Question: Given the above information, please answer the following question with info about how do you reach each value like YTM or cost of debt :

Given the above information, please answer the following question with info about how do you reach each value like YTM or cost of debt :

Given the above information, please answer the following question with info about how do you reach each value like YTM or cost of debt :

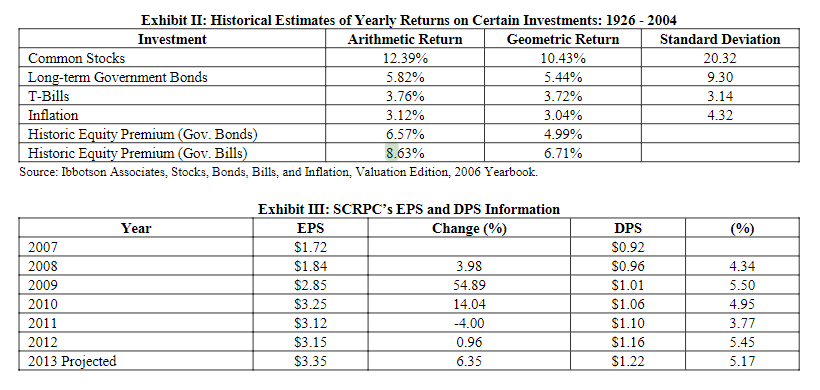

Estimate the firms after-tax cost for long debt. Why do analysts use the after-tax measure in the calculation of a firms cost of capital?

Calculate the cost for the current common stock investors.

(a) Estimate the cost for common stock using the Gordon Model (dividend valuation model).

(b) Calculate the cost of common stock using the Capital Asset Pricing Model.

(d) Find the cost of common stock using Bond Risk Premium Approach.

Exhibit II: Historical Estimates of Yearly Returns on Certain Investments: 1926 - 2004 Investment Arithmetic Return Geometric Return Standard Deviation Common Stocks 12.39% 10.43% 20.32 Long-term Government Bonds 5.82% 5.44% 9.30 T-Bills 3.76% 3.72% 3.14 Inflation 3.12% 3.04% 4.32 Historic Equity Premium (Gov. Bonds) 6.57% 4.99% Historic Equity Premium (Gov. Bills) 8.63% 6.71% Source: Ibbotson Associates, Stocks. Bonds. Bills, and Inflation, Valuation Edition, 2006 Yearbook. Year (%) 2007 2008 2009 2010 2011 2012 2013 Projected Exhibit III: SCRPC's EPS and DPS Information EPS Change (%) $1.72 $1.84 3.98 $2.85 54.89 $3.25 14.04 $3.12 -4.00 $3.15 0.96 $3.35 6.35 DPS $0.92 $0.96 $1.01 $1.06 $1.10 $1.16 $1.22 4.34 5.50 4.95 3.77 5.45 5.17 Exhibit II: Historical Estimates of Yearly Returns on Certain Investments: 1926 - 2004 Investment Arithmetic Return Geometric Return Standard Deviation Common Stocks 12.39% 10.43% 20.32 Long-term Government Bonds 5.82% 5.44% 9.30 T-Bills 3.76% 3.72% 3.14 Inflation 3.12% 3.04% 4.32 Historic Equity Premium (Gov. Bonds) 6.57% 4.99% Historic Equity Premium (Gov. Bills) 8.63% 6.71% Source: Ibbotson Associates, Stocks. Bonds. Bills, and Inflation, Valuation Edition, 2006 Yearbook. Year (%) 2007 2008 2009 2010 2011 2012 2013 Projected Exhibit III: SCRPC's EPS and DPS Information EPS Change (%) $1.72 $1.84 3.98 $2.85 54.89 $3.25 14.04 $3.12 -4.00 $3.15 0.96 $3.35 6.35 DPS $0.92 $0.96 $1.01 $1.06 $1.10 $1.16 $1.22 4.34 5.50 4.95 3.77 5.45 5.17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts