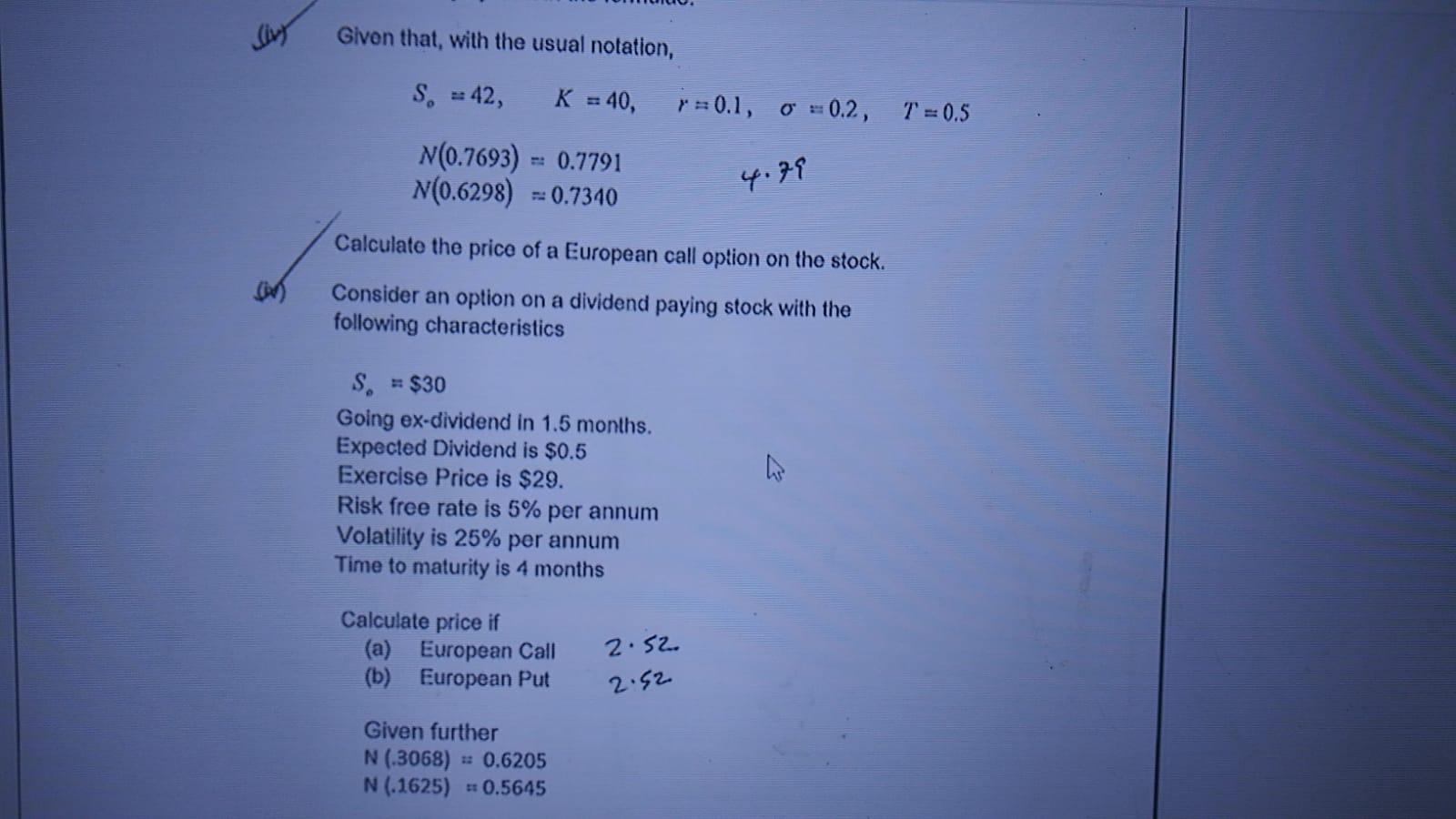

Question: Given that, with the usual notation, S. = 42, K = 40, y = 0.1, O = 0.2, T=0.5 N(0.7693) = 0.7791 N(0.6298) -0.7340 4.79

Given that, with the usual notation, S. = 42, K = 40, y = 0.1, O = 0.2, T=0.5 N(0.7693) = 0.7791 N(0.6298) -0.7340 4.79 Calculate the price of a European call option on the stock. Consider an option on a dividend paying stock with the following characteristics S. = $30 Going ex-dividend in 1.5 months. Expected Dividend is $0.5 Exercise Price is $29. Risk free rate is 5% per annum Volatility is 25% per annum Time to maturity is 4 months Calculate price if (a) European Call (b) European Put 2.520 2.52 Given further N (.3068) 12 0.6205 N (.1625) = 0.5645

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts