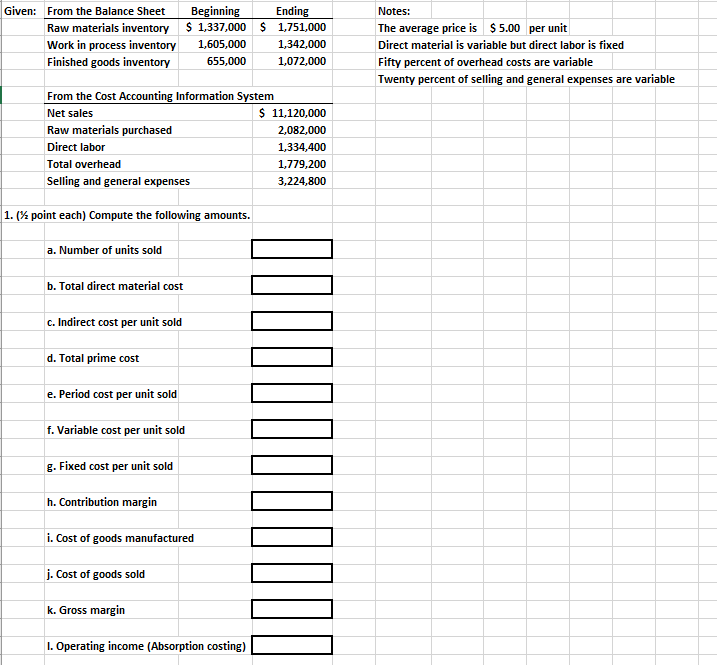

Question: Given: From the Balance Sheet Raw materials inventory Beginning $1,337,000 $ 1,751,000 Ending Work in process inventory Finished goods inventory 1,605,000 655,000 1,342,000 1,072,000

Given: From the Balance Sheet Raw materials inventory Beginning $1,337,000 $ 1,751,000 Ending Work in process inventory Finished goods inventory 1,605,000 655,000 1,342,000 1,072,000 From the Cost Accounting Information System Net sales $ 11,120,000 Raw materials purchased 2,082,000 Direct labor 1,334,400 Total overhead 1,779,200 Selling and general expenses 3,224,800 1. ( point each) Compute the following amounts. a. Number of units sold b. Total direct material cost c. Indirect cost per unit sold d. Total prime cost e. Period cost per unit sold f. Variable cost per unit sold g. Fixed cost per unit sold h. Contribution margin i. Cost of goods manufactured j. Cost of goods sold k. Gross margin I. Operating income (Absorption costing) Notes: The average price is $5.00 per unit Direct material is variable but direct labor is fixed Fifty percent of overhead costs are variable Twenty percent of selling and general expenses are variable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts