Question: GIVE ME FULL CALCULATION ANSWER QUESTION 2 (25 MARKS) A. As of October 2021, the risk-free rate, represented by annual return on 20-year treasury bond

GIVE ME FULL CALCULATION ANSWER

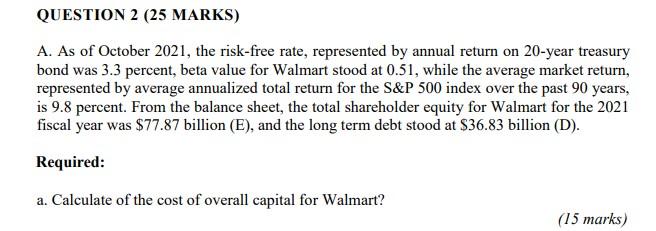

QUESTION 2 (25 MARKS) A. As of October 2021, the risk-free rate, represented by annual return on 20-year treasury bond was 3.3 percent, beta value for Walmart stood at 0.51, while the average market return, represented by average annualized total return for the S&P 500 index over the past 90 years, is 9.8 percent. From the balance sheet, the total shareholder equity for Walmart for the 2021 fiscal year was $77.87 billion (E), and the long term debt stood at $36.83 billion (D). Required: a. a. Calculate of the cost of overall capital for Walmart? (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts