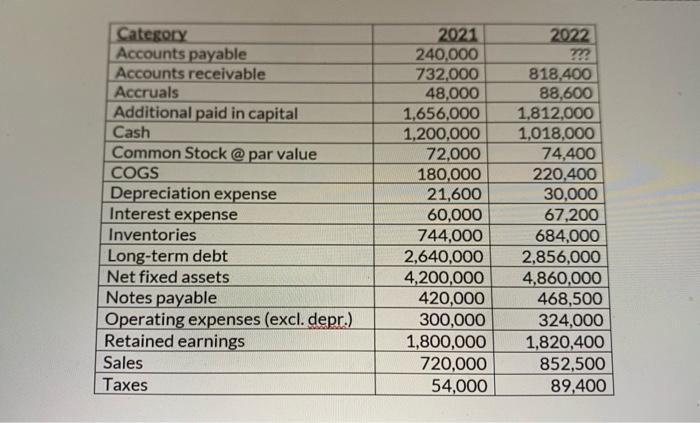

Question: Given the data in following table, the return on assests (ROA) 2022 was % What were the current liabilites in 2022 what was cash flow

\begin{tabular}{|l|r|r|} \hline Category & 2021 & 2022 \\ \hline Accounts payable & 240,000 & ??9 \\ \hline Accounts receivable & 732,000 & 818,400 \\ \hline Accruals & 48,000 & 88,600 \\ \hline Additional paid in capital & 1,656,000 & 1,812,000 \\ \hline Cash & 1,200,000 & 1,018,000 \\ \hline Common Stock @ par value & 72,000 & 74,400 \\ \hline COGS & 180,000 & 220,400 \\ \hline Depreciation expense & 21,600 & 30,000 \\ \hline Interest expense & 60,000 & 67,200 \\ \hline Inventories & 744,000 & 684,000 \\ \hline Long-term debt & 2,640,000 & 2,856,000 \\ \hline Net fixed assets & 4,200,000 & 4,860,000 \\ \hline Notes payable & 420,000 & 468,500 \\ \hline Operating expenses (excl. depr.) & 300,000 & 324,000 \\ \hline Retained earnings & 1,800,000 & 1,820,400 \\ \hline Sales & 720,000 & 852,500 \\ \hline Taxes & 54,000 & 89,400 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts