Question: part B please Your factory has been offered a contract to produce a part foc a new printer. The contract would last for 3 years

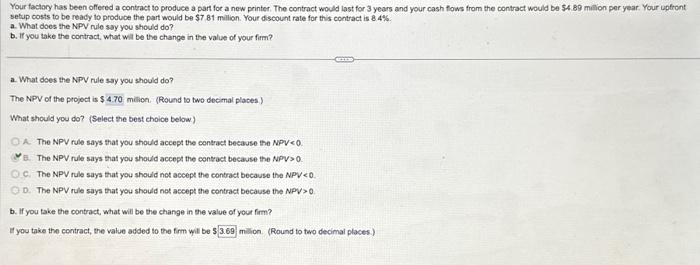

Your factory has been offered a contract to produce a part foc a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.89 milion per year. Your uptront setup costs to be ready to prodube the part would be $7.81 million. Your discount rate for this contract is 8.4%. a. What does the NPV nule say you should do? b. If you take the contract, what will be the change in the value of your firm? a. What does the NPV rule say you should do? The NPV of the projoct is $ milion. (Round to two decimal places) What should you do? (Select ree best choice below) A. The NPV rule says that you should accept the contract because the NPV 0. c. The NPV rule says that you should not accept the contract because the NPV>0 b. If you take the contract, what will be the change in the value of yout firm? Ef you take the contract, the value added to the firm wilt be s milion. (Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts