Question: give answer in 20 mins I will thumb up 22 A company considers the following investment project (all amount are in millions of euros, all

give answer in 20 mins I will thumb up

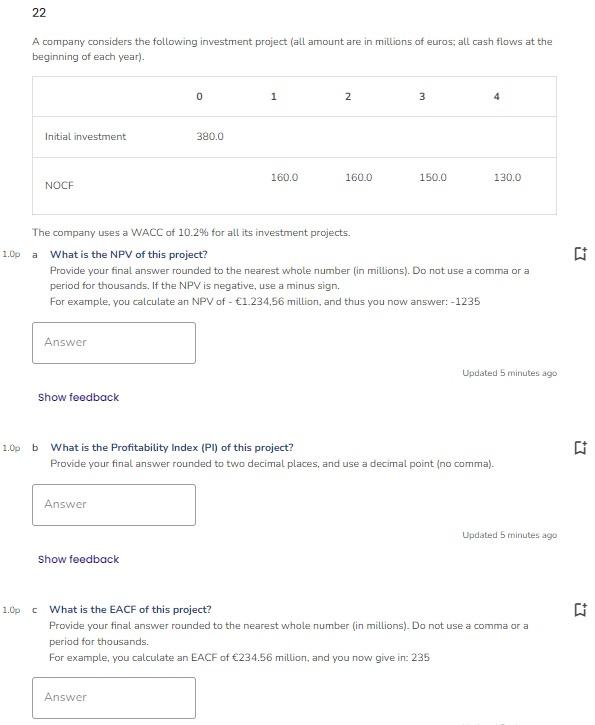

22 A company considers the following investment project (all amount are in millions of euros, all cash flows at the beginning of each year). 0 1 N 3 Initial investment 380.0 160.0 160.0 150.0 130.0 NOCE 1.0p a The company uses a WACC of 10.2% for all its investment projects. What is the NPV of this project? Provide your final answer rounded to the nearest whole number (in millions). Do not use a comma or a period for thousands. If the NPV is negative, use a minus sign. For example, you calculate an NPV of - 1.234,56 million, and thus you now answer: -1235 Answer Updated 5 minutes ago Show feedback 1.Opb +7 What is the Profitability Index (Pl) of this project? Provide your final answer rounded to two decimal places, and use a decimal point (no comma). Answer Updated 5 minutes ago Show feedback 13 1.0pc What is the EACF of this project? Provide your final answer rounded to the nearest whole number (in millions). Do not use a comma or a period for thousands For example, you calculate an EACF of 234.56 million, and you now give in: 235

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts