Question: Given the data from the following table: What if the period from 1990 to 2021 had been normal? a. Calculate the arithmetic average return on

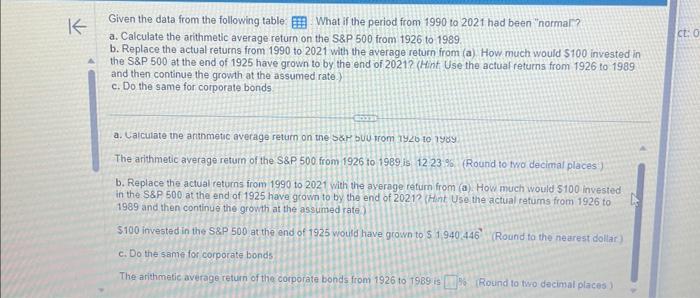

Given the data from the following table: What if the period from 1990 to 2021 had been "normal? a. Calculate the arithmetic average return on the S\&P 500 from 1926 to 1989. b. Replace the actual returns from 1990 to 2021 with the average return from (a) How much would $100 invested in the S\&P 500 at the end of 1925 have grown to by the end of 2021 ? (Hint Use the actual returns from 1926 to 1989 and then continue the growth at the assumed rate.) c. Do the same for corporate bonds a. Lalculate the anthmetic average return on the s\&b buu trom 1920 to 790y The arithmetic average retum of the S\&P 500 from 1926 to 1989 is 1223% (Round to fwo decimal places) b. Replace the actual returns from 1990 to 2021 with the average refurn from (a). How much would $100 invested in the S8P 500 at the end of 1925 have grown to by the end of 2021 ? (Hint Use the actual tetums from 1926 to 1989 and then continue the growth at the assumed rate. $100 invested in the S\&P 500 at the end of 1925 would have grown to $1,940,446 (Round to the nearest dollar) c. Do the same for corporate bonds The arithmetic average return of the corporate bonds from 1926 to 1989 is 9. (Rosind to two decimal places )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts