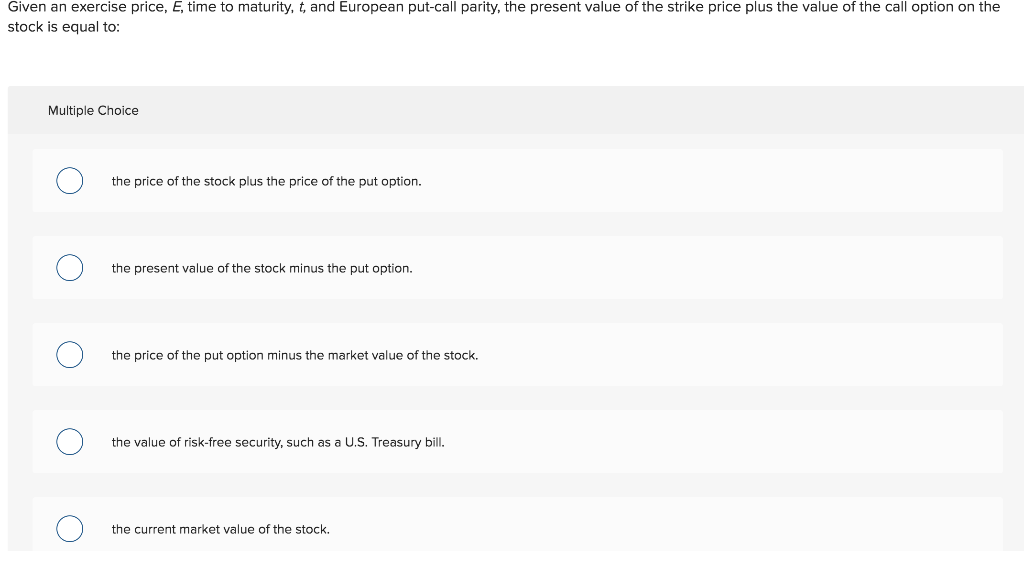

Question: Given an exercise price, E, time to maturity, t, and European put-call parity, the present value of the strike price plus the value of the

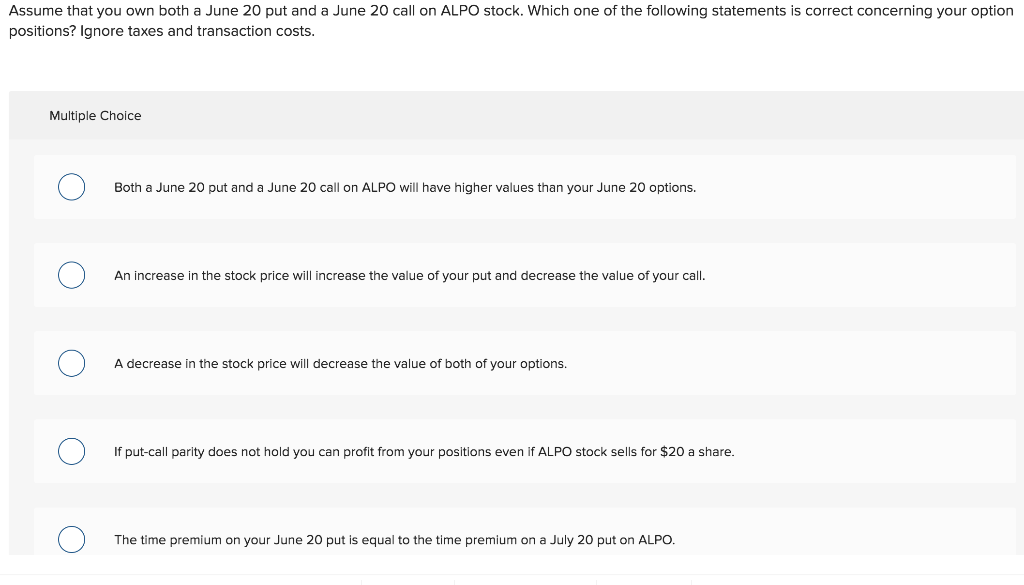

Given an exercise price, E, time to maturity, t, and European put-call parity, the present value of the strike price plus the value of the call option on the stock is equal to: Multiple Choice 0 the price of the stock plus the price of the put option. 0 O the present value of the stock minus the put option. 0 the price of the put option minus the market value of the stock. 0 O the value of risk-free security, such as a U.S. Treasury bill. 0 the current market value of the stock. Assume that you own both a June 20 put and a June 20 call on ALPO stock. Which one of the following statements is correct concerning your option positions? Ignore taxes and transaction costs. Multiple Choice Both a June 20 put and a June 20 call on ALPO will have higher values than your June 20 options. An increase in the stock price will increase the value of your put and decrease the value of your call. ooooo A decrease in the stock price will decrease the value of both of your options. If put-call parity does not hold you can profit from your positions even if ALPO stock sells for $20 a share. The time premium on your June 20 put is equal to the time premium on a July 20 put on ALPO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts