Question: Give me the answer and tell me why. (Please type the answer, dont take picture.) 20. In respect to stockholders' equity, indicate which one of

Give me the answer and tell me why. (Please type the answer, dont take picture.)

Give me the answer and tell me why. (Please type the answer, dont take picture.)

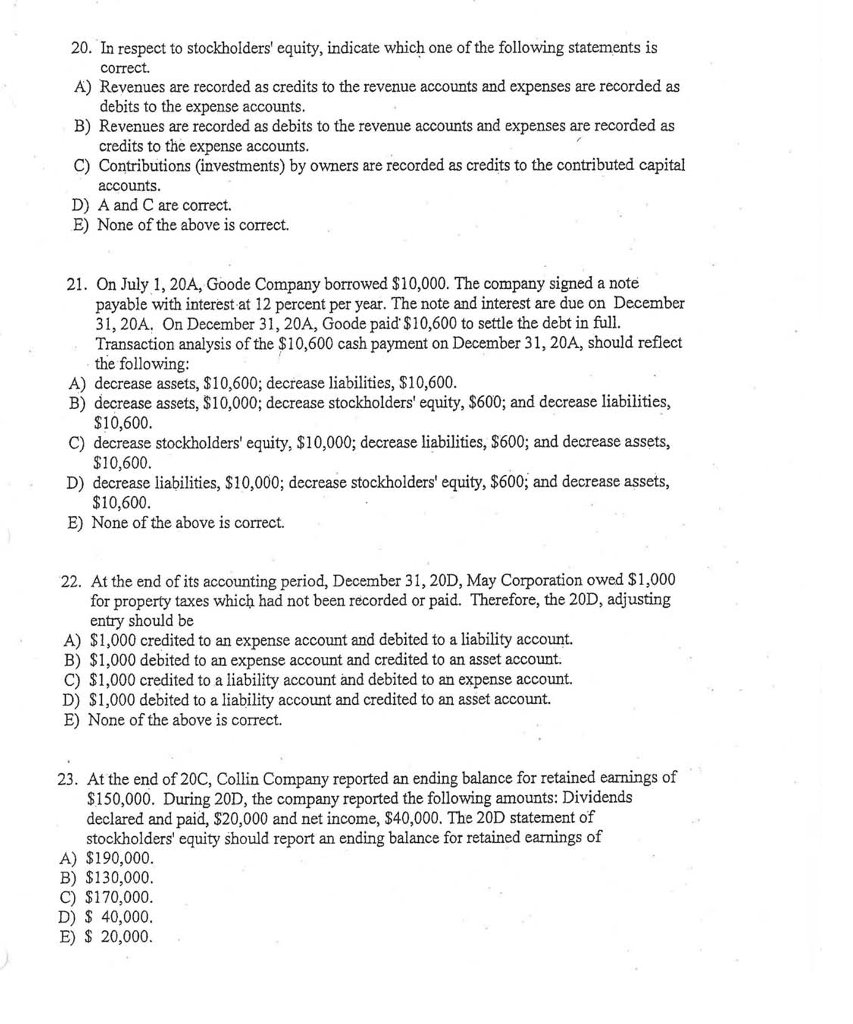

20. In respect to stockholders' equity, indicate which one of the following statements is correct. A) Revenues are recorded as credits to the revenue accounts and expenses are recorded as debits to the expense accounts B) Revenues are recorded as debits to the revenue accounts and expenses are recorded as credits to the expense accounts C) Contributions (investments) by owners are recorded as credits to the contributed capital accounts D) A and C are correct. E) None of the above is correct. 21. On July 1, 20A, Goode Company borrowed S10,000. The company signed a note payable with interest at 12 percent per year. The note and interest are due on December 31,20A. On December 31, 20A, Goode paid $10,600 to settle the debt in full. Transaction analysis of the $10,600 cash payment on December 31, 20A, should reflect the following A) decrease assets, $10,600; decrease liabilities, $10,600 B) decrease assets, $10,000; decrease stockholders' equity, $600; and decrease liabilities, C) decrease stockholders' equity, S10,000; decrease liabilities, S600; and decrease asset.s, D) decrease liabilities, $10,000; decrease stockholders' equity, $600; and decrease assets, E) None of the above is correct. $10,600 $10,600 $10,600 22. At the end of its accounting period, December 31, 20D, May Corporation owed $1,000 for property taxes which had not been recorded or paid. Therefore, the 20D, adjusting entry should be A) $1,000 credited to an expense account and debited to a liability account. B) $1,000 debited to an expense account and credited to an asset account. C) S1,000 credited to a liability account and debited to an expense account. D) S1,000 debited to a liability account and credited to an asset account. E) None of the above is correct. 23. At the end of 20C, Collin Company reported an ending balance for retained earnings of $150,000. During 20D, the company reported the following amounts: Dividends declared and paid, $20,000 and net income, S40,000. The 20D statement of stockholders' equity should report an ending balance for retained earnings of A) S190,000 B) $130,000 C) $170,000 D) S 40,000 E) S 20,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts