Question: :Give correct answers ,thanks. Introduction to international finance. Why would one select this concept of International finance for further examination? Why is it an important

:Give correct answers ,thanks.

Introduction to international finance.

Why would one select this concept of International finance for further examination?

Why is it an important aspect of financial management?

Respond to the following two posts,

Below are two participant response you must respond

back

Lisa, I believe international finance is important because it's part of our financial economics. When looking at international finance you are also thinking about exchange rates of currency, the different monetary systems in the world, foreign direct investments, foreign markets and any other financial issues connected with the international financial management. Businesses today are going global more than ever thanks to the internet which includes all major economic functions such as consumption, production and investments. It is vitally important to understand all the areas that

come with international finances and how they could affect your business. Not only does international finances affect our economic functions but also our government. Countries are known to borrow from each other, and it is good to understand how the money is used and the value of the exchange rates. One of the areas we hear most often about are the international and foreign trades which have a huge affect on the growth of economies around the world. Here in the U.S., stock watchers often see what is happening in the foreign markets because ultimately it could trickle to us and affect our market and economy. Proper management and analysis of international finances helps in managing all markets. International finance affects everything we do

so it is important to be informed on what is happening here in the U.S. and around the world.

John, It seems with each passing day our economic ties become more and more intertwined with other countries. We are truly in a global economy. The international markets impact our domestic economy much more that ever before. I think that the international finance component was included because of our global economy. I also think that when a firm is investing in financial instruments international tools are an essential tool in the financial toolbox. I, for one strongly believe in the American Economy, but I still invest a portion of our family?s investments in international funds. Not only is it easy to invest in international economies, but it certainly adds to a well rounded and diversified portfolio of investments. With so many firms doing business across national boundaries, it only makes sense to include the international finance component as a part of this class. It is also important to understand currency exchange principles and exchange rates when a firm is doing

business internationally. The firm also needs to understand tariffs, international tax rates, and other regulations. Again, it seems the inclusion of international finance was a wise addition to this class.

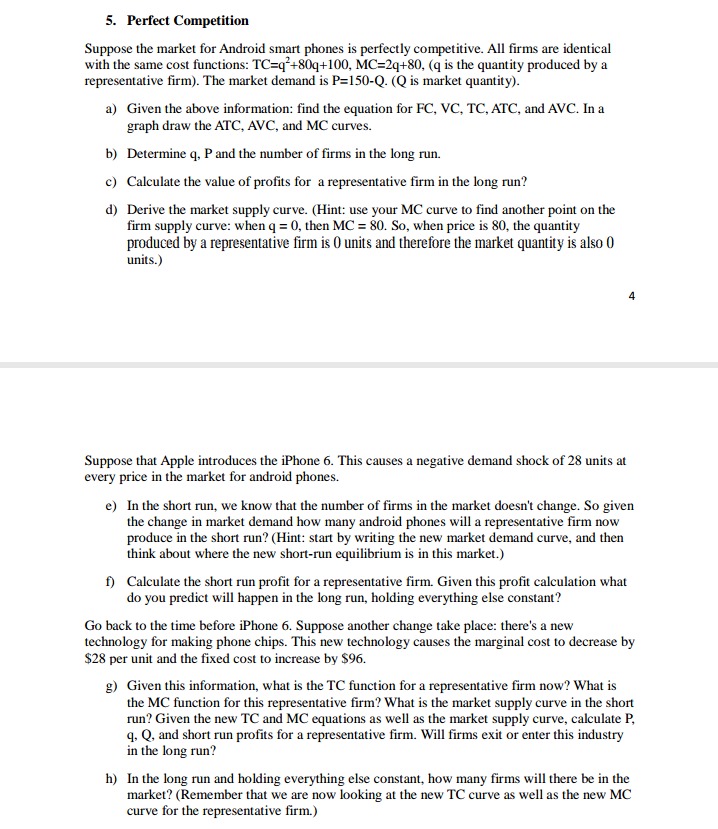

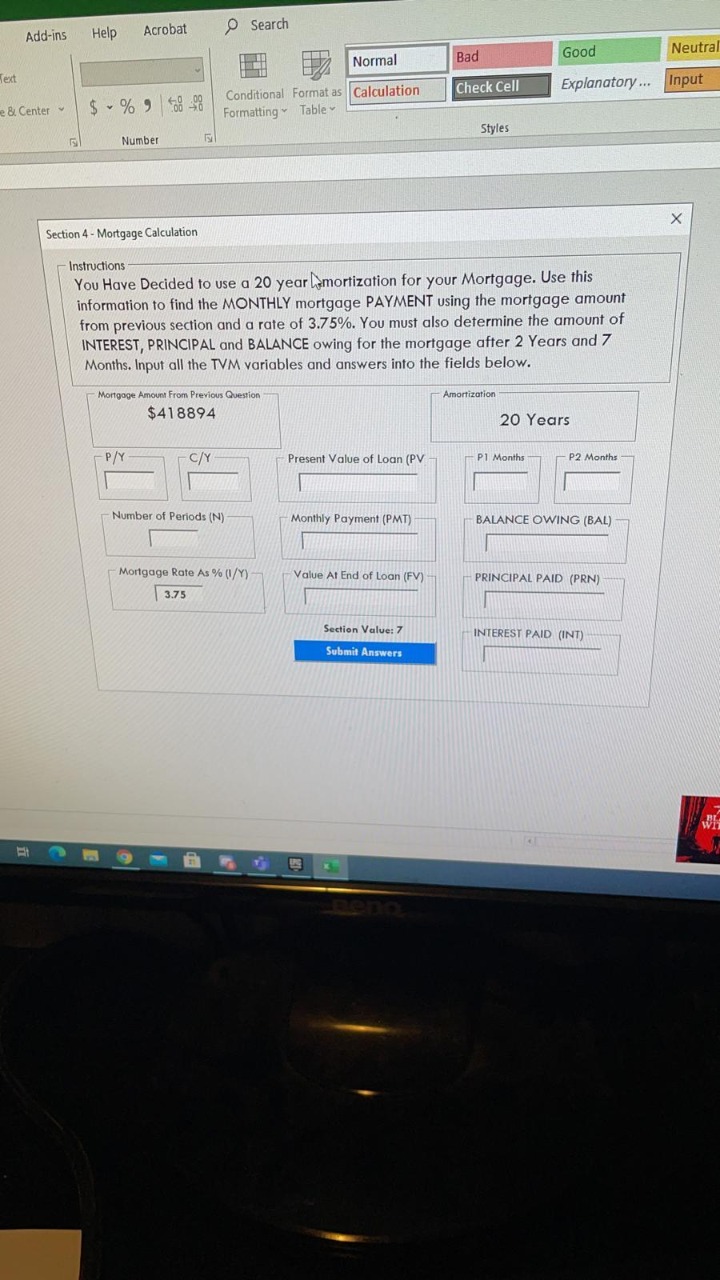

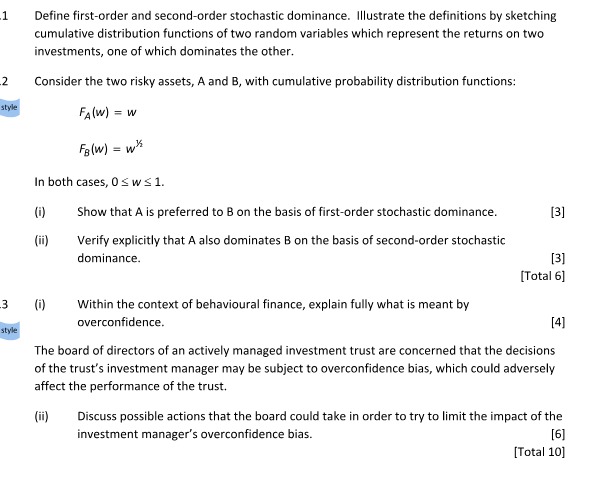

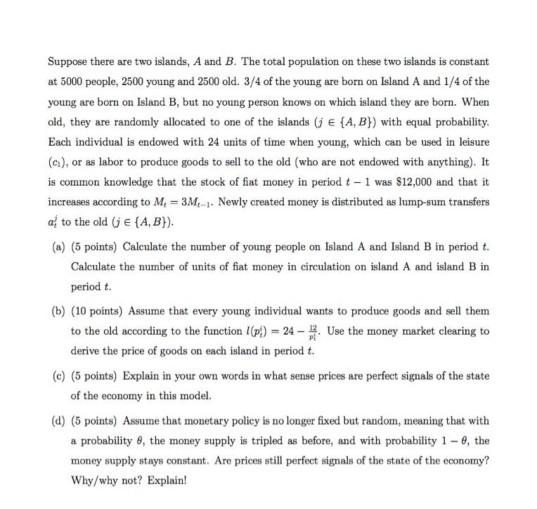

5. Perfect Competition Suppose the market for Android smart phones is perfectly competitive. All firms are identical with the same cost functions: TC=q-+80q+100, MC=2q+80, (q is the quantity produced by a representative firm). The market demand is P=150-Q. (Q is market quantity). a) Given the above information: find the equation for FC, VC, TC, ATC, and AVC. In a graph draw the ATC, AVC, and MC curves. b) Determine q, P and the number of firms in the long run. c) Calculate the value of profits for a representative firm in the long run? d) Derive the market supply curve. (Hint: use your MC curve to find another point on the firm supply curve: when q = 0, then MC = 80. So, when price is 80, the quantity produced by a representative firm is 0 units and therefore the market quantity is also 0 units.) Suppose that Apple introduces the iPhone 6. This causes a negative demand shock of 28 units at every price in the market for android phones. e) In the short run, we know that the number of firms in the market doesn't change. So given the change in market demand how many android phones will a representative firm now produce in the short run? (Hint: start by writing the new market demand curve, and then think about where the new short-run equilibrium is in this market.) f) Calculate the short run profit for a representative firm. Given this profit calculation what do you predict will happen in the long run, holding everything else constant? Go back to the time before iPhone 6. Suppose another change take place: there's a new technology for making phone chips. This new technology causes the marginal cost to decrease by $28 per unit and the fixed cost to increase by $96. g) Given this information, what is the TC function for a representative firm now? What is the MC function for this representative firm? What is the market supply curve in the short run? Given the new TC and MC equations as well as the market supply curve, calculate P, q. Q, and short run profits for a representative firm. Will firms exit or enter this industry in the long run? h) In the long run and holding everything else constant, how many firms will there be in the market? (Remember that we are now looking at the new TC curve as well as the new MC curve for the representative firm.)Add-ins Help Acrobat Search Normal Bad Good Neutra Text Conditional Format as |Calculation Check Cell Explanatory ... Input & Center $ ~ % 9 08 40 Formatting * Table Number Styles Section 4 - Mortgage Calculation X Instructions You Have Decided to use a 20 year amortization for your Mortgage. Use this information to find the MONTHLY mortgage PAYMENT using the mortgage amount from previous section and a rate of 3.75%. You must also determine the amount of INTEREST, PRINCIPAL and BALANCE owing for the mortgage after 2 Years and 7 Months. Input all the TVM variables and answers into the fields below. Mortgage Amount From Previous Question Amortization $418894 20 Years Present Value of Loan (PV P1 Months P2 Months Number of Periods (N) Monthly Payment (PMT) BALANCE OWING (BAL) Mortgage Rate As % (1/Y) Value At End of Loan (FV) PRINCIPAL PAID (PRN) 3.75 Section Value: 7 INTEREST PAID (INT) Submit Answers1 Define first-order and second-order stochastic dominance. Illustrate the definitions by sketching cumulative distribution functions of two random variables which represent the returns on two investments, one of which dominates the other. 2 Consider the two risky assets, A and B, with cumulative probability distribution functions: style FA(w) = w Fa (w) = wh In both cases, OSw $ 1. Show that A is preferred to B on the basis of first-order stochastic dominance. [3] (ii) Verify explicitly that A also dominates B on the basis of second-order stochastic dominance. [3] [Total 6] 3 Within the context of behavioural finance, explain fully what is meant by overconfidence. [4] style The board of directors of an actively managed investment trust are concerned that the decisions of the trust's investment manager may be subject to overconfidence bias, which could adversely affect the performance of the trust. (ii) Discuss possible actions that the board could take in order to try to limit the impact of the investment manager's overconfidence bias. [6] [Total 10]Suppose there are two islands, A and B. The total population on these two islands is constant at 5000 people, 2500 young and 2500 old. 3/4 of the young are born on Island A and 1/4 of the young are born on Island B, but no young person knows on which island they are born. When old, they are randomly allocated to one of the islands ( 6 {A, B}) with equal probability. Each individual is endowed with 24 units of time when young, which can be used in leisure (c), or as labor to produce goods to sell to the old (who are not endowed with anything). It is common knowledge that the stock of fiat money in period : - I was $12,000 and that it increases according to M, = 3.MY,-1. Newly created money is distributed as lump-sum transfers a, to the old (je {A, B)). (a) (5 points) Calculate the number of young people on Island A and Island B in period t. Calculate the number of units of fiat money in circulation on island A and island B in period t. (b) (10 points) Assume that every young individual wants to produce goods and sell them to the old according to the function /(p() = 24 - #. Use the money market clearing to derive the price of goods on each island in period t. (c) (5 points) Explain in your own words in what sense prices are perfect signals of the state of the economy in this model. (d) (5 points) Assume that monetary policy is no longer fixed but random, meaning that with a probability 8, the money supply is tripled as before, and with probability 1 - 9, the money supply stays constant. Are prices still perfect signals of the state of the economy? Why/why not? Explain