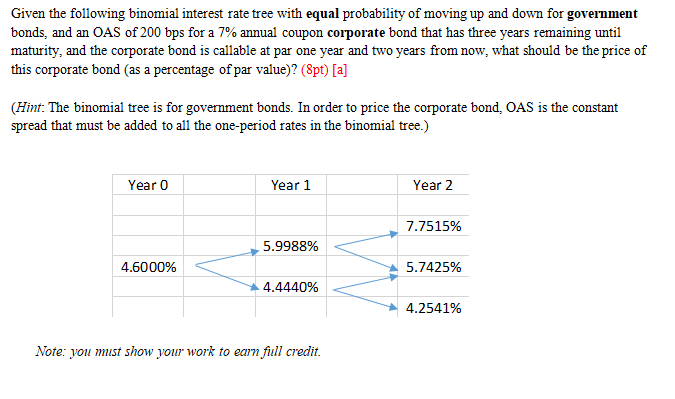

Question: Given the following binomial interest rate tree with equal probability of moving up and down for government bonds, and an OAS of 200 bps for

Given the following binomial interest rate tree with equal probability of moving up and down for government bonds, and an OAS of 200 bps for a 7% annual coupon corporate bond that has three years remaining until maturity, and the corporate bond is callable at par one year and two years from now, what should be the price of this corporate bond (as a percentage of par value)? (Spt) [a] (Hint: The binomial tree is for government bonds. In order to price the corporate bond, OAS is the constant spread that must be added to all the one-period rates in the binomial tree.) Year o Year 1 Year 2 7.7515% 5.9988% 4.6000% 5.7425% 4.4440% 4.2541% Note: you must show your work to earn full credit. Given the following binomial interest rate tree with equal probability of moving up and down for government bonds, and an OAS of 200 bps for a 7% annual coupon corporate bond that has three years remaining until maturity, and the corporate bond is callable at par one year and two years from now, what should be the price of this corporate bond (as a percentage of par value)? (Spt) [a] (Hint: The binomial tree is for government bonds. In order to price the corporate bond, OAS is the constant spread that must be added to all the one-period rates in the binomial tree.) Year o Year 1 Year 2 7.7515% 5.9988% 4.6000% 5.7425% 4.4440% 4.2541% Note: you must show your work to earn full credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts