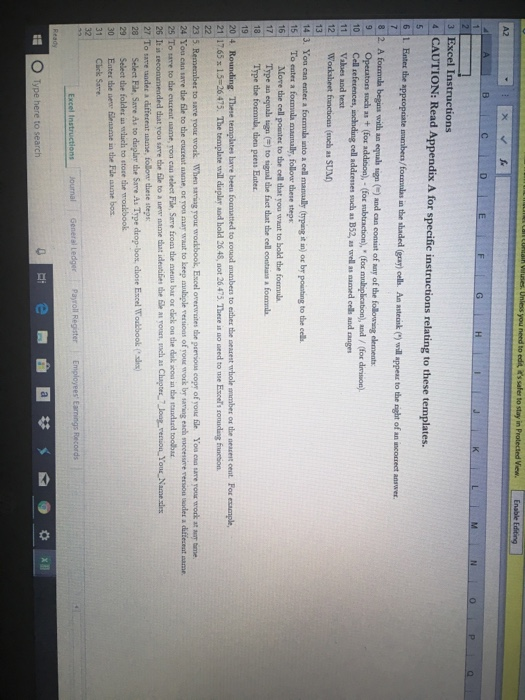

Question: GIH JK MN 3 Excel Instructions CAUTION: Read Appendix A for specific instructions relating to these templates. 6 1. Entec the appcopriste sambes/focmalas in the

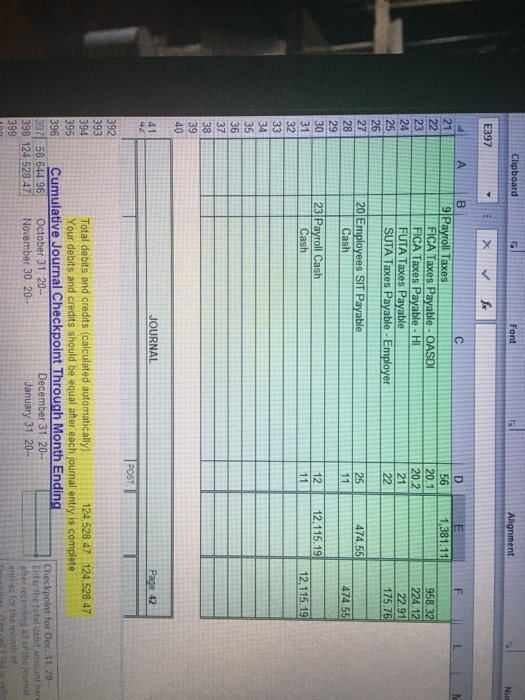

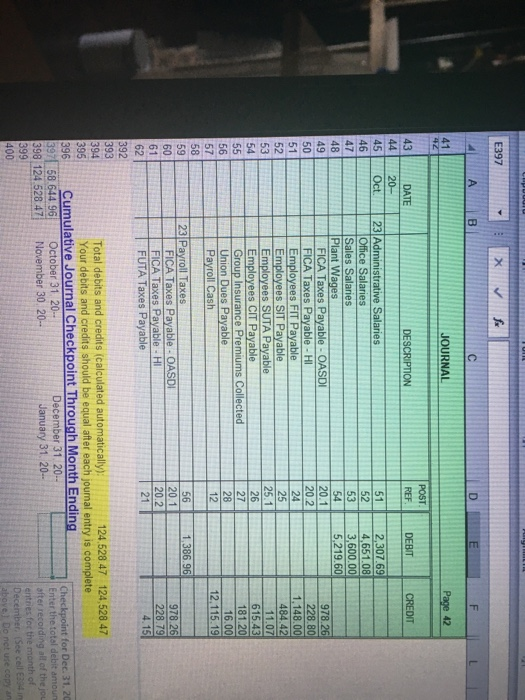

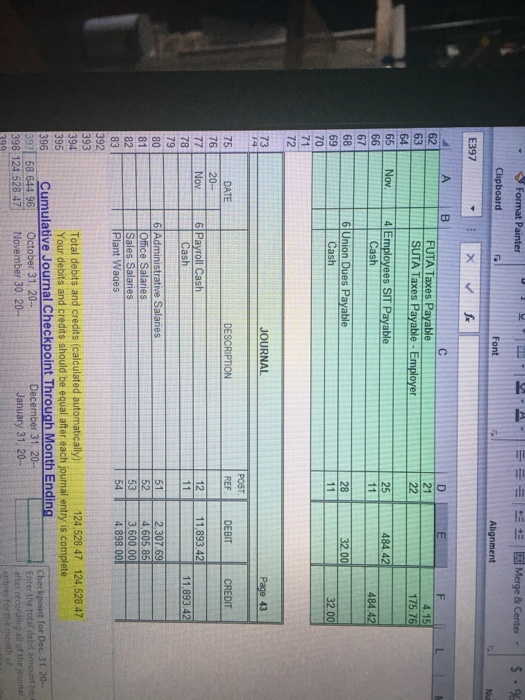

GIH JK MN 3 Excel Instructions CAUTION: Read Appendix A for specific instructions relating to these templates. 6 1. Entec the appcopriste sambes/focmalas in the shaded (gsar) cells Ank) will sppes to the sight of an iscostect anrwe 8 2 A foemla begins with an equalh sign () and cas conmsist of aay of the following elements + (for addition), (for subtraction),(or miplicabion), 0 Cell teferences, jachding cell addcees such as B52,a ellamed cels and anges 11 Valaes and test 12 Wodsheet functious (such as SUM) 3. You can entet a foemnla into a cell manally (typing i n) r by pointing t 15 To enter a formala manmually, followr these the cels e steps More the cell poistes to the cell that you want to hold the foemula Type in egal ugn to tignal the fact that the cell costaa a foamda 18Tpe the formula, then pcess Eater 204. Rounding These templates have beeu foematted to roued aeuben to ether the searest whole anamber or the neasent ceat For esampl 21 17.65 x 15-26.475. The template will display and hold 2648, not 26-475. These is no ueed to use Escel's sonndang funcsion. 23 5 Remember to lare roa work when traag your wodbook, Escel orerwutes the penun eopr of rous file You eaa tare rots work at tme 24 You can save due file to the cucreut name, or you waat to keep ulaple ressioas of you work by saing each soccessime rersion sader a daffeceat same 25 To sare to the euccent uame, roa can select File, Sare from the mmeaus bar or cick ou the diak scoa in the reaudazd toolb 26 1, recommended dat ro, sare he fle to a new n ame that ideat a, de Ele a. roun, meh as Chapte, 7 og renou Yous Nanem 27 To sare taacles a dufteceat name, follom dhese steps 28 Select Fide, Sare As to displar the Save As Type drop-box, chose Esscel Woulbook 29 Select the foldes as wluch to stoce the roxkbook 30 Eater the ea in the Fle ame bos 31 Click Same Excel t O Type here to search 41 JOURNAL DEBITCREDIT DE DATE 4 20 5 Oct9 Payroll Cash 12 12,052.01 12.052.01 Cash 512.307.69 4,651.08 3,600.00 644 898 00 9Administrative Salaries 52 53 Office Salaries Sales Salaries Plant Wages 10 958.33 224. 14 1,118.00 20.1 20.2 FICA Taxes Payable -OASDI FICA Taxes Payable -HI 13 14 16 18 Employees SIT Payable 10.85 602.89 16 00 12.052.01 25.1 Union Dues Payable Payroll Cash 19 1.381.11 56 20.1 9 Payroll Taxes FICA Taxes Payable OASDI 392 2 5 124 528 47 124 528 47 Total debits and credits (calculated automatically Your debits and credits should be equal after each jounal entry is complete 394 396 Cumulative Journal Checkpoint Through Month Ending 397 58.644 96 October 31 20- 398 124 528 47November 30 20 t for Deci 31, 20-- December 31 20- January 31 20 Clipboard E397 Payroll Taxes 1,381.11 FICA Taxes Payable-OASDI FICA Taxes Payable H 958.32 224.12 22.91 175.76 20.1 20.2 21 FUTA Taxes Payable 24 SUTA Taxes Payable-Employer 27 20 Employees SIT Payable Cash 474. 55 29 30 31 12 12,115.19 Cash 12,115.19 35 36 37 38 39 40 JOURNAL Page 42 42 392 393 394 395 396Cumulative Journal Checkpoint Through Month Endin 97 58 644 96 October 31 20- 398 124 528.47November 30 20 Total debits and credits (calculated automatically) Your debits and credits should be equal after each journal entry is complete Checkpoint for Dec. 31, 20- December 31. 20 January 31, 20 nter the total debit anount hera for the E397 JOURNAL 42 POST REF 43 DATE 44 20 45 Oct. 23 Administrative Salaries 46 47 48 49 50 CREDIT DESCRIPTION DEBIT Office Salaries Sales Salaries Plant Wages 4,651.08 978.26 228.80 FICA Taxes Payable -Hl Employees FIT Payable 24 s SIT Payable 484.42 11.0 615.43 181.20 16.00 12,115.19 Employees SUTA Payable Employees CIT Payable Group Insurance Premiums Collected Union Dues Payable Payroll Cash 1,386.96 59 20.1 202 FICA Taxes Payable H FUTA Taxes Payable 228.79 Total debits and credits (calculated automatically)y Your debits and credits should be equal after each jounal entry is complete 24.528 47 124,528 47 395 96 Cumulative Journal Checkpoint Through Month Endingi 398 124.528 47 November 30, 20- 9 December 31. 20 January 31, 20 October 31, 20 58.644 96 Enter the total debit amoun See Clip ce Font Alignment E397 A B 4.15 FUTA Taxes Payable SUTA Taxes Payable-Employer 21 64 484.42 65 Nov. 4 Employees SIT Payable 484.42 Cash 67 68 69 70 71 72 6 Union Dues Payable Cash Page 43 JOURNAL 73 POST DESCRIPTION REF DEBIT DATE 76 20- 1211.893.42 77Nov 79 81 Cash 2.307.69 4 605.85 53 3.600 0o 54 4.898.00 51 6 Administrative Salaries Office Salaries Sales Salaries Plant Wades 92 393 394 124, 528 47 124 528 47 Total debits and credits (calculated automatically) Your debits and credits should be equal after each journal entry is complete Cumulative Journal Checkpoint Through Month Ending for Dec 96 91 58 644 96October 31, 20 398 124 528 47 November 30 20- December 31, 20- January 31, 20- Sales Salaries 53 3.600.00 4,898.00 83 Plant Wages FICA Taxes Payable - OASDI FICA Taxes Payable - HI Employees FIT Payable Employees SIT Payable Employees SUTA Payable Employees CIT Payable Union Dues Payable 20.1 20.2 24 955.53 223.49 1-238.00 473.16 10.82 601.12 16.00 85 86 87 25.1 90 91 28 12 11,893.42 6 Payroll Taxes 56 20.1 20.2 1,343.71 FICA Taxes Payable OASDI FICA Taxes Payable- H SUTA Taxes Payable Employer 95 96 97 98 223.47 64.72 13 Payroll Cash 1.428.45 100 Cash 102 103 104 Pana 44 124 528.47 124.528 47 Total debits and credits (calculated automatically) Your debits and credits should be equal after each journal entry is complete 394 395 96 Cumulative Journal Checkpoint Through Month Ending 397 58 .644 96October 31 20 398 124 528 47November 30 20 December 31 20 January 31 20 Enter the total debi 108 Nov.1 109 110 13 Office Salaries 2,079.32 FICA Taxes Payable -OASDI FICA Taxes Payable H Employees FIT Payable Employees SIT Payable Employees SUTA Payable Employees CIT Payable Group Insurance Premiums Collected Payroll Cash 20.1 20.2 128.92 30.15 331.00 63.84 1.46 81.10 14.40 112 25.1 26 115 118 119 120 13 Payroll Taxes 159.07 FICA Taxes Payable -OASDI FICA Taxes Payable H 2 30.15 122 123 124 125 126 127 128 905.85 20.2 FICA Taxes Payable-Hl Employee FIT Payable 7.045 02 Cash 1.218.32 16 Employee CIT Payable 1218.3 Cash 537.00 130 393 394 Total debits and credits (calculated automatically Your debits and credits should be equal after each joumal entry is complete 124.528 47 124 528.47 395 396 Cumulative Journal Checkpoint Through Month Ending December 31 20 January 31 20 58.644 96October 31 20- 97 5 398 124 528.47 399 400 November 30 20 129 537.00 18 Employees SIT Payable 537.00 132 133 129 20 Payroll Cash 9,216.00 9.216.00 135 136 137 2.307 69 3,398.00 53 3,600.00 20 Administrative Salaries Office Salaries Sales Salaries Plant Wages 4,616.40 139 140 863.18 201.89 828.00 427.43 FICA Taxes Payable OASIDI FICA Taxes Payable Hl Employees FIT Payable Employees SIT Payable Employees SUTA Payable 20.2 142 25.1 543.02 166.80 16.00 1650 00 9 216.00 Employees CIT Payable Group Insurance Premiums Collected Union Dues Payable SIMPLE Contributions Payable Payroll Cash 150 152 393 Total debits and credits (calculated automatically) Your debits and credits should be equal after each journal entry is complete 124 528 47 124.528.47 Cumulative Journal Checkpoint Through Month Ending 306 C. 150 151 152 153 3 45 JOURNAL 154 100 POST REF DEBITCE CREDIT DESCRIPTION 56DATE 157 20 1,113.15 158 Nov.20 Payroll Taxes 863.17 2 20.1 20.2 FICA Taxes Payable OASD 2 159 160 161 162 163 164 165 166 167 168 169 170 5 FICA Taxes Payable HI SUTA Taxes Payable Employer 48.11 Total debits and credits (calculated automatically) Your debits and credits should be equal after each journal entry is complete 124.528 47 124 528.47 393 394 395 396 Cumulative Journal Checkpoint Through Month Ending December 31. 20- Type here to GIH JK MN 3 Excel Instructions CAUTION: Read Appendix A for specific instructions relating to these templates. 6 1. Entec the appcopriste sambes/focmalas in the shaded (gsar) cells Ank) will sppes to the sight of an iscostect anrwe 8 2 A foemla begins with an equalh sign () and cas conmsist of aay of the following elements + (for addition), (for subtraction),(or miplicabion), 0 Cell teferences, jachding cell addcees such as B52,a ellamed cels and anges 11 Valaes and test 12 Wodsheet functious (such as SUM) 3. You can entet a foemnla into a cell manally (typing i n) r by pointing t 15 To enter a formala manmually, followr these the cels e steps More the cell poistes to the cell that you want to hold the foemula Type in egal ugn to tignal the fact that the cell costaa a foamda 18Tpe the formula, then pcess Eater 204. Rounding These templates have beeu foematted to roued aeuben to ether the searest whole anamber or the neasent ceat For esampl 21 17.65 x 15-26.475. The template will display and hold 2648, not 26-475. These is no ueed to use Escel's sonndang funcsion. 23 5 Remember to lare roa work when traag your wodbook, Escel orerwutes the penun eopr of rous file You eaa tare rots work at tme 24 You can save due file to the cucreut name, or you waat to keep ulaple ressioas of you work by saing each soccessime rersion sader a daffeceat same 25 To sare to the euccent uame, roa can select File, Sare from the mmeaus bar or cick ou the diak scoa in the reaudazd toolb 26 1, recommended dat ro, sare he fle to a new n ame that ideat a, de Ele a. roun, meh as Chapte, 7 og renou Yous Nanem 27 To sare taacles a dufteceat name, follom dhese steps 28 Select Fide, Sare As to displar the Save As Type drop-box, chose Esscel Woulbook 29 Select the foldes as wluch to stoce the roxkbook 30 Eater the ea in the Fle ame bos 31 Click Same Excel t O Type here to search 41 JOURNAL DEBITCREDIT DE DATE 4 20 5 Oct9 Payroll Cash 12 12,052.01 12.052.01 Cash 512.307.69 4,651.08 3,600.00 644 898 00 9Administrative Salaries 52 53 Office Salaries Sales Salaries Plant Wages 10 958.33 224. 14 1,118.00 20.1 20.2 FICA Taxes Payable -OASDI FICA Taxes Payable -HI 13 14 16 18 Employees SIT Payable 10.85 602.89 16 00 12.052.01 25.1 Union Dues Payable Payroll Cash 19 1.381.11 56 20.1 9 Payroll Taxes FICA Taxes Payable OASDI 392 2 5 124 528 47 124 528 47 Total debits and credits (calculated automatically Your debits and credits should be equal after each jounal entry is complete 394 396 Cumulative Journal Checkpoint Through Month Ending 397 58.644 96 October 31 20- 398 124 528 47November 30 20 t for Deci 31, 20-- December 31 20- January 31 20 Clipboard E397 Payroll Taxes 1,381.11 FICA Taxes Payable-OASDI FICA Taxes Payable H 958.32 224.12 22.91 175.76 20.1 20.2 21 FUTA Taxes Payable 24 SUTA Taxes Payable-Employer 27 20 Employees SIT Payable Cash 474. 55 29 30 31 12 12,115.19 Cash 12,115.19 35 36 37 38 39 40 JOURNAL Page 42 42 392 393 394 395 396Cumulative Journal Checkpoint Through Month Endin 97 58 644 96 October 31 20- 398 124 528.47November 30 20 Total debits and credits (calculated automatically) Your debits and credits should be equal after each journal entry is complete Checkpoint for Dec. 31, 20- December 31. 20 January 31, 20 nter the total debit anount hera for the E397 JOURNAL 42 POST REF 43 DATE 44 20 45 Oct. 23 Administrative Salaries 46 47 48 49 50 CREDIT DESCRIPTION DEBIT Office Salaries Sales Salaries Plant Wages 4,651.08 978.26 228.80 FICA Taxes Payable -Hl Employees FIT Payable 24 s SIT Payable 484.42 11.0 615.43 181.20 16.00 12,115.19 Employees SUTA Payable Employees CIT Payable Group Insurance Premiums Collected Union Dues Payable Payroll Cash 1,386.96 59 20.1 202 FICA Taxes Payable H FUTA Taxes Payable 228.79 Total debits and credits (calculated automatically)y Your debits and credits should be equal after each jounal entry is complete 24.528 47 124,528 47 395 96 Cumulative Journal Checkpoint Through Month Endingi 398 124.528 47 November 30, 20- 9 December 31. 20 January 31, 20 October 31, 20 58.644 96 Enter the total debit amoun See Clip ce Font Alignment E397 A B 4.15 FUTA Taxes Payable SUTA Taxes Payable-Employer 21 64 484.42 65 Nov. 4 Employees SIT Payable 484.42 Cash 67 68 69 70 71 72 6 Union Dues Payable Cash Page 43 JOURNAL 73 POST DESCRIPTION REF DEBIT DATE 76 20- 1211.893.42 77Nov 79 81 Cash 2.307.69 4 605.85 53 3.600 0o 54 4.898.00 51 6 Administrative Salaries Office Salaries Sales Salaries Plant Wades 92 393 394 124, 528 47 124 528 47 Total debits and credits (calculated automatically) Your debits and credits should be equal after each journal entry is complete Cumulative Journal Checkpoint Through Month Ending for Dec 96 91 58 644 96October 31, 20 398 124 528 47 November 30 20- December 31, 20- January 31, 20- Sales Salaries 53 3.600.00 4,898.00 83 Plant Wages FICA Taxes Payable - OASDI FICA Taxes Payable - HI Employees FIT Payable Employees SIT Payable Employees SUTA Payable Employees CIT Payable Union Dues Payable 20.1 20.2 24 955.53 223.49 1-238.00 473.16 10.82 601.12 16.00 85 86 87 25.1 90 91 28 12 11,893.42 6 Payroll Taxes 56 20.1 20.2 1,343.71 FICA Taxes Payable OASDI FICA Taxes Payable- H SUTA Taxes Payable Employer 95 96 97 98 223.47 64.72 13 Payroll Cash 1.428.45 100 Cash 102 103 104 Pana 44 124 528.47 124.528 47 Total debits and credits (calculated automatically) Your debits and credits should be equal after each journal entry is complete 394 395 96 Cumulative Journal Checkpoint Through Month Ending 397 58 .644 96October 31 20 398 124 528 47November 30 20 December 31 20 January 31 20 Enter the total debi 108 Nov.1 109 110 13 Office Salaries 2,079.32 FICA Taxes Payable -OASDI FICA Taxes Payable H Employees FIT Payable Employees SIT Payable Employees SUTA Payable Employees CIT Payable Group Insurance Premiums Collected Payroll Cash 20.1 20.2 128.92 30.15 331.00 63.84 1.46 81.10 14.40 112 25.1 26 115 118 119 120 13 Payroll Taxes 159.07 FICA Taxes Payable -OASDI FICA Taxes Payable H 2 30.15 122 123 124 125 126 127 128 905.85 20.2 FICA Taxes Payable-Hl Employee FIT Payable 7.045 02 Cash 1.218.32 16 Employee CIT Payable 1218.3 Cash 537.00 130 393 394 Total debits and credits (calculated automatically Your debits and credits should be equal after each joumal entry is complete 124.528 47 124 528.47 395 396 Cumulative Journal Checkpoint Through Month Ending December 31 20 January 31 20 58.644 96October 31 20- 97 5 398 124 528.47 399 400 November 30 20 129 537.00 18 Employees SIT Payable 537.00 132 133 129 20 Payroll Cash 9,216.00 9.216.00 135 136 137 2.307 69 3,398.00 53 3,600.00 20 Administrative Salaries Office Salaries Sales Salaries Plant Wages 4,616.40 139 140 863.18 201.89 828.00 427.43 FICA Taxes Payable OASIDI FICA Taxes Payable Hl Employees FIT Payable Employees SIT Payable Employees SUTA Payable 20.2 142 25.1 543.02 166.80 16.00 1650 00 9 216.00 Employees CIT Payable Group Insurance Premiums Collected Union Dues Payable SIMPLE Contributions Payable Payroll Cash 150 152 393 Total debits and credits (calculated automatically) Your debits and credits should be equal after each journal entry is complete 124 528 47 124.528.47 Cumulative Journal Checkpoint Through Month Ending 306 C. 150 151 152 153 3 45 JOURNAL 154 100 POST REF DEBITCE CREDIT DESCRIPTION 56DATE 157 20 1,113.15 158 Nov.20 Payroll Taxes 863.17 2 20.1 20.2 FICA Taxes Payable OASD 2 159 160 161 162 163 164 165 166 167 168 169 170 5 FICA Taxes Payable HI SUTA Taxes Payable Employer 48.11 Total debits and credits (calculated automatically) Your debits and credits should be equal after each journal entry is complete 124.528 47 124 528.47 393 394 395 396 Cumulative Journal Checkpoint Through Month Ending December 31. 20- Type here to

Step by Step Solution

There are 3 Steps involved in it

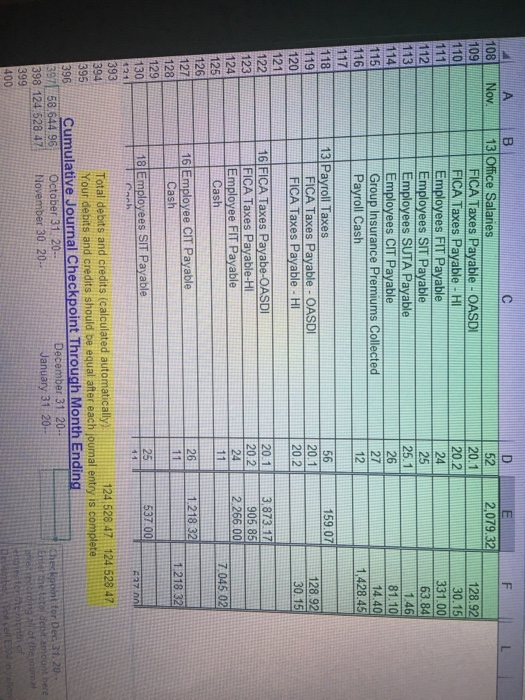

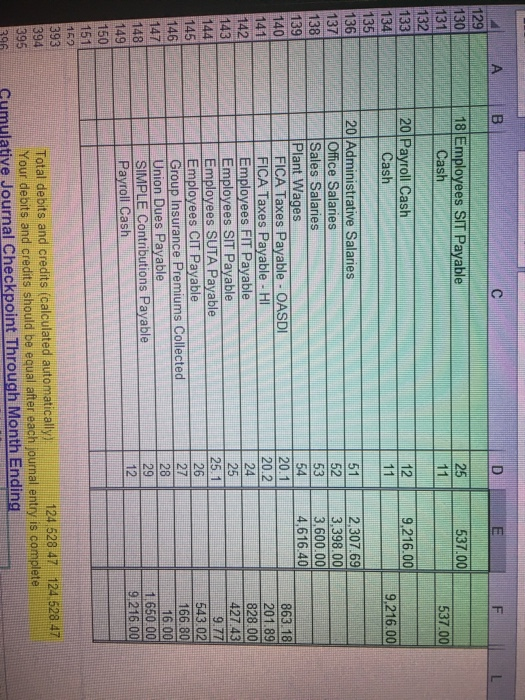

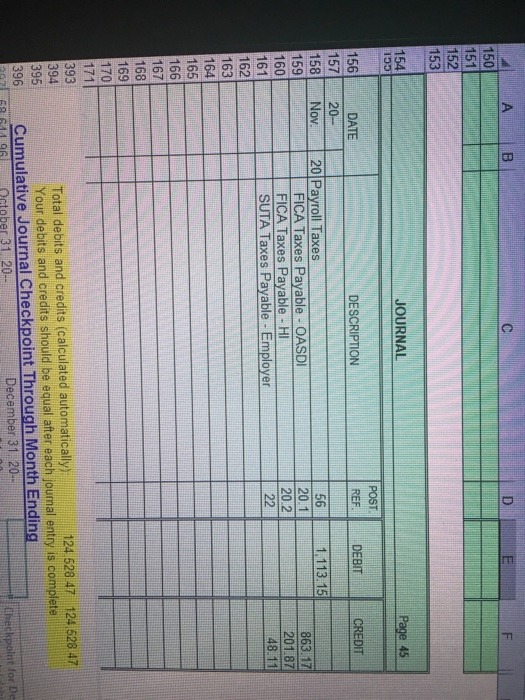

Get step-by-step solutions from verified subject matter experts