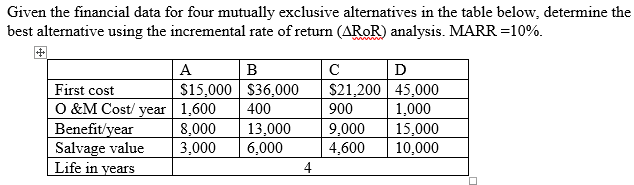

Question: Given the financial data for four mutually exclusive alternatives in the table below, determine the best alternative using the incremental rate of return (AROR) analysis.

Given the financial data for four mutually exclusive alternatives in the table below, determine the best alternative using the incremental rate of return (AROR) analysis. MARR-1090. First cost O &M Cost/ vear 1,600 400 Benefit/year Salvage value3,0006,000 Life in years $15.000 S36,000 S21,200 45,000 1,000 9,00015.000 4.600 10,000 900 8.000 13.000 Given the financial data for four mutually exclusive alternatives in the table below, determine the best alternative using the incremental rate of return (AROR) analysis. MARR-1090. First cost O &M Cost/ vear 1,600 400 Benefit/year Salvage value3,0006,000 Life in years $15.000 S36,000 S21,200 45,000 1,000 9,00015.000 4.600 10,000 900 8.000 13.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts