Question: General Meter is considering two mergers. The first is with Firm A in its own volatile industry, the second is a merger with Firm B

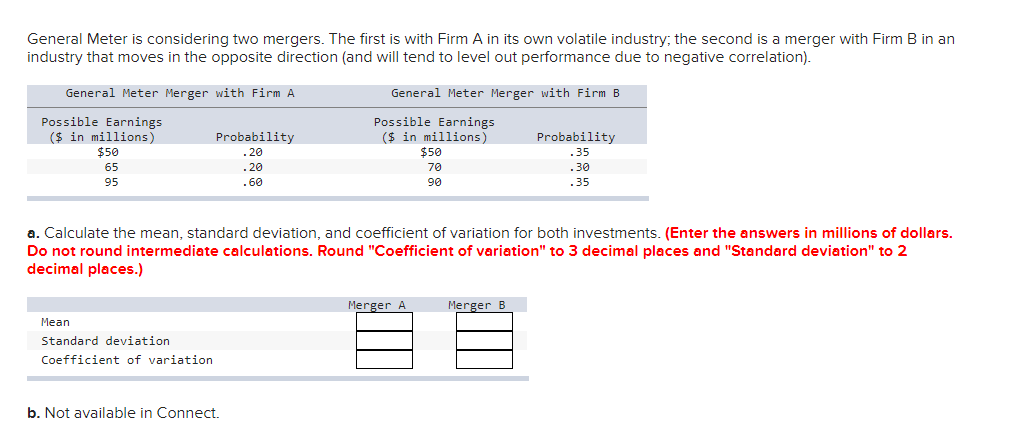

General Meter is considering two mergers. The first is with Firm A in its own volatile industry, the second is a merger with Firm B in an industry that moves in the opposite direction (and will tend to level out performance due to negative correlation). General Meter Merger with Firm A Possible Earnings ($ in millions) $50 65 95 Probability .20 . 20 .60 General Meter Merger with Firm B Possible Earnings ($ in millions) Probability $50 .35 70 .30 90 .35 a. Calculate the mean, standard deviation, and coefficient of variation for both investments. (Enter the answers in millions of dollars. Do not round intermediate calculations. Round "Coefficient of variation" to 3 decimal places and "Standard deviation" to 2 decimal places.) Merger A Merger B Mean Standard deviation Coefficient of variation b. Not available in Connect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts