Question: Given below is the post - closing trial balance from the previous accounting period. The assignment is to joumal the transactions and all adjusting entries

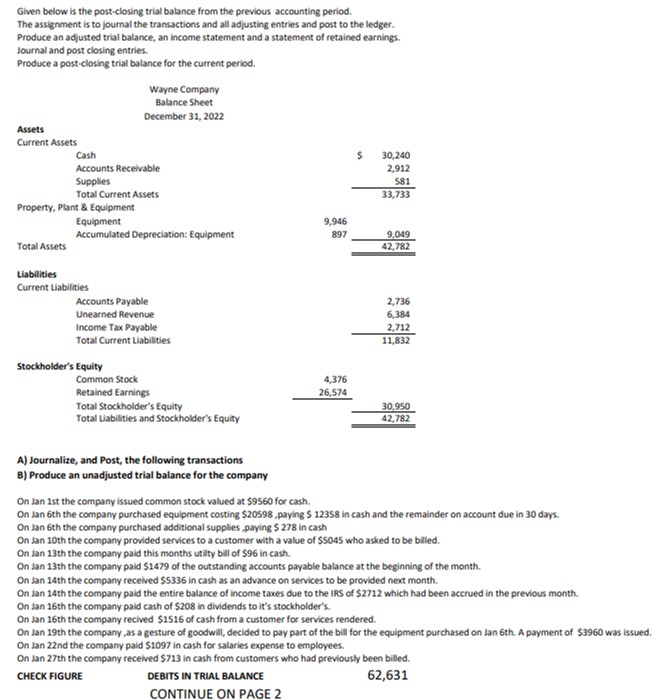

Given below is the postclosing trial balance from the previous accounting period.

The assignment is to joumal the transactions and all adjusting entries and post to the ledger.

Produce an adjusted trial balance, an income statement and a statement of retained earnings.

Journal and post closing entries.

Produce a postclosing trial balance for the current period.

Wayne Company

Balance Sheet

December

Assets

Current Assets

Cash

Accounts Receivable

Supplies

Total Current Assets

Property, Plant & Equipment

Equipment

Accumulated Depreciation: Equipment

Total Assets

Llabilities

Current Liabilities

Accounts Payable

Unearned Revenue

Income Tax Payable

Total Current Liabilities

Stockholder's Equity

Common Stock

Retained Earnings

Total Stockholder's Equity

Total Liabilities and Stockholder's Equity

A Journalize, and Post, the following transactions

B Produce an unadjusted trial balance for the company

On lan st the company issued common stock valued at $ for cash.

On Jan th the company purchased equipment costing $ paying $ in cash and the remainder on account due in days.

On Jan th the company purchased additional supplies, paying $ in cash

On Jan th the company provided services to a customer with a value of $ who asked to be billed.

On Jan th the company paid this months utily bill of $ in cash.

On Jan th the company paid $ of the outstanding accounts payable balance at the beginning of the month.

On Jan th the company received $ in cash as an advance on services to be provided next month.

On Jan th the company paid the entire balance of income taxes due to the IRS of $ which had been accrued in the previous month.

On Jan th the company paid cash of $ in dividends to it's stockholder's.

On Jan th the company recived $ of cash from a customer for services rendered.

On Jan th the company, as a gesture of goodwill, decided to pay part of the bill for the equipment purchased on lan th A payment of $ was issued.

On Jan nd the company paid $ in cash for salaries expense to employees.

On Jan th the company received $ in cash from customers who had previously been billed.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock