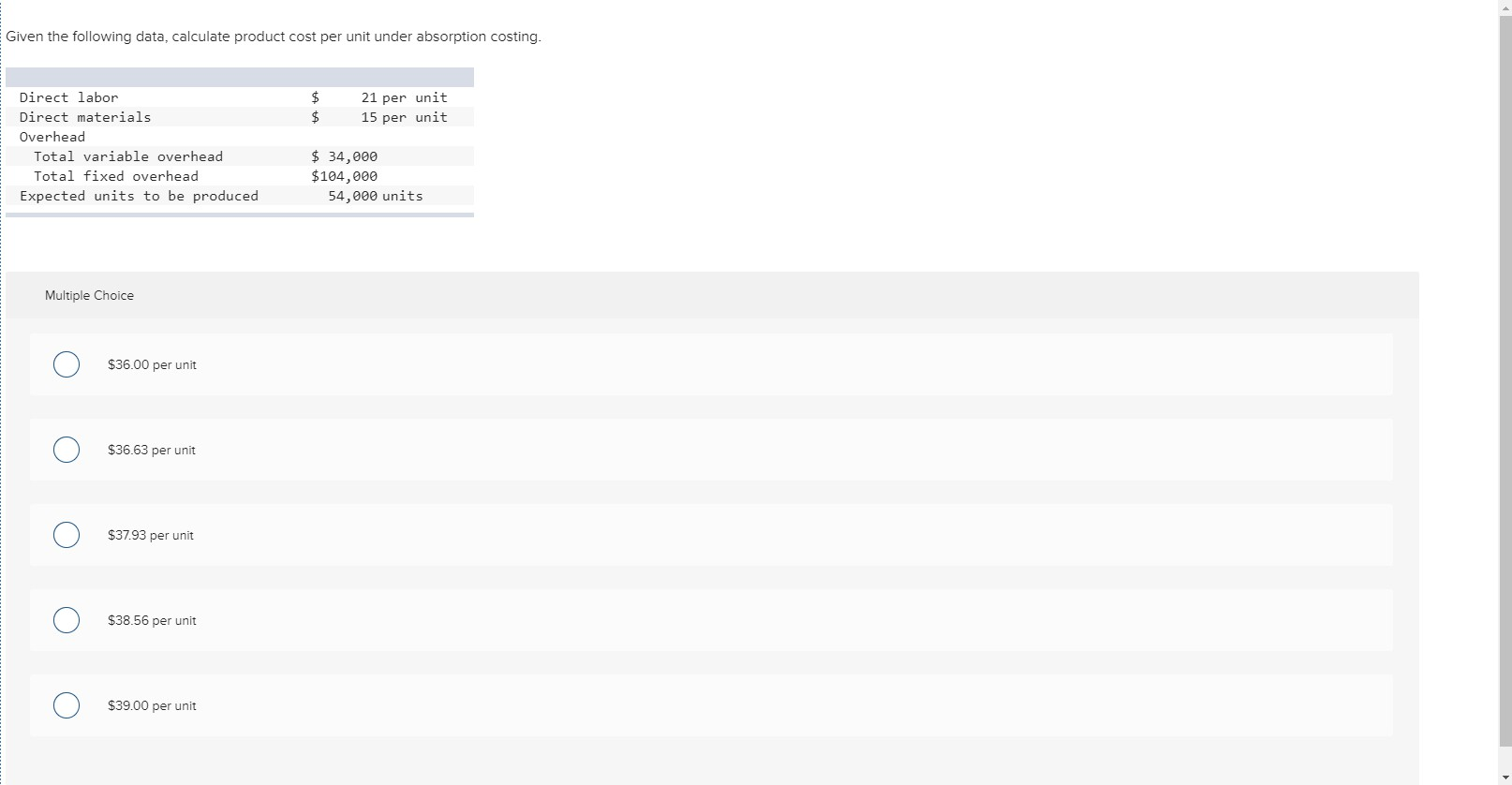

Question: Given the following data, calculate product cost per unit under absorption costing. 21 per unit 15 per unit ta Direct labor Direct materials Overhead Total

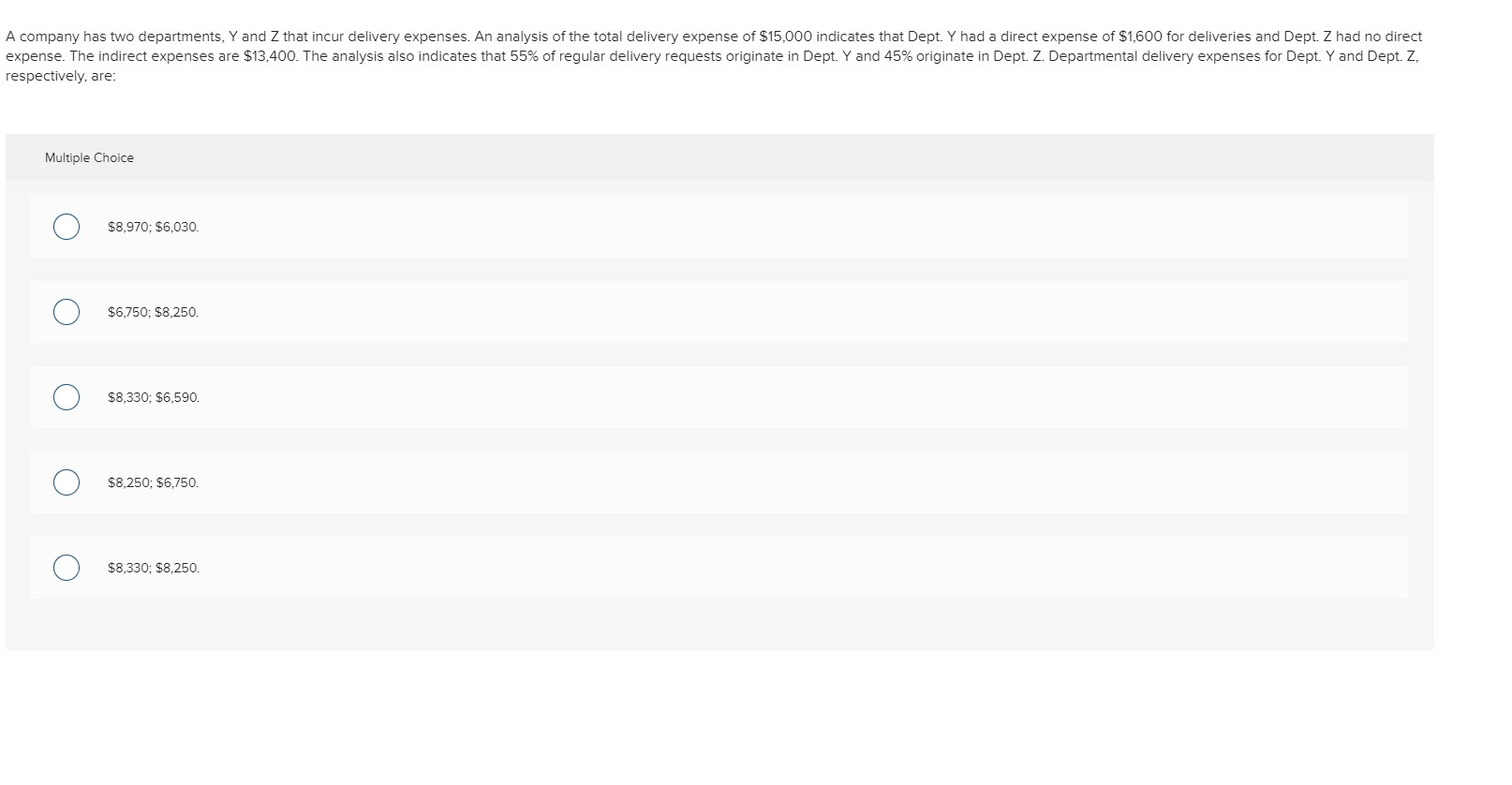

Given the following data, calculate product cost per unit under absorption costing. 21 per unit 15 per unit ta Direct labor Direct materials Overhead Total variable overhead Total fixed overhead Expected units to be produced $ 34,000 $104,000 54,000 units Multiple Choice $36.00 per unit $36.63 per unit $37.93 per unit $38.56 per unit O $39.00 per unit A company has two departments, Y and Z that incur delivery expenses. An analysis of the total delivery expense of $15,000 indicates that Dept. Y had a direct expense of $1,600 for deliveries and Dept. Z had no direct expense. The indirect expenses are $13,400. The analysis also indicates that 55% of regular delivery requests originate in Dept. Y and 45% originate in Dept. Z. Departmental delivery expenses for Dept. Y and Dept. Z, respectively, are: Multiple Choice 0 $8,970; $6,030. 0 $6,750; $8,250. 0 $8,330; $6,590 0 $8,250; $6,750. 0 $8,330; $8,250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts