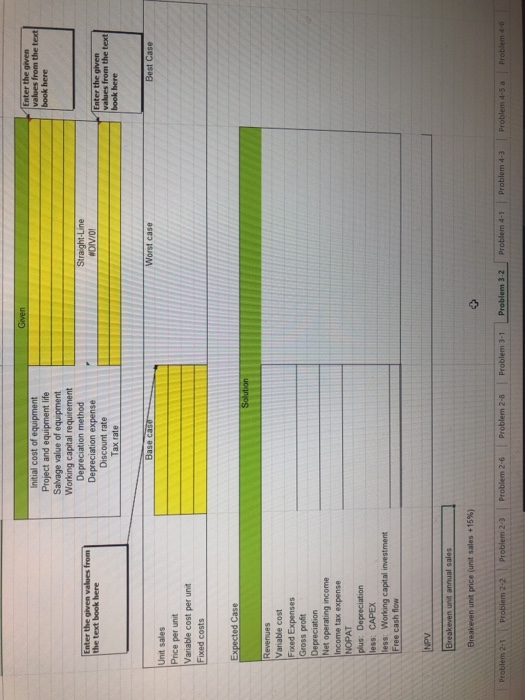

Question: Given Enter the given values from the text book here Initial cost of equipment Project and equipment life Salvage value of equipment Working capital requirement

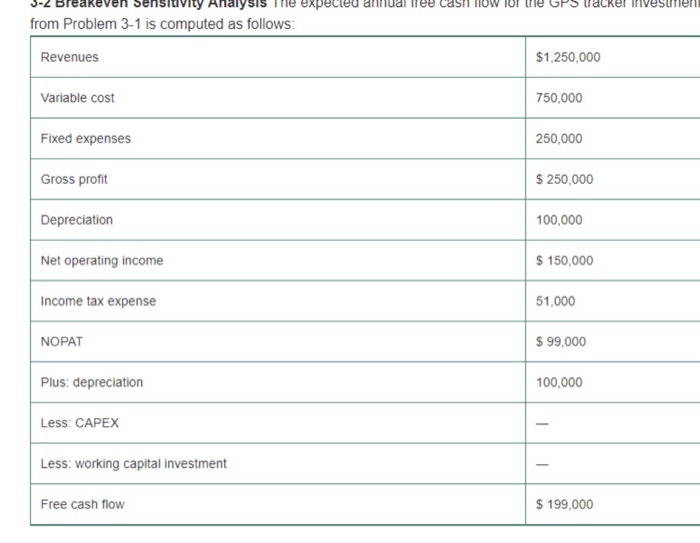

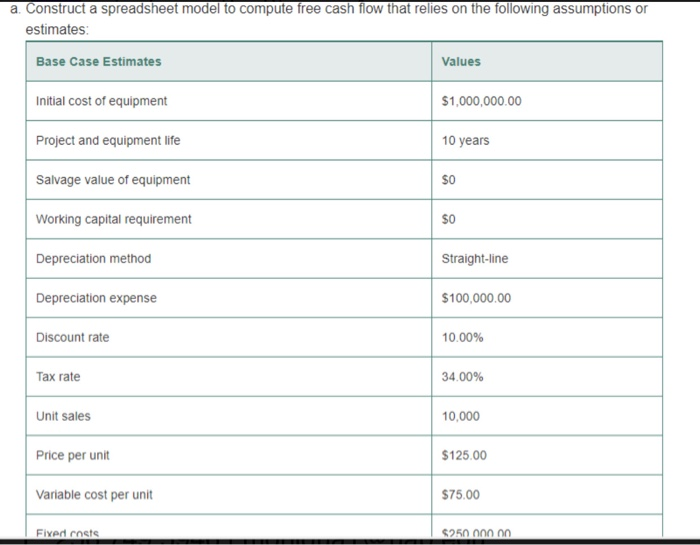

Given Enter the given values from the text book here Initial cost of equipment Project and equipment life Salvage value of equipment Working capital requirement Depreciation method Depreciation expense Discount rate Tax rate Enter the given values from the text book here Straight-Line NDIV/0! Enter the given values from the text book here Base Case Worst case Best Case Unit sales Price per unit Variable cost per unit Fixed costs Expected Case Solution Revenues Variable cost Fixed Expenses Gross profit Depreciation Net operating income Income tax expense NOPAT plus: Depreciation less: CAPEX less: Working capital investment Free cash flow NPV Breakeven unit annual sales Breakeven unit price (unit sales +15%) Problem 2-1 Problem 2-2 Problem 2-3 Problem 2-6 Problem 2-8 Problem 3-1 Problem 3-2 Problem 4-1 Problem 4-3 Problem 4-5 a Problem 4-6 expected annual fee Casti IUW acker from Problem 3-1 is computed as follows: Revenues $1,250,000 Variable cost 750,000 Fixed expenses 250,000 Gross profit $ 250,000 Depreciation 100,000 Net operating income $ 150,000 Income tax expense 51,000 NOPAT $ 99,000 Plus depreciation 100,000 Less: CAPEX Less: working capital investment Free cash flow $ 199,000 a Construct a spreadsheet model to compute free cash flow that relies on the following assumptions or estimates: Base Case Estimates Values Initial cost of equipment $1,000,000.00 Project and equipment life 10 years Salvage value of equipment SO Working capital requirement SO Depreciation method Straight-line Depreciation expense $100,000.00 Discount rate 10.00% Tax rate 34.00% Unit sales 10,000 Price per unit $125.00 Variable cost per unit $75.00 Fixed costs $250 annnn Given Enter the given values from the text book here Initial cost of equipment Project and equipment life Salvage value of equipment Working capital requirement Depreciation method Depreciation expense Discount rate Tax rate Enter the given values from the text book here Straight-Line NDIV/0! Enter the given values from the text book here Base Case Worst case Best Case Unit sales Price per unit Variable cost per unit Fixed costs Expected Case Solution Revenues Variable cost Fixed Expenses Gross profit Depreciation Net operating income Income tax expense NOPAT plus: Depreciation less: CAPEX less: Working capital investment Free cash flow NPV Breakeven unit annual sales Breakeven unit price (unit sales +15%) Problem 2-1 Problem 2-2 Problem 2-3 Problem 2-6 Problem 2-8 Problem 3-1 Problem 3-2 Problem 4-1 Problem 4-3 Problem 4-5 a Problem 4-6 expected annual fee Casti IUW acker from Problem 3-1 is computed as follows: Revenues $1,250,000 Variable cost 750,000 Fixed expenses 250,000 Gross profit $ 250,000 Depreciation 100,000 Net operating income $ 150,000 Income tax expense 51,000 NOPAT $ 99,000 Plus depreciation 100,000 Less: CAPEX Less: working capital investment Free cash flow $ 199,000 a Construct a spreadsheet model to compute free cash flow that relies on the following assumptions or estimates: Base Case Estimates Values Initial cost of equipment $1,000,000.00 Project and equipment life 10 years Salvage value of equipment SO Working capital requirement SO Depreciation method Straight-line Depreciation expense $100,000.00 Discount rate 10.00% Tax rate 34.00% Unit sales 10,000 Price per unit $125.00 Variable cost per unit $75.00 Fixed costs $250 annnn

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts