Question: General Tool is purchasing a $10 million machine. It will cost $50,000 to transport and install the machine. The machine has a depreciable life of

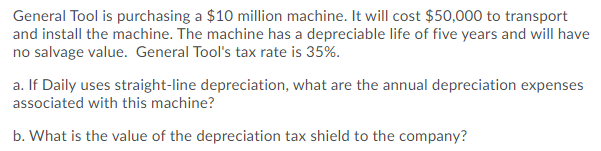

General Tool is purchasing a $10 million machine. It will cost $50,000 to transport and install the machine. The machine has a depreciable life of five years and will have no salvage value. General Tool's tax rate is 35%. a. If Daily uses straight-line depreciation, what are the annual depreciation expenses associated with this machine? b. What is the value of the depreciation tax shield to the company

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock