Question: Given the attached problem, the projected financial statements are needed. *I need help on the projected Balance Sheet and the projected statement of cash flows,

Given the attached problem, the projected financial statements are needed.

*I need help on the projected Balance Sheet and the projected statement of cash flows, however feel free to change any answers I've placed in the yellow cells

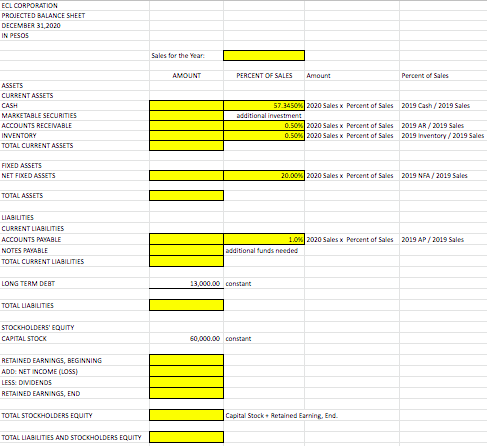

- Balance Sheet

- Income Statement

- My projected Income Statement

- Projected Balance sheet template

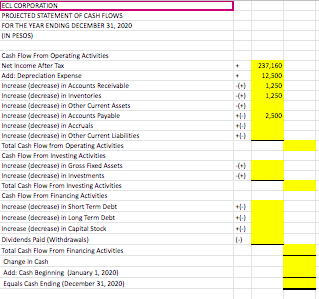

- Projected Statement of Cash Flows Template

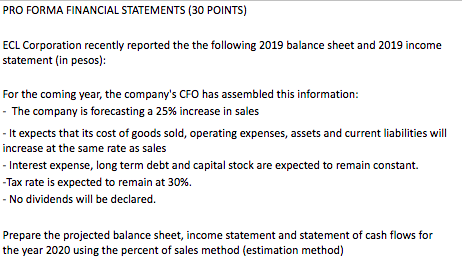

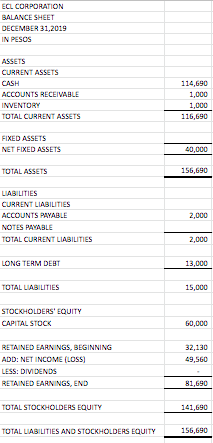

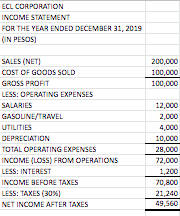

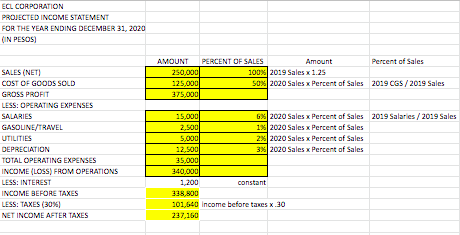

PRO FORMA FINANCIAL STATEMENTS (30 POINTS) ECL Corporation recently reported the the following 2019 balance sheet and 2019 income statement (in pesos): For the coming year, the company's CFO has assembled this information: - The company is forecasting a 25% increase in sales - It expects that its cost of goods sold, operating expenses, assets and current liabilities will increase at the same rate as sales - Interest expense, long term debt and capital stock are expected to remain constant. -Tax rate is expected to remain at 30%. - No dividends will be declared. Prepare the projected balance sheet, income statement and statement of cash flows for the year 2020 using the percent of sales method (estimation method) ECL CORPORATION BALANCE SHEET DECEMBER 31,2019 IN PESOS ASSETS CURRENT ASSETS CASH ACCOUNTS RECEIVABLE INVENTORY TOTAL CURRENT ASSETS FIXED ASSETS NET FIXED ASSETS TOTAL ASSETS LIABILITIES CURRENT LIABILITIES ACCOUNTS PAYABLE NOTES PAYABLE TOTAL CURRENT LIABILITIES LONG TERM DEBT TOTAL LIABILITIES STOCKHOLDERS' EQUITY CAPITAL STOCK RETAINED EARNINGS, BEGINNING ADD: NET INCOME (LOSS) LESS: DIVIDENDS RETAINED EARNINGS, END TOTAL STOCKHOLDERS EQUITY TOTAL LIABILITIES AND STOCKHOLDERS EQUITY 114,690 1,000 1,000 116,690 40,000 156,690 2,000 2,000 13,000 15,000 60,000 32,130 49,560 81,690 141,690 156,690 ECL CORPORATION INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2019 (IN PESOS) SALES (NET) COST OF GOODS SOLD GROSS PROFIT LESS: OPERATING EXPENSES SALARIES GASOLINE/TRAVEL UTILITIES DEPRECIATION TOTAL OPERATING EXPENSES INCOME (LOSS) FROM OPERATIONS LESS: INTEREST INCOME BEFORE TAXES LESS: TAXES (30%) NET INCOME AFTER TAXES 200,000 100,000 100,000 12,000 2,000 4,000 10,000 28,000 72,000 1,200 70,800 21,240 49,560 ECL CORPORATION PROJECTED INCOME STATEMENT FOR THE YEAR ENDING DECEMBER 31, 2020 (IN PESOS) SALES (NET) COST OF GOODS SOLD GROSS PROFIT LESS: OPERATING EXPENSES SALARIES GASOLINE/TRAVEL UTILITIES DEPRECIATION TOTAL OPERATING EXPENSES INCOME (LOSS) FROM OPERATIONS LESS: INTEREST INCOME BEFORE TAXES LESS: TAXES (30%) NET INCOME AFTER TAXES Amount Percent of Sales 100% 2019 Sales x 1.25 50% 2020 Sales x Percent of Sales 2019 CGS/2019 Sales 6% 2020 Sales x Percent of Sales 2019 Salaries/2019 Sales 1% 2020 Sales x Percent of Sales 2% 2020 Sales x Percent of Sales 3% 2020 Sales x Percent of Sales AMOUNT PERCENT OF SALES 250,000 125,000 375,000 15,000 2,500 5,000 12,500 35,000 340,000 1,200 constant 338,800 101,640 Income before taxes x.30 237,160 ECL CORPORATION PROJECTED BALANCE SHEET DECEMBER 31,2020 IN PESOS ASSETS CURRENT ASSETS CASH MARKETABLE SECURITIES ACCOUNTS RECEIVABLE INVENTORY TOTAL CURRENT ASSETS FIXED ASSETS NET FIXED ASSETS TOTAL ASSETS LIABILITIES CURRENT LIABILITIES ACCOUNTS PAYABLE NOTES PAYABLE TOTAL CURRENT LIABILITIES LONG TERM DEBT TOTAL LIABILITIES STOCKHOLDERS' EQUITY CAPITAL STOCK RETAINED EARNINGS, BEGINNING ADD: NET INCOME (LOSS) LESS: DIVIDENDS RETAINED EARNINGS, END TOTAL STOCKHOLDERS EQUITY TOTAL LIABILITIES AND STOCKHOLDERS EQUITY Sales for the Year AMOUNT PERCENT OF SALES additional investment Amount Percent of Sales 57.3450 % 2020 Sales x Percent of Sales 2019 Cash/2019 Sales 2019 AR/2019 Sales 0.50% 2020 Sales x Percent of Sales 0.50% 2020 Sales x Percent of Sales 2019 Inventory/2019 Sales 20.00% 2020 Sales x Percent of Sales 2019 NFA/2019 Sales 1.0% 2020 Sales x Percent of Sales 2019 AP/2019 Sales additional funds needed 13,000.00 constant 60,000.00 constant Capital Stock Retained Earning, End. ECL CORPORATION PROJECTED STATEMENT OF CASH FLOWSs FOR THE YEAR ENDING DECEMBER 31, 2020 IN PESOS) Cash Flow From Operating Activities Net Income After Tax Add: Depreciation Expense Increase (decrease) in Accounts Receivable Increase (decrease) in Inventories Increase (decrease) in Other Current Assets Increase (decrease) in Accounts Payable Increase (decrease) in Accruals Increase (decrease) in Other Current Liabilities Total Cash Flow from Operating Activities Cash Flow From Investing Activities Increase (decrease) in GrossFixed Assets Increase (decrease) in Investments Total Cash Flow From Investing Activities Cash Flow From Financing Activities Increase (decrease) in Short Term Debt Increase (decrease) in Long Term Debt Increase (decrease) in Capital Stock Dividends Paid (Withdrawals) Total Cash Flow From Financing Activities Change in Cash Add: Cash Beginning (January 1, 2020) Equals Cash Ending (December 31, 2020) + + ***### +-) -(+) 0 (-) 237,160 12,500 1,250 1,250 2,500 PRO FORMA FINANCIAL STATEMENTS (30 POINTS) ECL Corporation recently reported the the following 2019 balance sheet and 2019 income statement (in pesos): For the coming year, the company's CFO has assembled this information: - The company is forecasting a 25% increase in sales - It expects that its cost of goods sold, operating expenses, assets and current liabilities will increase at the same rate as sales - Interest expense, long term debt and capital stock are expected to remain constant. -Tax rate is expected to remain at 30%. - No dividends will be declared. Prepare the projected balance sheet, income statement and statement of cash flows for the year 2020 using the percent of sales method (estimation method) ECL CORPORATION BALANCE SHEET DECEMBER 31,2019 IN PESOS ASSETS CURRENT ASSETS CASH ACCOUNTS RECEIVABLE INVENTORY TOTAL CURRENT ASSETS FIXED ASSETS NET FIXED ASSETS TOTAL ASSETS LIABILITIES CURRENT LIABILITIES ACCOUNTS PAYABLE NOTES PAYABLE TOTAL CURRENT LIABILITIES LONG TERM DEBT TOTAL LIABILITIES STOCKHOLDERS' EQUITY CAPITAL STOCK RETAINED EARNINGS, BEGINNING ADD: NET INCOME (LOSS) LESS: DIVIDENDS RETAINED EARNINGS, END TOTAL STOCKHOLDERS EQUITY TOTAL LIABILITIES AND STOCKHOLDERS EQUITY 114,690 1,000 1,000 116,690 40,000 156,690 2,000 2,000 13,000 15,000 60,000 32,130 49,560 81,690 141,690 156,690 ECL CORPORATION INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2019 (IN PESOS) SALES (NET) COST OF GOODS SOLD GROSS PROFIT LESS: OPERATING EXPENSES SALARIES GASOLINE/TRAVEL UTILITIES DEPRECIATION TOTAL OPERATING EXPENSES INCOME (LOSS) FROM OPERATIONS LESS: INTEREST INCOME BEFORE TAXES LESS: TAXES (30%) NET INCOME AFTER TAXES 200,000 100,000 100,000 12,000 2,000 4,000 10,000 28,000 72,000 1,200 70,800 21,240 49,560 ECL CORPORATION PROJECTED INCOME STATEMENT FOR THE YEAR ENDING DECEMBER 31, 2020 (IN PESOS) SALES (NET) COST OF GOODS SOLD GROSS PROFIT LESS: OPERATING EXPENSES SALARIES GASOLINE/TRAVEL UTILITIES DEPRECIATION TOTAL OPERATING EXPENSES INCOME (LOSS) FROM OPERATIONS LESS: INTEREST INCOME BEFORE TAXES LESS: TAXES (30%) NET INCOME AFTER TAXES Amount Percent of Sales 100% 2019 Sales x 1.25 50% 2020 Sales x Percent of Sales 2019 CGS/2019 Sales 6% 2020 Sales x Percent of Sales 2019 Salaries/2019 Sales 1% 2020 Sales x Percent of Sales 2% 2020 Sales x Percent of Sales 3% 2020 Sales x Percent of Sales AMOUNT PERCENT OF SALES 250,000 125,000 375,000 15,000 2,500 5,000 12,500 35,000 340,000 1,200 constant 338,800 101,640 Income before taxes x.30 237,160 ECL CORPORATION PROJECTED BALANCE SHEET DECEMBER 31,2020 IN PESOS ASSETS CURRENT ASSETS CASH MARKETABLE SECURITIES ACCOUNTS RECEIVABLE INVENTORY TOTAL CURRENT ASSETS FIXED ASSETS NET FIXED ASSETS TOTAL ASSETS LIABILITIES CURRENT LIABILITIES ACCOUNTS PAYABLE NOTES PAYABLE TOTAL CURRENT LIABILITIES LONG TERM DEBT TOTAL LIABILITIES STOCKHOLDERS' EQUITY CAPITAL STOCK RETAINED EARNINGS, BEGINNING ADD: NET INCOME (LOSS) LESS: DIVIDENDS RETAINED EARNINGS, END TOTAL STOCKHOLDERS EQUITY TOTAL LIABILITIES AND STOCKHOLDERS EQUITY Sales for the Year AMOUNT PERCENT OF SALES additional investment Amount Percent of Sales 57.3450 % 2020 Sales x Percent of Sales 2019 Cash/2019 Sales 2019 AR/2019 Sales 0.50% 2020 Sales x Percent of Sales 0.50% 2020 Sales x Percent of Sales 2019 Inventory/2019 Sales 20.00% 2020 Sales x Percent of Sales 2019 NFA/2019 Sales 1.0% 2020 Sales x Percent of Sales 2019 AP/2019 Sales additional funds needed 13,000.00 constant 60,000.00 constant Capital Stock Retained Earning, End. ECL CORPORATION PROJECTED STATEMENT OF CASH FLOWSs FOR THE YEAR ENDING DECEMBER 31, 2020 IN PESOS) Cash Flow From Operating Activities Net Income After Tax Add: Depreciation Expense Increase (decrease) in Accounts Receivable Increase (decrease) in Inventories Increase (decrease) in Other Current Assets Increase (decrease) in Accounts Payable Increase (decrease) in Accruals Increase (decrease) in Other Current Liabilities Total Cash Flow from Operating Activities Cash Flow From Investing Activities Increase (decrease) in GrossFixed Assets Increase (decrease) in Investments Total Cash Flow From Investing Activities Cash Flow From Financing Activities Increase (decrease) in Short Term Debt Increase (decrease) in Long Term Debt Increase (decrease) in Capital Stock Dividends Paid (Withdrawals) Total Cash Flow From Financing Activities Change in Cash Add: Cash Beginning (January 1, 2020) Equals Cash Ending (December 31, 2020) + + ***### +-) -(+) 0 (-) 237,160 12,500 1,250 1,250 2,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts