Question: A3. This exercise is based on the CAPM model, as well as the Fama and French three-factor model. The dependent variable is the excess return

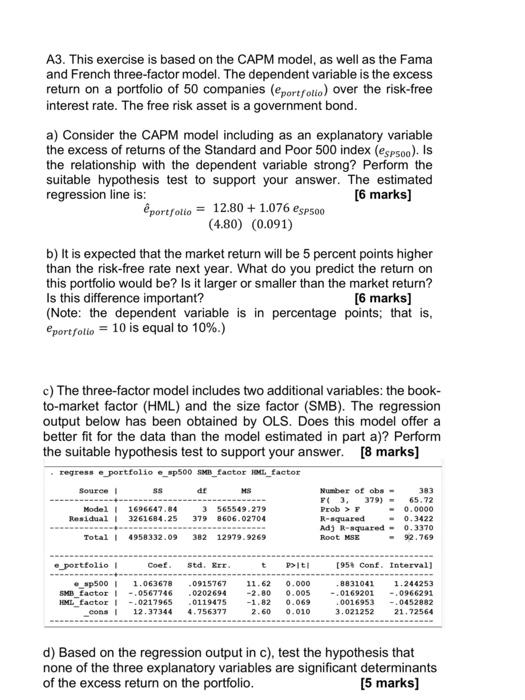

A3. This exercise is based on the CAPM model, as well as the Fama and French three-factor model. The dependent variable is the excess return on a portfolio of 50 companies (eportfolio) over the risk-free interest rate. The free risk asset is a government bond. a) Consider the CAPM model including as an explanatory variable the excess of returns of the Standard and Poor 500 index (eSPS00). Is the relationship with the dependent variable strong? Perform the suitable hypothesis test to support your answer. The estimated regression line is: e^portfolio=12.80+1.076eSP500(4.80)(0.091) [6 marks] b) It is expected that the market return will be 5 percent points higher than the risk-free rate next year. What do you predict the return on this portfolio would be? Is it larger or smaller than the market return? Is this difference important? [6 marks] (Note: the dependent variable is in percentage points; that is, eportfolio=10 is equal to 10%.) c) The three-factor model includes two additional variables: the bookto-market factor (HML) and the size factor (SMB). The regression output below has been obtained by OLS. Does this model offer a better fit for the data than the model estimated in part a)? Perform the suitable hypothesis test to support your answer. [8 marks] d) Based on the regression output in c), test the hypothesis that none of the three explanatory variables are significant determinants of the excess return on the portfolio. [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts