Question: give right information 014 Exercise 8.7 Shareholder Wealth, NPV Maximisation and Value Added Consider the Grohl Company that is currently committed to NPV maximisation in

give right information

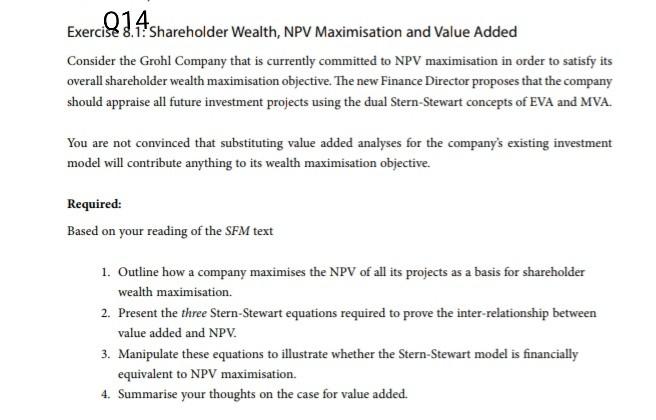

014 Exercise 8.7 Shareholder Wealth, NPV Maximisation and Value Added Consider the Grohl Company that is currently committed to NPV maximisation in order to satisfy its overall shareholder wealth maximisation objective. The new Finance Director proposes that the company should appraise all future investment projects using the dual Stern-Stewart concepts of EVA and MVA. You are not convinced that substituting value added analyses for the company's existing investment model will contribute anything to its wealth maximisation objective. Required: Based on your reading of the SFM text 1. Outline how a company maximises the NPV of all its projects as a basis for shareholder wealth maximisation 2. Present the three Stern-Stewart equations required to prove the inter-relationship between value added and NPV. 3. Manipulate these equations to illustrate whether the Stern-Stewart model is financially equivalent to NPV maximisation. 4. Summarise your thoughts on the case for value addedStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock