Question: give all the details please. . . 2. Consider the following information from StayYoung Cosmetics Company. Total sales $4,200 Costs $3,300 Current assets $3,600 Current

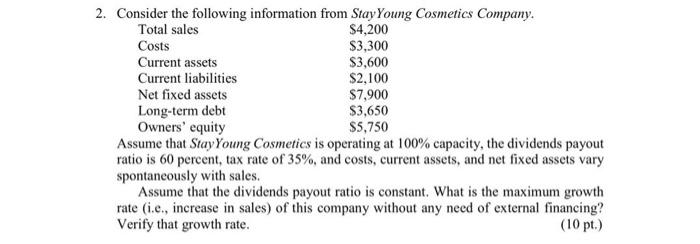

2. Consider the following information from StayYoung Cosmetics Company. Total sales $4,200 Costs $3,300 Current assets $3,600 Current liabilities $2,100 Net fixed assets $7,900 Long-term debt $3,650 Owners' equity $5,750 Assume that StayYoung Cosmetics is operating at 100% capacity, the dividends payout ratio is 60 percent, tax rate of 35%, and costs, current assets, and net fixed assets vary spontaneously with sales. Assume that the dividends payout ratio is constant. What is the maximum growth rate (.e., increase in sales) of this company without any need of external financing? Verify that growth rate. (10 pt.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts