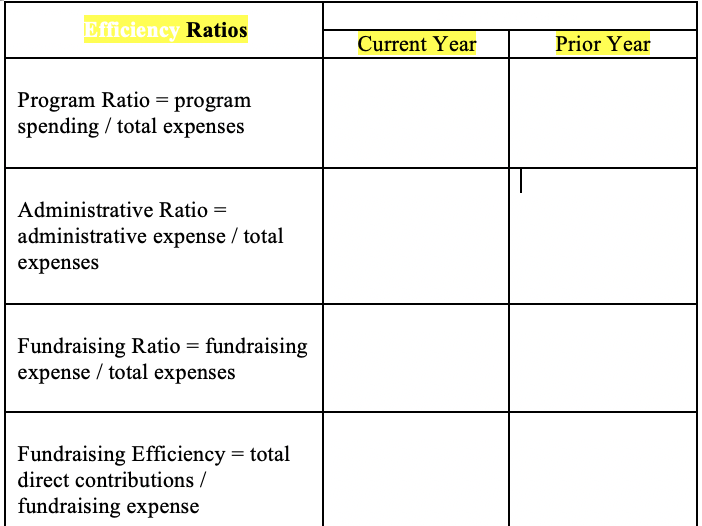

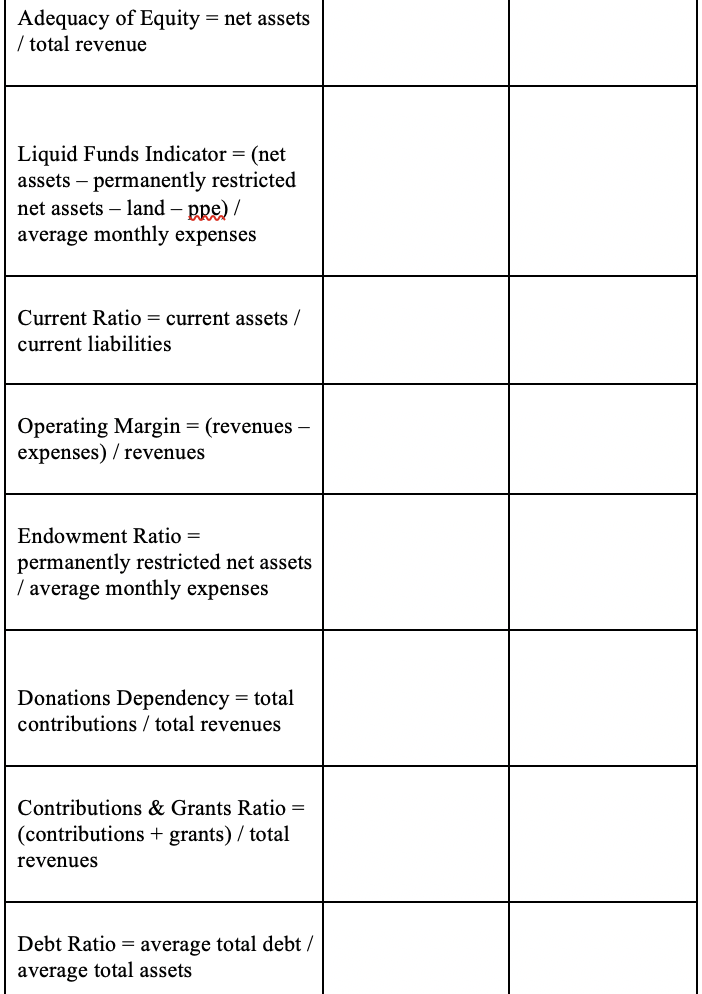

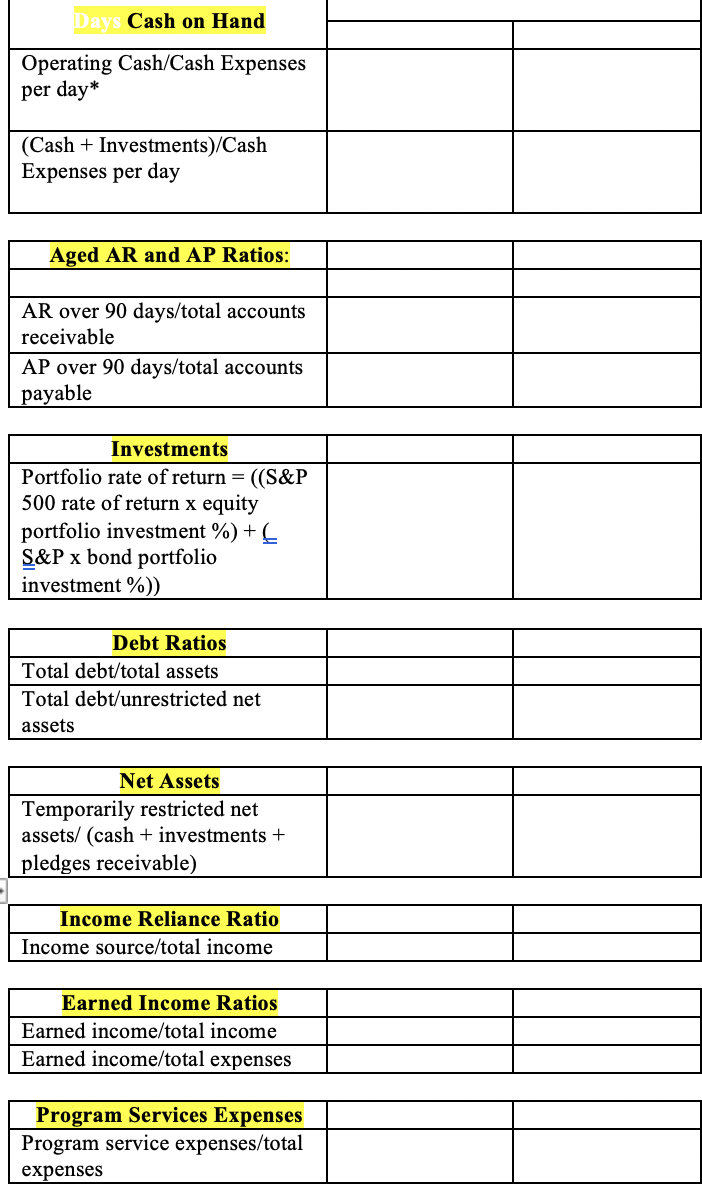

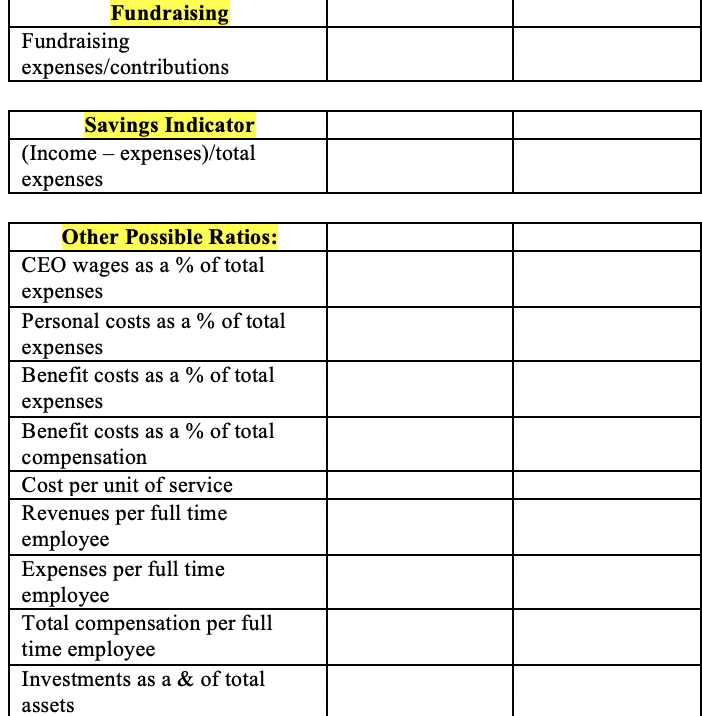

Question: Get the Data from : https://apps.irs.gov/pub/epostcard/cor/470902020_201912_990_2021021817717899.pdf formuls: Cash Expenses =Operating Exp - depreciation and amortization - in-kind exp. - unusual exp. Cash Expenses daily (per

Get the Data from: https://apps.irs.gov/pub/epostcard/cor/470902020_201912_990_2021021817717899.pdf

formuls:

- Cash Expenses =Operating Exp - depreciation and amortization - in-kind exp. - unusual exp.

- Cash Expenses daily (per day) = cash Exp. /360

Plesas calculate and show your work. write N/A if the data isn't available

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock