Question: give right information Whilst the value added debate continues, it is worth noting that the Stern-Stewart model does provide support for the MM capital structure

give right information

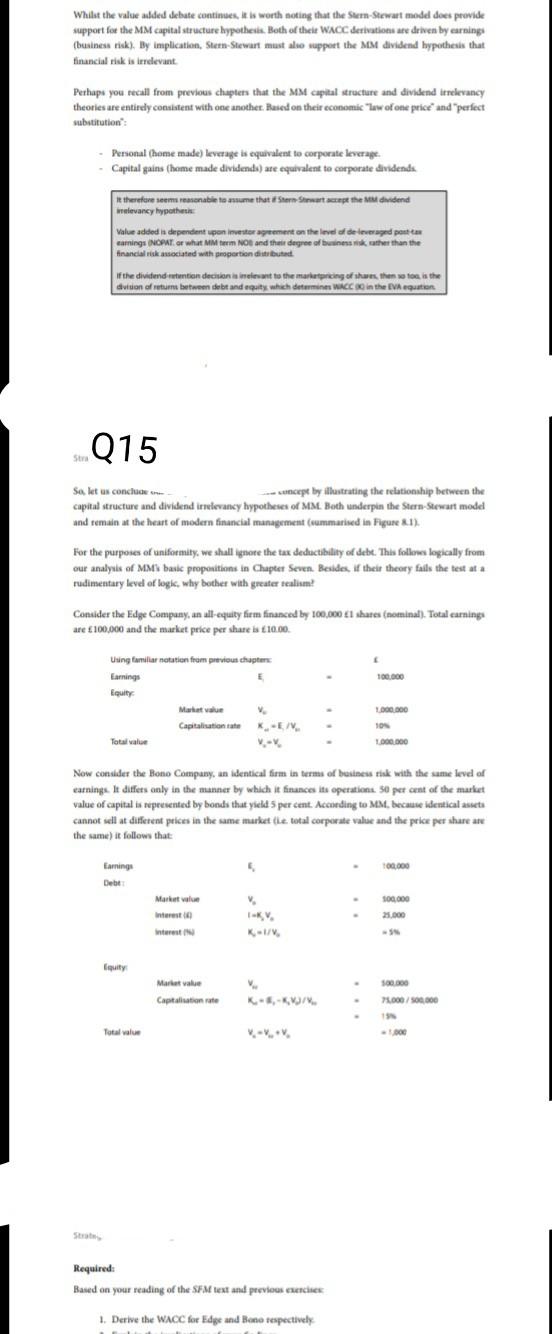

Whilst the value added debate continues, it is worth noting that the Stern-Stewart model does provide support for the MM capital structure hypothesis. Both of thelt WACC derivations are driven by earnings (business rick). By implication, Stern-Stewart must also support the MM dividend hypothesis that financial risk is irrelevant relevant Perhaps you recall from previous chapters that the MM capital structure and dividend irrelevancy theories are entirdy consistent with one another. Based on their economic law of one price and perfect substitution" Personal (home made) leverage is equivalent to corporate leverage. Capital gains (home made dividends) are equivalent to corporate dividends. is therefore seem reasonable to me that Stern Stwarte the dividend ievancy hypothes Value added is dependent upon Investor agreement on the level of de leveraged partem samnings NOPAT or what MM term NO and their degree of business is ather than the financial riskanociated with proportionate If the dividend tention decision is in to the marketing of the then toe is the dion of return between debt and equity which determine WACC in the IVA equation Q15 Stra So, let us conclude scept by illustrating the relationship between the capital structure and dividend irrelevancy hypotheses of MM. Both underpin the Stern-Stewart mode and remain at the heart of modern financial management (summarised in Figure 1). . For the purposes of uniformity, we shall ignore the tax deductibility of debt. This follows logically from our analysis of MMS basic propositions in Chapter Seven. Besides of the theory fails the test at a rudimentary level of logic, why bother with greater teslim! Consider the Edge Company, an all-equity firm financed by 100,000 1 shares (nominal). Total carnings are 100,000 and the market price per share is 10.00 100.000 Using familiar notation from previous chapters Earnings Equity Market value V Capitalisation latek KEN Total value 1.000.000 SON 1.000.000 Now consider the Bono Company, an identical firm in terms of business risk with the same leve of earnings. It differs only in the manner by which it finances its operations. 50 per cent of the market value of capital is represented by bonds that yield 5 per cent. Acceding to MM, because identical assets Cannot sell at different prices in the same market the total corporate value and the price per share are the same it follows that 100.000 Earnings Debt Market value 100.000 25.000 interest interest KU, Equity Market value Capitalisation rate 50.000 74.000/500,000 K,- Total value Required: Based on your reading of the SFM text and previous exercise 1. Derive the WACC for Edge and Bano respectivelyStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock