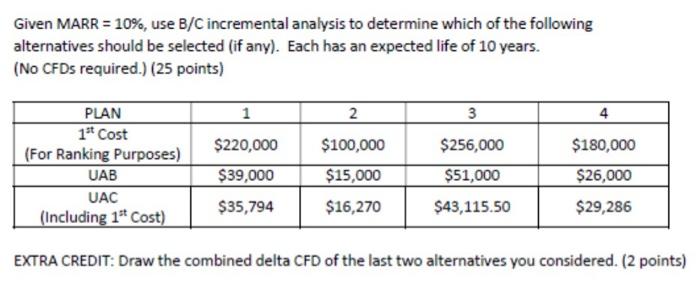

Question: Given MARR = 10%, use B/C incremental analysis to determine which of the following alternatives should be selected (if any). Each has an expected life

Given MARR = 10%, use B/C incremental analysis to determine which of the following alternatives should be selected (if any). Each has an expected life of 10 years. (No CFDs required.) (25 points) 1 2 3 4 $100,000 $256,000 PLAN 1* Cost (For Ranking Purposes) UAB UAC (Including 1" Cost) $220,000 $39,000 $35,794 $180,000 $26,000 $51,000 $15,000 $16,270 $43,115.50 $29,286 EXTRA CREDIT: Draw the combined delta CFD of the last two alternatives you considered. (2 points)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock