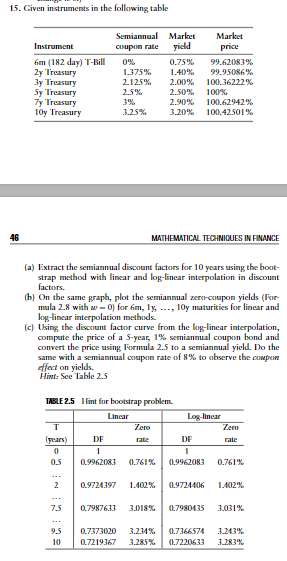

Question: Given instruments in the following table ( a ) Extract the semiannual discount factors for 1 0 years using the boot - strap method with

Given instruments in the following table

a Extract the semiannual discount factors for years using the boot

strap method with linear and loglinear interpolation in discount

factors.

b On the same graph, plot the semiannual zerocoupon yields For

mula with for dots, maturities for linear and

log linear interpolation methods.

c Using the discount factor curve from the loglinear interpolation,

compute the price of a year, semiannual coupon bond and

convert the price using Fiormula to a semiannual yield. Do the

same with a semiannual coupon rate of to observe the compon

effect on yields.

Hint: See Table

TAELE Hint for bootstrap problem.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock