Question: None No answer PROBLEM 4 As part of your audit of receivables of Bunny Merchandising, you performed a cut-off test of sales. Results of the

None

No answer

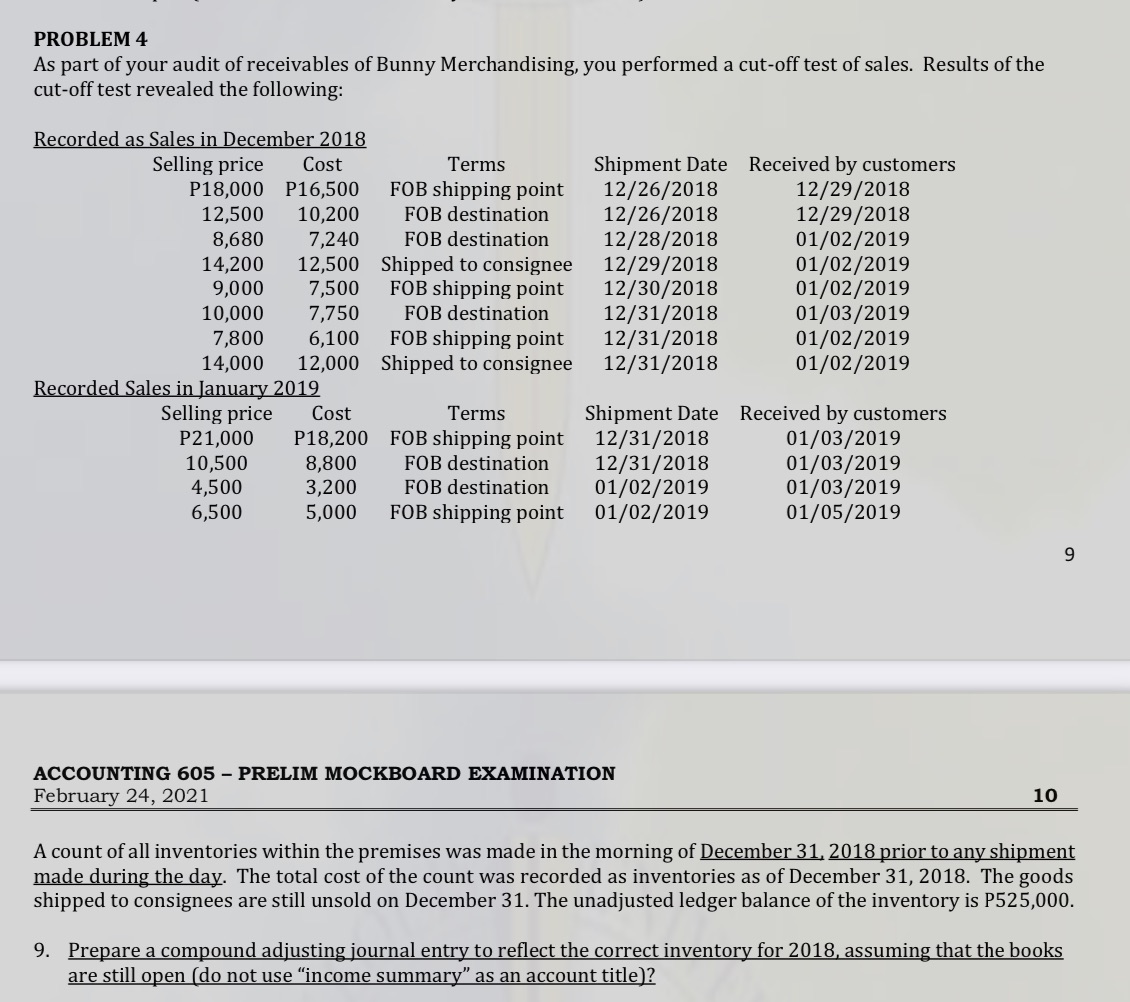

PROBLEM 4 As part of your audit of receivables of Bunny Merchandising, you performed a cut-off test of sales. Results of the cut-off test revealed the following: Recorded as Sales in December 2018 Selling price Cost Terms Shipment Date Received by customers P18,000 P16,500 FOB shipping point 12/26/2018 12/29/2018 12,500 10,200 FOB destination 12/26/2018 12/29/2018 8,680 7,240 FOB destination 12/28/2018 01/02/2019 14,200 12,500 Shipped to consignee 12/29/2018 01/02/2019 9,000 7,500 FOB shipping point 12/30/2018 01/02/2019 10,000 7,750 FOB destination 12/31/2018 01/03/2019 7,800 6,100 FOB shipping point 12/31/2018 01/02/2019 14,000 12,000 Shipped to consignee 12/31/2018 01/02/2019 Recorded Sales in January 2019 Selling price Cost Terms Shipment Date Received by customers P21,000 P18,200 FOB shipping point 12/31/2018 01/03/2019 10,500 8,800 FOB destination 12/31/2018 01/03/2019 4,500 3,200 FOB destination 01/02/2019 01/03/2019 6,500 5,000 FOB shipping point 01/02/2019 01/05/2019 9 ACCOUNTING 605 - PRELIM MOCKBOARD EXAMINATION February 24, 2021 10 A count of all inventories within the premises was made in the morning of December 31, 2018 prior to any shipment made during the day. The total cost of the count was recorded as inventories as of December 31, 2018. The goods shipped to consignees are still unsold on December 31. The unadjusted ledger balance of the inventory is P525,000. 9. Prepare a compound adjusting journal entry to reflect the correct inventory for 2018, assuming that the books are still open (do not use "income summary" as an account title)

PROBLEM 4 As part of your audit of receivables of Bunny Merchandising, you performed a cut-off test of sales. Results of the cut-off test revealed the following: Recorded as Sales in December 2018 Selling price Cost Terms Shipment Date Received by customers P18,000 P16,500 FOB shipping point 12/26/2018 12/29/2018 12,500 10,200 FOB destination 12/26/2018 12/29/2018 8,680 7,240 FOB destination 12/28/2018 01/02/2019 14,200 12,500 Shipped to consignee 12/29/2018 01/02/2019 9,000 7,500 FOB shipping point 12/30/2018 01/02/2019 10,000 7,750 FOB destination 12/31/2018 01/03/2019 7,800 6,100 FOB shipping point 12/31/2018 01/02/2019 14,000 12,000 Shipped to consignee 12/31/2018 01/02/2019 Recorded Sales in January 2019 Selling price Cost Terms Shipment Date Received by customers P21,000 P18,200 FOB shipping point 12/31/2018 01/03/2019 10,500 8,800 FOB destination 12/31/2018 01/03/2019 4,500 3,200 FOB destination 01/02/2019 01/03/2019 6,500 5,000 FOB shipping point 01/02/2019 01/05/2019 9 ACCOUNTING 605 - PRELIM MOCKBOARD EXAMINATION February 24, 2021 10 A count of all inventories within the premises was made in the morning of December 31, 2018 prior to any shipment made during the day. The total cost of the count was recorded as inventories as of December 31, 2018. The goods shipped to consignees are still unsold on December 31. The unadjusted ledger balance of the inventory is P525,000. 9. Prepare a compound adjusting journal entry to reflect the correct inventory for 2018, assuming that the books are still open (do not use "income summary" as an account title)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock