Question: Give right answer Kudos! Question 4 1 pts 4. Your firm is a U.S.-based exporter of bicycles. You have sold an order to a French

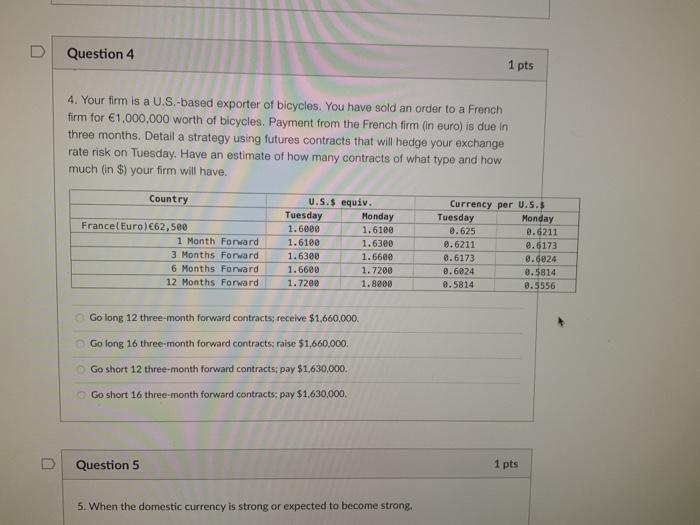

Question 4 1 pts 4. Your firm is a U.S.-based exporter of bicycles. You have sold an order to a French firm for 1,000,000 worth of bicycles. Payment from the French firm (in euro) is due in three months. Detail a strategy using futures contracts that will hedge your exchange rate risk on Tuesday. Have an estimate of how many contracts of what type and how much (in $) your firm will have. Country France(Euro)62,500 1 Month Forward 3 Months Forward 6 Months Forward 12 Months Forward U.S. $ equiv. Tuesday Monday 1.6000 1.6100 1.6100 1.6300 1.6388 1.6660 1.6600 1.7200 1.7200 1.8900 Currency per U.S. Tuesday Monday 9.625 0.6211 0.6211 0.6173 0.6173 8.6824 0.6024 8.5814 0.5814 0.5556 Go long 12 three-month forward contracts, receive $1,660,000. Golong 16 three-month forward contracts, raise $1,660,000 Go short 12 three-month forward contracts; pay $1,630,000. Go short 16 three-month forward contracts: pay $1,630,000. Question 5 1 pts 5. When the domestic currency is strong or expected to become strong

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts