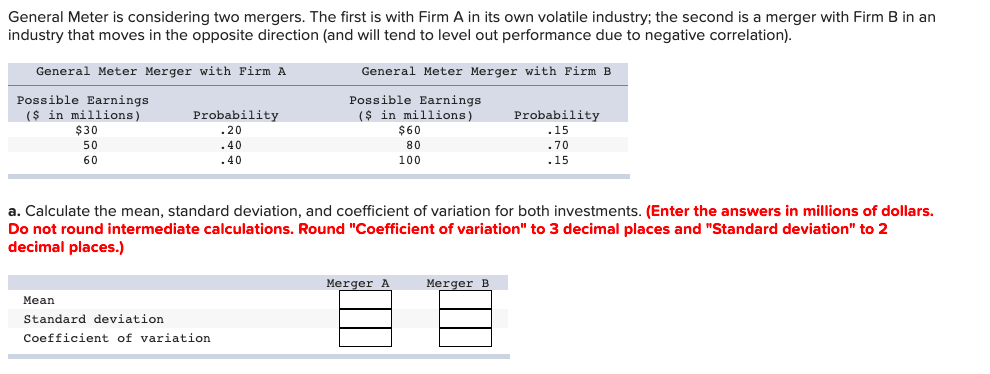

General Meter is considering two mergers. The first is with Firm A in its own volatile industry; the second is a merger with Firm B in an industry that moves in the opposite direction (and will tend to level out performance due to negative correlation). General Meter Merger with Firm A General Meter Merger with Firm B Possible Earnings ($ in millions) $30 50 60 Probability .20 .40 .40 Possible Earnings ($ in millions) $60 80 100 Probability .15 .70 .15 a. Calculate the mean, standard deviation, and coefficient of variation for both investments. (Enter the answers in millions of dollars. Do not round intermediate calculations. Round "Coefficient of variation" to 3 decimal places and "Standard deviation" to 2 decimal places.) Merger A Merger B Mean Standard deviation Coefficient of variation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts