Question: Given: Investment in Time zero = $400,000. Depreciation method: 100% bonus Five-year depreciable life Income per year = $165,000 Combined federal and state tax rate=

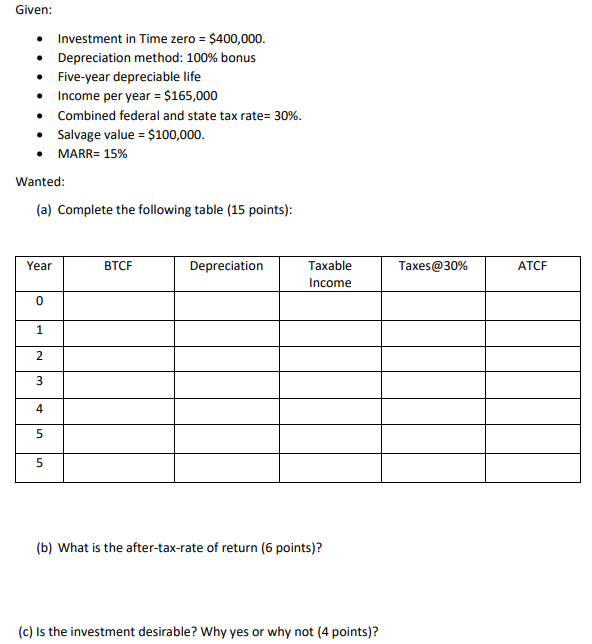

Given: Investment in Time zero = $400,000. Depreciation method: 100% bonus Five-year depreciable life Income per year = $165,000 Combined federal and state tax rate= 30%. Salvage value = $100,000. MARR= 15% Wanted: (a) Complete the following table (15 points): Year BTCF Depreciation Taxes@30% ATCF Taxable Income 0 1 2 3 4 5 5 (b) What is the after-tax-rate of return (6 points)? (c) Is the investment desirable? Why yes or why not (4 points)? Given: Investment in Time zero = $400,000. Depreciation method: 100% bonus Five-year depreciable life Income per year = $165,000 Combined federal and state tax rate= 30%. Salvage value = $100,000. MARR= 15% Wanted: (a) Complete the following table (15 points): Year BTCF Depreciation Taxes@30% ATCF Taxable Income 0 1 2 3 4 5 5 (b) What is the after-tax-rate of return (6 points)? (c) Is the investment desirable? Why yes or why not (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts