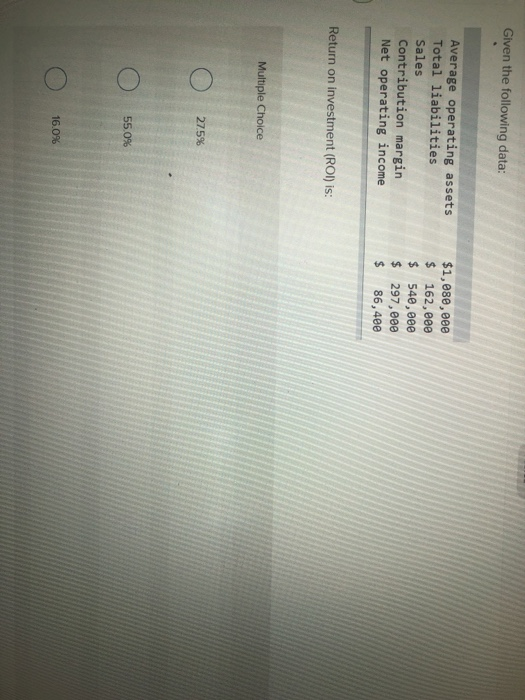

Question: Given the following data: Average operating assets Total liabilities Sales Contribution margin Net operating income $1,080,000 $ 162,00 $ 540,000 $ 297,000 $ 86,400 Return

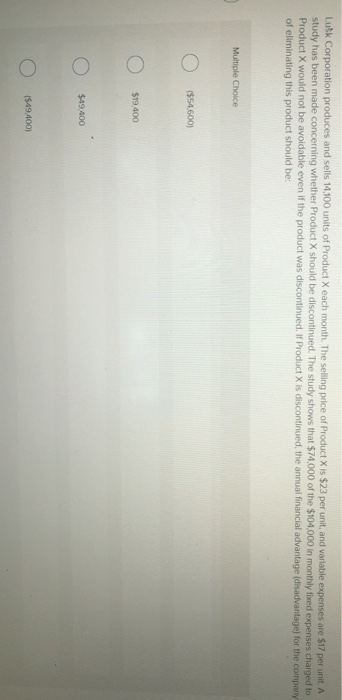

Given the following data: Average operating assets Total liabilities Sales Contribution margin Net operating income $1,080,000 $ 162,00 $ 540,000 $ 297,000 $ 86,400 Return on investment (ROI) is: Multiple Choice 0 27.5% 0 55.0% o 16.0% Luk Corporation produces and sells 14,100 units of Product X each month. The selling price of Product X is $23 per unit, and variable expenses are $17 per unit. A study has been made concerning whether Product X should be discontinued. The study shows that $74,000 of the $104,000 in monthly fixed expenses charged to Product X would not be avoidable even if the product was discontinued. If Product X is discontinued, the annual financial advantage (disadvantage) for the company of eliminating this product should be: Multiple Choice 0 ($54.600) 0 $19.400 0 $49.400 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts