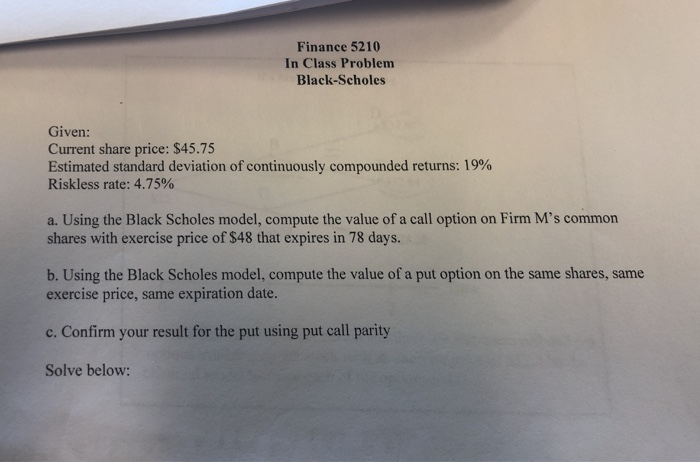

Question: Given Current share price: $45.75 Estimated standard deviation of continuously compounded returns: 19% Riskless rate: 4.75% A. Using the black scholes model, compute the value

Given

Current share price: $45.75

Estimated standard deviation of continuously compounded returns: 19%

Riskless rate: 4.75%

A. Using the black scholes model, compute the value of a call option on firm Ms common shares with exercise price of $48 that expires in 78 days.

B. Using the black scholes model, compute the value of a put option on the same shares, same exercise prices, same expiration date

C. Confirm your result for the put using the put call parity

Finance 5210 In Class Problem Black-Scholes Given: Current share price: $45.75 Estimated standard deviation of continuously compounded returns: 19% Riskless rate: 4.75% a. Using the Black Scholes model, compute the value of a call option on Firm M's common shares with exercise price of $48 that expires in 78 days. b Using the Blaek Scholesodel, computcthe valuc ofa u pto on e same shares, same exercise price, same expiration date. c. Confirm your result for the put using put call parity Solve below

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock