Question: tabke data is there now this is the second time of me uploading this table Given the data from the following table: a. Which asset

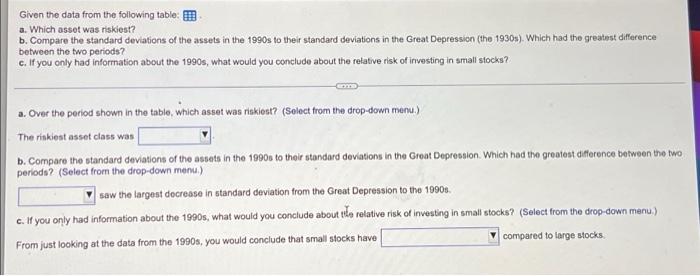

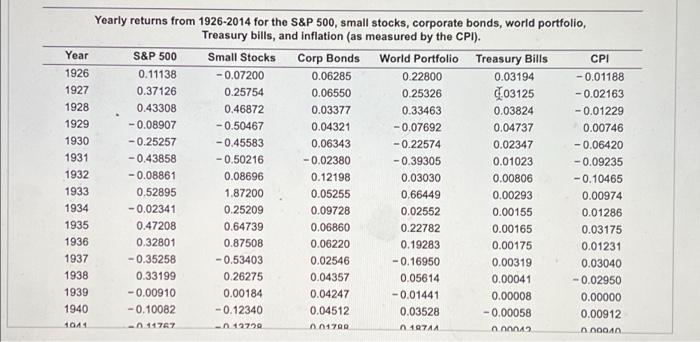

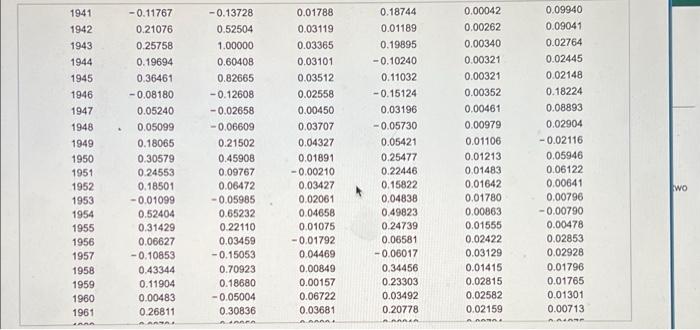

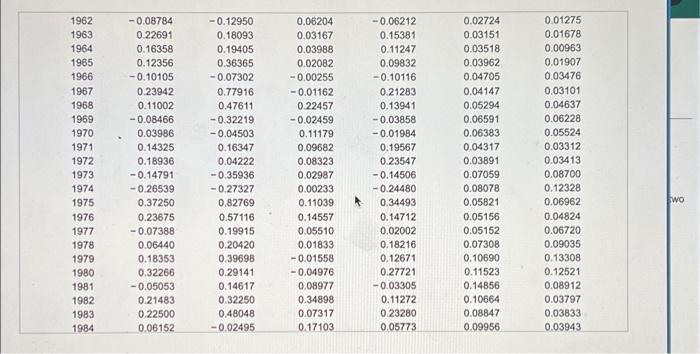

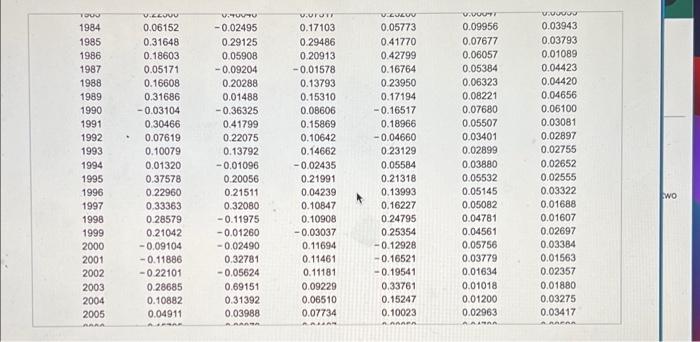

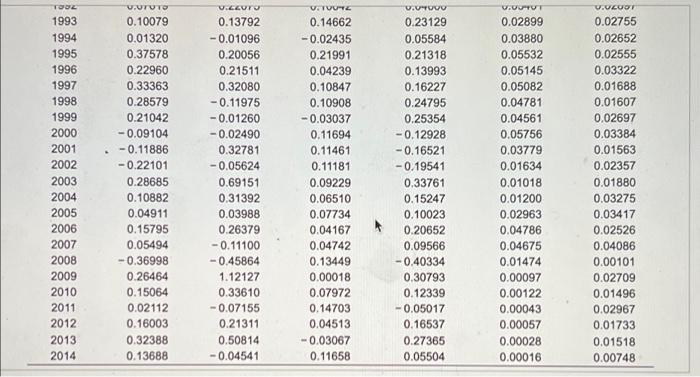

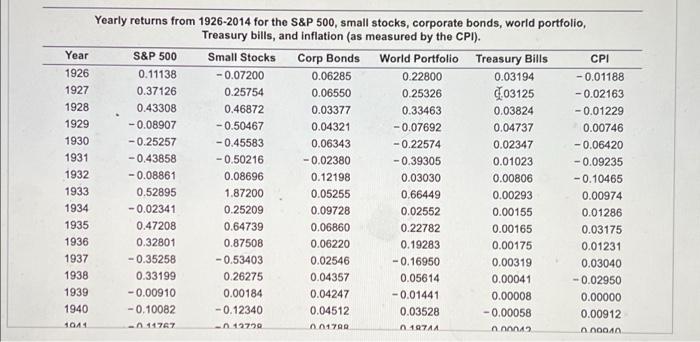

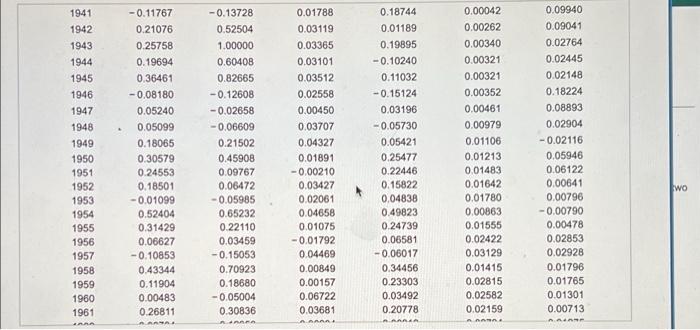

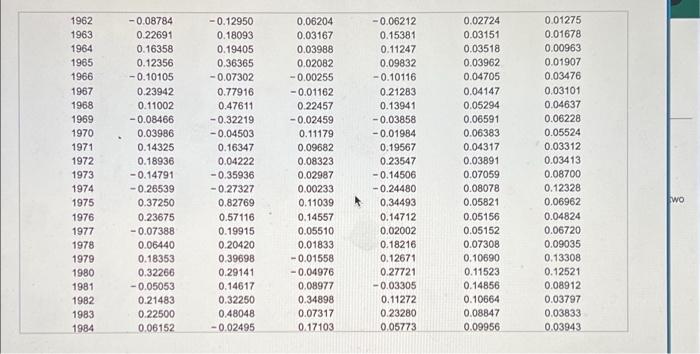

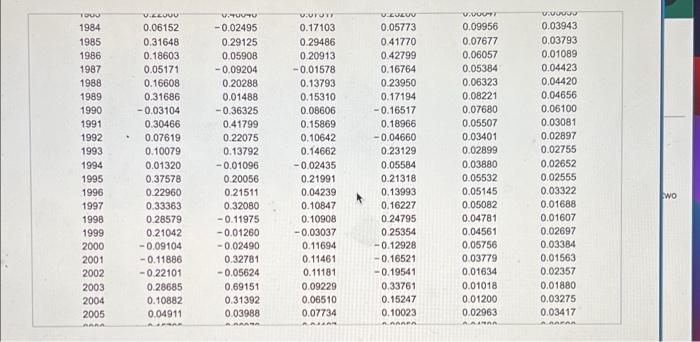

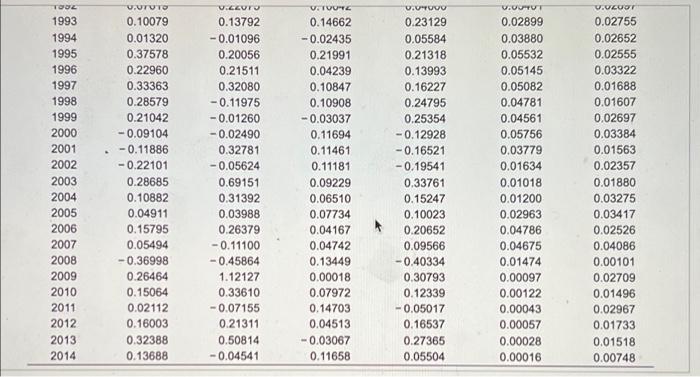

Given the data from the following table: a. Which asset was riskiest? b. Compare the standard deviations of the assets in the 1990s to their standard deviations in the Great Depression (the 1930s). Which had the greatest difference between the two periods? c. If you only had information about the 1990s, what would you conclude about the relative risk of investing in small stocks? a. Over the period shown in the table, which asset was riskiest? (Select from the drop-down menu.) The riskiest asset class was b. Compare the standard deviations of the assets in the 1990s to their standard deviations in the Great Depression. Which had the greatest difference between the two periods? (Select from the drop-down menu.) saw the largest decrease in standard deviation from the Great Depression to the 1990s. c. If you only had information about the 1990s, what would you conclude about the relative risk of investing in small stocks? (Select from the drop-down menu.) From just looking at the data from the 1990s, you would conclude that small stocks have compared to large stocks Yearly returns from 1926-2014 for the S&P 500, small stocks, corporate bonds, world portfolio, Treasury bills, and inflation (as measured by the CPI). Year S&P 500 Small Stocks Corp Bonds World Portfolio Treasury Bills CPI 1926 0.11138 -0.07200 0.06285 0.22800 0.03194 -0.01188 1927 0.37126 0.25754 0.06550 0.25326 03125 -0.02163 1928 0.43308 0.46872 0.03377 0.33463 0.03824 -0.01229 1929 -0.08907 -0.50467 0.04321 -0.07692 0.04737 0.00746 1930 -0.25257 -0.45583 0.06343 -0.22574 0.02347 -0.06420 1931 -0.43858 -0.50216 -0.02380 -0.39305 0.01023 -0.09235 1932 -0.08861 0.08696 0.12198 0.03030 0.00806 -0.10465 1933 0.52895 1.87200 0.05255 0.66449 0.00293 0.00974 1934 -0.02341 0.25209 0.09728 0.02552 0.00155 0.01286 1935 0.64739 0.06860 0.22782 0.00165 0.03175 0.47208 0.32801 1936 0.87508 0.06220 0.19283 0.00175 0.01231 1937 -0.35258 -0.53403 0.02546 -0.16950 0.00319 0.03040 1938 0.33199 0.26275 0.04357 0.05614 0.00041 -0.02950 1939 -0.00910 0.00184 0.04247 -0.01441 0.00008 0.00000 1940 -0,10082 -0.12340 0.04512 0.03528 -0.00058 0.00912 1041 -0.11767 -0.12729 0.01799 0.1971 0.00042 0.00040. 1941 1942 1943 1944 1945 1946 1947 1948 1949 1950 1951 1952 1953 1954 1955 1956 1957 1958 1959 1960 1961 -0.11767 0.21076 0.25758 0.19694 0.36461 -0.08180 0.05240 0.05099 0.18065 0.30579 0.24553 0.18501 -0.01099 0.52404 0.31429 0.06627 -0.10853 0.43344 0.11904 0.00483 0.26811 -0.13728 0.52504 1.00000 0.60408 0.82665 -0.12608 -0.02658 -0.06609 0.21502 0.45908 0.09767 0.06472 -0.05985 0.65232 0.22110 0.03459 -0.15053 0.70923 0.18680 -0.05004 0.30836 0.01788 0.03119 0.03365 0.03101 0.03512 0.02558 0.00450 0.03707 0.04327 0.01891 -0.00210 0.03427 0.02061 0.04658 0.01075 -0.01792 0.04469 0.00849 0.00157 0.06722 0.03681 AAAAAD 0.18744 0.01189 0.19895 -0.10240 0.11032 -0.15124 0.03196 -0.05730 0.05421 0.25477 0.22446 0.15822 0.04838 0.49823 0.24739 0.06581 -0.06017 0.34456 0.23303 0.03492 0.20778 0.00042 0.00262 0.00340 0.00321 0.00321 0.00352 0.00461 0.00979 0.01106 0.01213 0.01483 0.01642 0.01780 0.00863 0.01555 0.02422 0.03129 0.01415 0.02815 0.02582 0.02159 ANANAS 0.09940 0.09041 0.02764 0.02445 0.02148 0.18224 0.08893 0.02904 -0.02116 0.05946 0.06122 0.00641 0.00796 -0.00790 0.00478 0.02853 0.02928 0.01796 0.01765 0.01301 0.00713 nninne Wo 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 -0.08784 0.22691 0.16358 0.12356 -0.10105 0.23942 0.11002 -0.08466 0.03986 0.14325 0.18936 -0.14791 -0.26539 0.37250 0.23675 -0.07388 0.06440 0.18353 0.32266 -0.05053 0.21483 0.22500 0.06152 -0.12950 0.18093 0.19405 0.36365 -0.07302 0.77916 0.47611 -0.32219 -0.04503 0.16347 0.04222 -0.35936 -0.27327 0.82769 0.57116 0.19915 0.20420 0.39698 0.29141 0.14617 0.32250 0.48048 -0.02495 0.06204 0.03167 0.03988 0.02082 -0.00255 -0.01162 0.22457 -0.02459 0.11179 0.09682 0.08323 0.02987 0.00233 0.11039 0.14557 0.05510 0.01833 -0.01558 -0.04976 0.08977 0.34898 0.07317 0.17103 -0.06212 0.15381 0.11247 0.09832 -0.10116 0.21283 0.13941 -0.03858 -0.01984 0.19567 0.23547 -0.14506 -0.24480 0.34493 0.14712 0.02002 0.18216 0.12671 0.27721 -0.03305 0.11272 0.23280 0.05773 0.02724 0.03151 0.03518 0.03962 0.04705 0.04147 0.05294 0.06591 0.06383 0.04317 0.03891 0.07059 0.08078 0.05821 0.05156 0.05152 0.07308 0.10690 0.11523 0.14856 0.10664 0.08847 0.09956 0.01275 0.01678 0.00963 0.01907 0.03476 0.03101 0.04637 0.06228 0.05524 0.03312 0.03413 0.08700 0.12328 0.06962 0.04824 0.06720 0.09035 0.13308 0.12521 0.08912 0.03797 0.03833 0.03943 wo YOUO 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 AAA V.EEUUU 0.06152 0.31648 0.18603 0.05171 0.16608 0.31686 -0.03104 0.30466 0.07619 0.10079 0.01320 0.37578 0.22960 0.33363 0.28579 0.21042 -0.09104 -0.11886 -0.22101 0.28685 0.10882 0.04911 0.40040 -0.02495 0.29125 0.05908 -0.09204 0.20288 0.01488 -0.36325 0.41799 0.22075 0.13792 -0.01096 0.20056 0.21511 0.32080 -0.11975 -0.01260 -0.02490 0.32781 -0.05624 0.69151 0.31392 0.03988 V.UTUT 0.17103 0.29486 0,20913 -0.01578 0.13793 0.15310 0.08606 0.15869 0.10642 0.14662 -0.02435 0.21991 0.04239 0.10847 0.10908 -0.03037 0.11694 0.11461 0.11181 0.09229 0.06510 0.07734 V:20200 0.05773 0.41770 0.42799 0.16764 0.23950 0.17194 -0.16517 0.18966 -0.04660 0.23129 0.05584 0.21318 0.13993 0.16227 0.24795 0.25354 -0.12928 -0.16521 -0.19541 0.33761 0.15247 0.10023 0.00077 0.09956 0.07677 0.06057 0.05384 0.06323 0.08221 0.07680 0.05507 0.03401 0.02899 0.03880 0.05532 0.05145 0.05082 0.04781 0.04561 0.05756 0.03779 0.01634 0.01018 0.01200 0.02963 www99 0.03943 0.03793 0.01089 0.04423 0.04420 0.04656 0.06100 0.03081 0.02897 0.02755 0.02652 0.02555 0.03322 0.01688 0.01607 0.02697 0.03384 0.01563 0.02357 0.01880 0.03275 0.03417 RAFARA wo 1002 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 0.07010 0.10079 0.01320 0.37578 0.22960 0.33363 0.28579 0.21042 -0.09104 .-0.11886 -0.22101 0.28685 0.10882 0.04911 0.15795 0.05494 -0.36998 0.26464 0.15064 0.02112 0.16003 0.32388 0.13688 0.22UTO 0.13792 -0.01096 0.20056 0.21511 0.32080 -0.11975 -0.01260 -0.02490 0.32781 -0.05624 0.69151 0.31392 0.03988 0.26379 -0.11100 -0.45864 1.12127 0.33610 -0.07155 0.21311 0.50814 -0.04541 V. TOUTE 0.14662 -0.02435 0.21991 0.04239 0.10847 0.10908 -0.03037 0.11694 0.11461 0.11181 0.09229 0.06510 0.07734 0.04167 0.04742 0.13449 0.00018 0.07972 0.14703 0.04513 -0.03067 0.11658 0:04000 0.23129 0.05584 0.21318 0.13993 0.16227 0.24795 0.25354 -0.12928 -0.16521 -0.19541 0.33761 0.15247 0.10023 0.20652 0.09566 -0.40334 0.30793 0.12339 -0.05017 0.16537 0.27365 0.05504 0:0040 0.02899 0.03880 0.05532 0.05145 0.05082 0.04781 0.04561 0.05756 0.03779 0.01634 0.01018 0.01200 0.02963 0.04786 0.04675 0.01474 0.00097 0.00122 0.00043 0.00057 0.00028 0.00016 0.02001 0.02755 0.02652 0.02555 0.03322 0.01688 0.01607 0.02697 0.03384 0.01563 0.02357 0.01880 0.03275 0.03417 0.02526 0.04086 0.00101 0.02709 0.01496 0.02967 0.01733 0.01518 0.00748 Yearly returns from 1926-2014 for the S&P 500, small stocks, corporate bonds, world portfolio, Treasury bills, and inflation (as measured by the CPI). Year S&P 500 Small Stocks World Portfolio Treasury Bills CPI Corp Bonds 0.06285 1926 0.11138 -0.07200 0.22800 0.03194 -0.01188 1927 0.37126 0.25754 0.06550 0.25326 03125 -0.02163 1928 0.43308 0.46872 0.03377 0.33463 0.03824 -0.01229 1929 -0.08907 -0.50467 0.04321 -0.07692 0.04737 0.00746 1930 -0.25257 -0.45583 0.06343 -0.22574 0.02347 -0.06420 1931 -0.43858 -0.50216 -0.02380 -0.39305 0.01023 -0.09235 1932 -0.08861 0.08696 0.12198 0.03030 0.00806 -0.10465 1933 0.52895 1.87200 0.05255 0.66449 0.00293 0.00974 1934 -0.02341 0.25209 0.09728 0.02552 0.00155 0.01286 1935 0.47208 0.64739 0.06860 0.22782 0.00165 0.03175 1936 0.32801 0.87508 0.06220 0.19283 0.00175 0.01231 1937 -0.35258 -0.53403 0.02546 -0.16950 0.00319 0.03040 1938 0.33199 0.26275 0.04357 0.05614 0.00041 -0.02950 1939 -0.00910 0.00184 0.04247 -0.01441 0.00008 0.00000 1940 -0.10082 -0.12340 0.04512 0.03528 -0.00058 0.00912 1041 -0.11767 -0.12729 0.01790 0 1971 0.00042 0.00040 . 1941 1942 1943 1944 1945 1946 1947 1948 1949 1950 1951 1952 1953 1954 1955 1956 1957 1958 1959 1960 1961 -0.11767 0.21076 0.25758 0.19694 0.36461 -0.08180 0.05240 0.05099 0.18065 0.30579 0.24553 0.18501 -0.01099 0.52404 0.31429 0.06627 -0.10853 0.43344 0.11904 0.00483 0.26811 -0.13728 0.52504 1.00000 0.60408 0.82665 -0.12608 -0.02658 -0.06609 0.21502 0.45908 0.09767 0.06472 -0.05985 0.65232 0.22110 0.03459 -0.15053 0.70923 0.18680 -0.05004 0.30836 0.01788 0.03119 0.03365 0.03101 0.03512 0.02558 0.00450 0.03707 0.04327 0.01891 -0.00210 0.03427 0.02061 0.04658 0.01075 -0.01792 0.04469 0.00849 0.00157 0.06722 0.03681 AAAAA 0.18744 0.01189 0.19895 -0.10240 0.11032 -0.15124 0.03196 -0.05730 0.05421 0.25477 0.22446 0.15822 0.04838 0.49823 0.24739 0.06581 -0.06017 0.34456 0.23303 0.03492 0.20778 0.00042 0.00262 0.00340 0.00321 0.00321 0.00352 0.00461 0.00979 0.01106 0.01213 0.01483 0.01642 0.01780 0.00863 0.01555 0.02422 0.03129 0.01415 0.02815 0.02582 0.02159 Anamn 0.09940 0.09041 0.02764 0.02445 0.02148 0.18224 0.08893 0.02904 -0.02116 0.05946 0.06122 0.00641 0.00796 -0.00790 0.00478 0.02853 0.02928 0.01796 0.01765 0.01301 0.00713 DIANE Wo 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 -0.08784 0.22691 0.16358 0.12356 -0.10105 0.23942 0.11002 -0.08466 0.03986 0.14325 0.18936 -0.14791 -0.26539 0.37250 0.23675 -0.07388 0.06440 0.18353 0.32266 -0.05053 0.21483 0.22500 0.06152 -0.12950 0.18093 0.19405 0.36365 -0.07302 0.77916 0.47611 -0.32219 -0.04503 0.16347 0.04222 -0.35936 -0.27327 0.82769 0.57116 0.19915 0.20420 0.39698 0.29141 0.14617 0.32250 0.48048 -0.02495 0.06204 0.03167 0.03988 0.02082 -0.00255 -0.01162 0.22457 -0.02459 0.11179 0.09682 0.08323 0.02987 0.00233 0.11039 0.14557 0.05510 0.01833 -0.01558 -0.04976 0.08977 0.34898 0.07317 0.17103 -0.06212 0.15381 0.11247 0.09832 -0.10116 0.21283 0.13941 -0.03858 -0.01984 0.19567 0.23547 -0.14506 -0.24480 0,34493 0.14712 0.02002 0.18216 0.12671 0.27721 -0.03305 0.11272 0.23280 0.05773 0.02724 0.03151 0.03518 0.03962 0.04705 0.04147 0.05294 0.06591 0.06383 0.04317 0.03891 0.07059 0.08078 0.05821 0.05156 0.05152 0.07308 0.10690 0.11523 0.14856 0.10664 0.08847 0.09956 0.01275 0.01678 0.00963 0.01907 0.03476 0.03101 0.04637 0.06228 0.05524 0.03312 0.03413 0.08700 0.12328 0.06962 0.04824 0.06720 0.09035 0.13308 0.12521 0.08912 0.03797 0.03833 0.03943 wo TOUU 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 AAA V.EEUUU 0.06152 0.31648 0.18603 0.05171 0.16608 0.31686 -0.03104 0.30466 0.07619 0.10079 0.01320 0.37578 0.22960 0.33363 0.28579 0.21042 -0.09104 -0.11886 -0.22101 0.28685 0.10882 0.04911 0.40040 -0.02495 0.29125 0.05908 -0.09204 0.20288 0.01488 -0.36325 0.41799 0.22075 0.13792 -0.01096 0.20056 0.21511 0.32080 -0.11975 -0.01260 -0.02490 0.32781 -0.05624 0.69151 0.31392 0.03988 LAAA V.UTUT 0.17103 0.29486 0,20913 -0.01578 0.13793 0.15310 0.08606 0.15869 0.10642 0.14662 -0.02435 0.21991 0.04239 0.10847 0.10908 -0.03037 0.11694 0.11461 0.11181 0.09229 0.06510 0.07734 VZUZUU 0.05773 0.41770 0.42799 0.16764 0.23950 0.17194 -0.16517 0.18966 -0.04660 0.23129 0.05584 0.21318 0.13993 0.16227 0.24795 0.25354 -0.12928 -0.16521 -0.19541 0.33761 0.15247 0.10023 0.0007 0.09956 0.07677 0.06057 0.05384 0.06323 0.08221 0.07680 0.05507 0.03401 0.02899 0.03880 0.05532 0.05145 0.05082 0.04781 0.04561 0.05756 0.03779 0.01634 0.01018 0.01200 0.02963 www 0.03943 0.03793 0.01089 0.04423 0.04420 0.04656 0.06100 0.03081 0.02897 0.02755 0.02652 0.02555 0.03322 0.01688 0.01607 0.02697 0.03384 0.01563 0.02357 0.01880 0.03275 0.03417 BACAA wo TOOL V.UTUTO 1993 0.10079 1994 0.01320 1995 0.37578 1996 0.22960 1997 0.33363 1998 0.28579 1999 0.21042 2000 -0.09104 2001 .-0.11886 2002 -0.22101 2003 0.28685 2004 0.10882 2005 0.04911 2006 0.15795 2007 0.05494 2008 -0.36998 2009 0.26464 2010 0.15064 2011 0.02112 2012 0.16003 2013 0.32388 2014 0.13688 V.EEUTU 0.13792 -0.01096 0.20056 0.21511 0.32080 -0.11975 -0.01260 -0.02490 0.32781 -0.05624 0.69151 0.31392 0.03988 0.26379 -0.11100 -0.45864 1.12127 0.33610 -0.07155 0.21311 0.50814 -0.04541 V. TOUTE 0.14662 -0.02435 0.21991 0.04239 0.10847 0.10908 -0.03037 0.11694 0.11461 0.11181 0.09229 0.06510 0.07734 0.04167 0.04742 0.13449 0.00018 0.07972 0.14703 0.04513 -0.03067 0.11658 0.04000 0.23129 0.05584 0.21318 0.13993 0.16227 0.24795 0.25354 -0.12928 -0.16521 -0.19541 0.33761 0.15247 0.10023 0.20652 0.09566 -0.40334 0.30793 0.12339 -0.05017 0.16537 0.27365 0.05504 0:0090 0.02899 0.03880 0.05532 0.05145 0.05082 0.04781 0.04561 0.05756 0.03779 0.01634 0.01018 0.01200 0.02963 0.04786 0.04675 0.01474 0.00097 0.00122 0.00043 0.00057 0.00028 0.00016 0.02097 0.02755 0.02652 0.02555 0.03322 0.01688 0.01607 0.02697 0.03384 0.01563 0.02357 0.01880 0.03275 0.03417 0.02526 0.04086 0.00101 0.02709 0.01496 0.02967 0.01733 0.01518 0.00748

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts