Question: Given the data on four stock indices, based on Section 12.7 on p.283 of the textbook, compute the component value at risk for each of

Given the data on four stock indices, based on Section 12.7 on p.283 of the textbook, compute the component value at risk for each of the four stock indices. Assume the portfolio consists of $4M in DJIA, $3M in FTSE-100, $1M in CAC-40 and $2M in Nikkei-225, all denominated in U.S. dollars (USD).

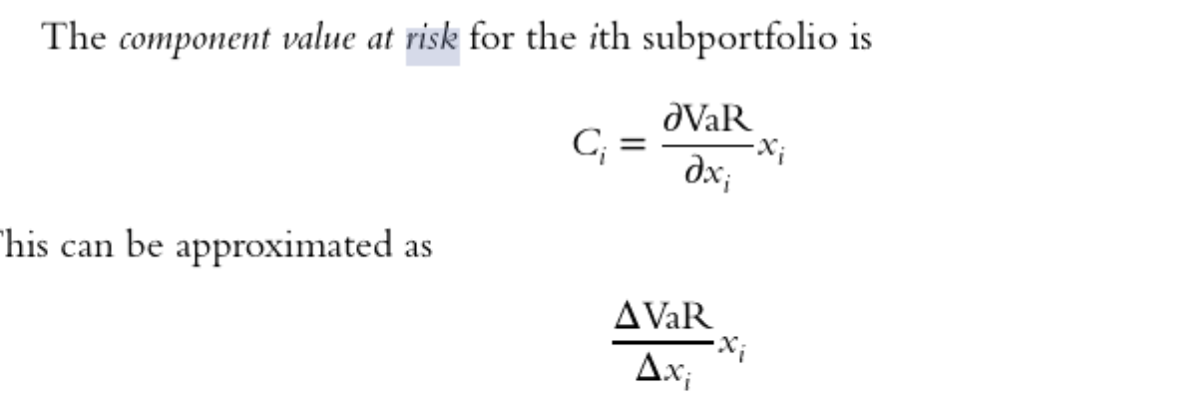

Section 12.7-

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts