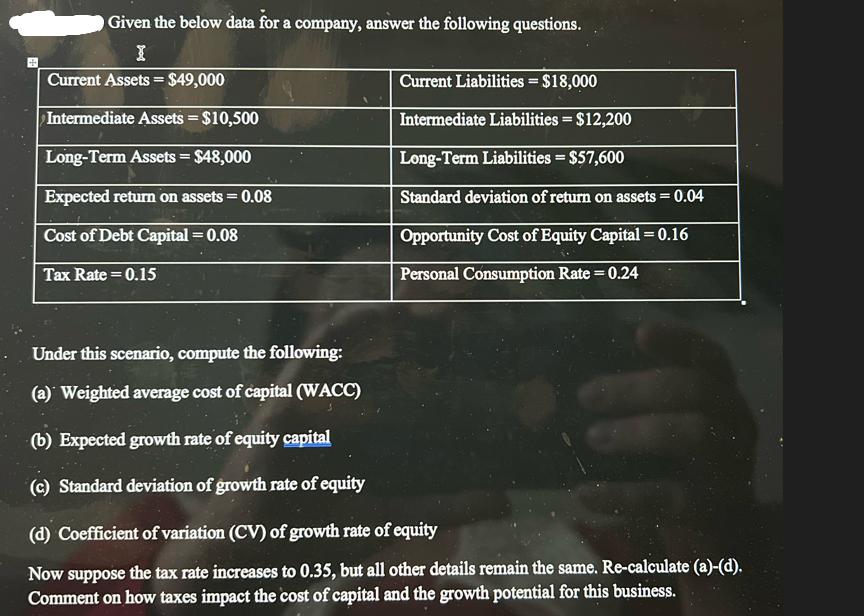

Question: Given the below data for a company, answer the following questions. I Current Assets = $49,000 Intermediate Assets = $10,500 Long-Term Assets = $48,000

Given the below data for a company, answer the following questions. I Current Assets = $49,000 Intermediate Assets = $10,500 Long-Term Assets = $48,000 Expected return on assets = 0.08 Cost of Debt Capital = 0.08 Tax Rate 0.15 = Current Liabilities = $18,000 Intermediate Liabilities = $12,200 Long-Term Liabilities = $57,600 Standard deviation of return on assets = 0.04 Opportunity Cost of Equity Capital = 0.16 Personal Consumption Rate = 0.24 Under this scenario, compute the following: (a) Weighted average cost of capital (WACC) (b) Expected growth rate of equity capital (c) Standard deviation of growth rate of equity (d) Coefficient of variation (CV) of growth rate of equity Now suppose the tax rate increases to 0.35, but all other details remain the same. Re-calculate (a)-(d). Comment on how taxes impact the cost of capital and the growth potential for this business.

Step by Step Solution

There are 3 Steps involved in it

a Weighted Average Cost of Capital WACC The WACC is calculated using the following formula WACC Cost of Debt Capital LongTerm Liabilities Intermediate ... View full answer

Get step-by-step solutions from verified subject matter experts