Question: Given below are data on investments. Asset under management (AUM) in millions of dollars, expected rate of return, and standard deviation are given. Investment

- Given below are data on investments. Asset under management (AUM) in millions of dollars, expected rate of return, and standard deviation are given.

| Investment | AUM (M$) | Expected Return % | Standard deviation % |

| Omega | 500 | 10 | 7 |

| Beta | 800 | 8 | 5 |

| Gamma | 600 | 12 | 9 |

Based on VaR criteria at 5% level, rank the three investments (best rank=1).

Using Roy's safety first criteria, rank the three investments. Assume RL is 2%.

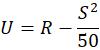

Assume an investor's utility function (U) is given as follows

U = R 2 50

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

To rank the three investments based on the Value at Risk VaR criteria at a 5 level we need to calculate the VaR for each investment and then rank them ... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock