Question: Geo Tech Thomas Boyatt did not set out to be a player in the sustainable development are na. When he founded Geosystems Technology Group (Geo

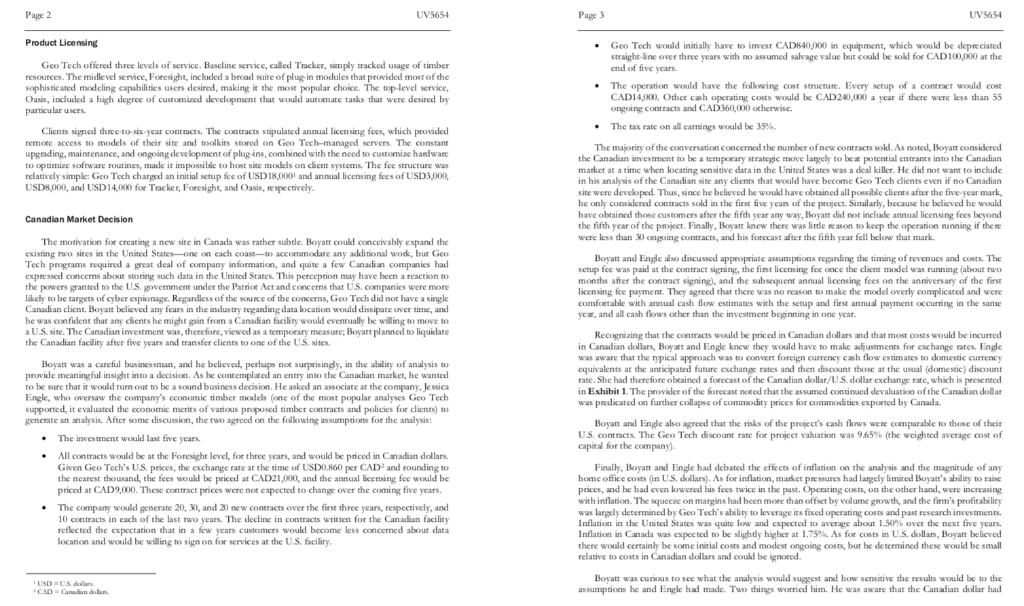

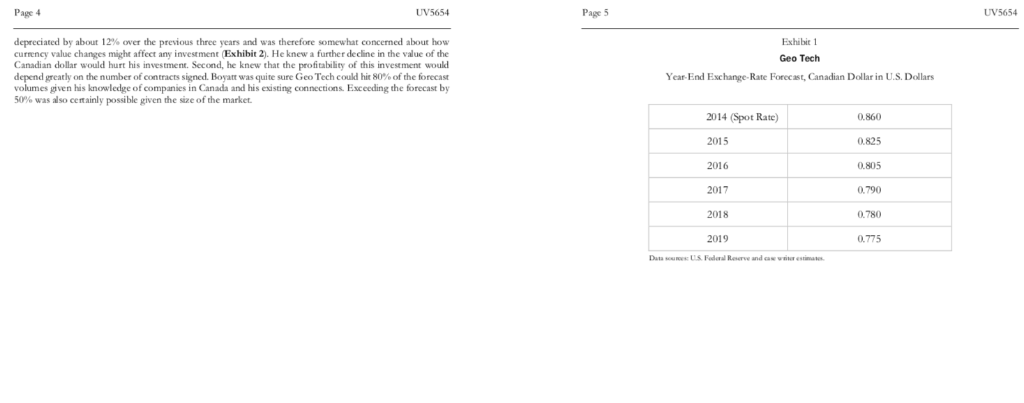

Geo Tech Thomas Boyatt did not set out to be a player in the sustainable development are na. When he founded Geosystems Technology Group (Geo Tech) in 2006 to develop and sell a geographic information system (GIS), his goal was for timberland owners to use the technology to monitor harvesting activities under sales contracts. But rising concerns about the sustainability of natural resources had greatly expanded the technology's possible applications, so the company had responded by developing a portfolio of products that enabled companies to access and explore data on their timber holdings, optimize development, and maximize long-term value. By the end of 2014, after a few early setbacks, Geo Tech was growing, and Boyatt was very pleased with the systems he was selling-valuable tools at a reasonable price. He was acutely aware, however, that even though Geo Tech's offering was still the only system of its kind with appreciable traction in the United States, a number of competing products were selling well internationally. To preempt the establishment of a competitor in Canada, where systems of this type were not yet regularly employed, Boyatt was considering the establishment of a Geo Tech facility in Alberta, Canada. Geo Tech Products As with most geographic information systems, Geo Tech's products presented geographic information digitally along spatial and temporal dimensions, allowing vast amounts of data to be manipulated intuitively for a wide variety of analytic purposes. Applications might include assessing the environmental impact of development, calculating the best delivery route for resources during natural disasters, or documenting the environmental impact of public works projects. Geo Tech leveraged these capabilities with the timber industry in mind. Within a digital model of a given client's site-derived from topographic maps and detailed ecological surveys and updated with weather data in real time-Geo Tech's sophisticated suite of products projected ecological system data dynamically, enabling the client to simulate and forecast outcomes for a variety of management strategies. A timberland owner could consider the long-term implications of various harvesting procedures, replanting choices, and development projects such as road and dam building. Information on the sites was regularly updated with spot visits. One advantage of Geo Tech's system was its ability to store and track timber contracts, which could be quite complex (specifying, for example, which types of trees could be harvested when, what kinds of access disturbances such as road building-were allowed, how long the contract lasted, and how the area would be treated after harvesting). By monitoring both compliance with these contracts and the many legal constraints in particular locations, timber companies could write contracts with a level of complexity more conducive to the development of sustainable practices. In fact, this feature had driven most of the interest in Geo Tech products and placed it at the forefront of the sustainability movement. Page 2 UV5654 Page 3 UV5654 Product Licensing Geo Tech would initially have to invest CAD840,000 in equipment, which would be depreciated straight-line over three years with no assumed salvage value but could be sokl for CAD 100,000 at the end of five years Gco Tech offered three levels of service. Baseline service, called Tracker, simply tracked usage of timber resources. The midlevel service, Foresight, included a broad suite of plug-in modules that provided most of the sophisticated modeling capabilities users desired, making it the most popular choice. The top-level service, Oasis, included a high degree of customized development that would automate tasks that were desired by particular users. The operation would have the folkwing cost structure. Every setup of a contract would cost CAD14,000. Other cash operating costs would be CAD240,000 a year if there were less than 55 ongoing contracts and CAD 360,000 otherwise. The tax rate on all earnings would be 35% Clients signed three-to-six-year contracts. The contracts stipulated annual licensing fees, which provided remote access to models of their site and toolkits stored on Geo Tech-managed servers. The constant upgrading, maintenance, and ongoing development of plug-ins, combined with the need to customize hardware to optimize software routines, made it impossible to host site models on client systems. The fee structure was relatively simple: Geo Tech charged an initial setup fee of USD 18,000 and annual licensing fees of USD3,000, USD8,000, and USD14,000 for Tracker, Foresight, and Oasis, respectively. The majority of the conversation concerned the number of new contracts sold. As noted, Boyatt considered the Canadian investment to be a temporary strategic move largely to beat potential entrants into the Canadian market at a time when locating sensitive data in the United States was a deal killer. He did not want to include in his analysis of the Canadian site any clients that would have become Geo Tech clients even if no Canadian site were developed. Thus, since he believed he would have obtained all possible clients after the five-year mark, he only considered contracts sold in the first five years of the project. Similarly, because he believed he would have obtained those customers after the fifth year any way, Boyant did not include annual licensing fees beyond the fifth year of the project. Finally, Boyat knew there was little reason to keep the operation running if there were less than 30 ongoing contracts, and his forecast after the fifth year fell below that mark. Canadian Market Decision The motivation for creating a new site in Canada was rather subtle Boyatt could conceivably expand the existing two sites in the United States one on each coast to accommodate any additional work, but Geo Tech programs required a great deal of company information, and quite a few Canadian companies had expressed concerns about storing such data in the United States. This perception may have been a reaction to the powers granted to the US government under the Patriot Act and concerns that US. companies were more likely to be targets of cyber espionage. Regardless of the source of the concerns, Gco Tech did not have a single Canadian client. Bovatt bclicved any tears in the industry regarding data location would dissipate over time, and he was confident that any clients he might gain from a Canadian facility would eventually be willing to move to a U.S. site. The Canadian investment was therefore, viewed as a temporary measure; Boyart planned to liquidate the Canadian facility after five years and transfer clients to one of the US, sites. Boyatt and inde also discussed appropriate assumptions regarding the timing of revenues and costs. The setup fee was paid at the contract signing, the first licensing fee once the client model was running about two months after the contract signing), and the subsequent annual licensing fees on the anniversary of the first licensing fee payment. They agreed that there was no reason to make the mode overly complicated and were comfortable with annual cash flow estimates with the setup and first annual payment occurring in the same year, and all cash flows other than the investment beginning in one year. Recognizing that the contracts would be price in Canadian dollars and that most costs would be incurred in Canadian dollars, Boyart and Engle knew they would have to make adjustments for exchange rates. Engle was aware that the typical approach was to convert foreign currency cash flow estimates to domestic currency equivalents at the anticipated future exchange rates and then discount those at the usual (domestic) discount rate. She had therefore obtained a forecast of the Canadian dollar/US dollar exchange rate, which is presented in Exhibit 1. The provider of the forecast noted that the assumed continued devaluation of the Canadian dollar was predicated on further collapse of commodity prices for commodities exported by Canada. Boyatt and Engle also agreed that the risks of the project's cash flows were comparable to those of their US contracts. The Geo Tech discount rate for project valuation was 9.65% (the weighted average cost of capital for the company). Boyatt was a careful businessman, and he believed, perhaps not surprisingly, in the ability of analysis to provide meaningful insight into a decision. As he contemplated an entry into the Canadian market, he wanted to be sure that it would run out to be a sound business decision. He asked an associate at the company, Jessica Engle, who oversaw the company's economic timber models (one of the most popular analyses Geo Tech supported, it evaluated the economic merits of various proposed timber contracts and policies for clients) to generate an analysis. After some discussion, the two agreed on the following assumptions for the analysis: The investment would last five years. All contracts would be at the Foresight level, for three years, and would be priced in Canadian dollars. Given Geo Tech's U.S. prices, the exchange rate at the time of USD0.860 per CAD and rounding to the nearest thousand, the fees would be priced at CAD21,000, and the annual licensing fee would be priced at CAD9,000. These contract prices were not expected to change over the coming five years. The company would generate 20,30, and 20 new contracts over the first three years, respectively, and 10 contracts in each of the last two years. The decline in contracts written for the Canadian facility reflected the expectation that in a few years customers would become less concerned about data location and would be willing to sign on for services at the U.S. facility. Finally, Boyatt and Engle had debated the effects of inflation on the analysis and the magnitude of any home office costs in U.S. dollars). As for inflation, market pressures had largely limited Boyate's ability to raise prices, and he had even lowered his fees twice in the past. Operating costs on the other hand, were increasing with inflation. The squeeze on margins had been more than offset by volume growth, and the firm's profitability was largely determined by Geo Tech's ability to leverage its fixed operating costs and past rescarch investments. Inflation in the United States was quite low and expected to average about 1.50% over the next five years. Inflation in Canada was expected to be slightly higher at 1.75%. As for costs in US dollars, Boyatt believed there would certainly be some initial costs and modest ongoing costs, but he determined these would be small relative to costs in Canadian dollars and could be ignored. USD - US dollars Boyatt was curious to see what the analysis would suggest and how sensitive the results would be to the assumptions he and Engle had made. Two things worried him. He was aware that the Canadian dollar had Page 4 UV5654 Page 5 UV5654 depreciated by about 12% over the previous three years and was therefore somewhat concerned about how currency value changes might affect any investment Exhibit 2). He knew a further decline in the value of the Canadian dollar would hurt his investment. Second, he knew that the profitability of this investment would depend greatly on the number of contracts signed. Boyat was quite sure Geo Tech could hit 80% of the forecast volumes given his knowledge of companies in Canada and his existing connections. Exceeding the forecast by 50% was also certainly possible given the size of the market. Exhibit 1 Geo Tech Year-End Exchange Rate Forecast, Canadian Dollar in U.S. Dollars 2014 (Spot Rate) 0.860 2015 0.825 2016 0.805 2017 0.790 2018 0.780 2019 0.775 Du US Federal Reserve and w e UV 5654 Geo Tech Case Study: Exhibit 2 Geo Tech Exchange Rate of Canadian Dollar in U.S. Dollars, January 2000 to December 2014 You may answer the following question. Shows the detailed calculations. USD 1.100 USD 1.000 1. Provide your best estimate of the project cash flows in Canadian dollars given the basic assumptions Boyatt believes are appropriate. Be sure to model inflation rate effects as appropriate 2. Based on the forecasted exchange rates, fine the Net Present Value (NPV) of the project in US dollars 3. Give your suggestions as to accept or reject the proposal with reasons. USD 0.900 USD 0.800 USD 0.700 USD 0.600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts