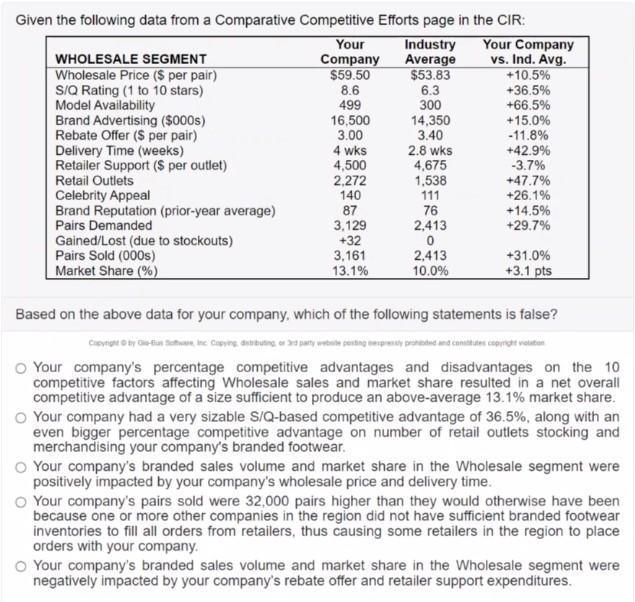

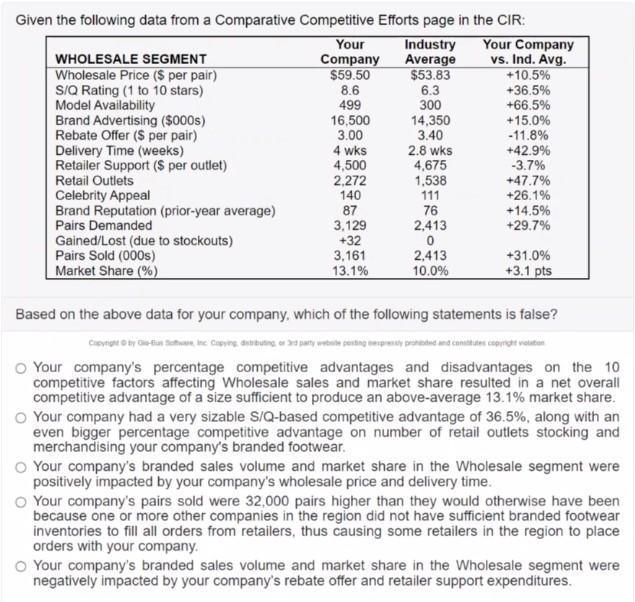

Question: Given the following data from a comparative Competitive Efforts page in the CIR: Your Industry Your Company WHOLESALE SEGMENT Company Average vs. Ind. Avg. Wholesale

Given the following data from a comparative Competitive Efforts page in the CIR: Your Industry Your Company WHOLESALE SEGMENT Company Average vs. Ind. Avg. Wholesale Price ($ per pair) $59.50 $53.83 +10.5% SIQ Rating (1 to 10 stars) 8.6 6.3 +36.5% Model Availability 499 300 +66.5% Brand Advertising ($000s) 16,500 14,350 +15.0% Rebate Offer (s per pair) 3.00 3.40 -11.8% Delivery Time (weeks) 4 wks 2.8 wks +42.9% Retailer Support (s per outlet) 4,500 4,675 -3.7% Retail Outlets 2,272 1,538 +47.7% Celebrity Appeal 140 111 +26.1% Brand Reputation (prior-year average) 87 76 +14.5% Pairs Demanded 3,129 2,413 +29.7% Gained/Lost (due to stockouts) +32 0 Pairs Sold (000s) 3,161 2,413 +31.0% Market Share (%) 13.1% 10.0% +3.1 pts Based on the above data for your company, which of the following statements is false? Can we eye out wity website ting and contes como voluto Your company's percentage competitive advantages and disadvantages on the 10 competitive factors affecting Wholesale sales and market share resulted in a net overall competitive advantage of a size sufficient to produce an above-average 13.1% market share. Your company had a very sizable S/Q-based competitive advantage of 36.5%, along with an even bigger percentage competitive advantage on number of retail outlets stocking and merchandising your company's branded footwear. Your company's branded sales volume and market share in the Wholesale segment were positively impacted by your company's wholesale price and delivery time. Your company's pairs sold were 32,000 pairs higher than they would otherwise have been because one or more other companies in the region did not have sufficient branded footwear inventories to fill all orders from retailers, thus causing some retailers in the region to place orders with your company. Your company's branded sales volume and market share in the Wholesale segment were negatively impacted by your company's rebate offer and retailer support expenditures. Given the following data from a comparative Competitive Efforts page in the CIR: Your Industry Your Company WHOLESALE SEGMENT Company Average vs. Ind. Avg. Wholesale Price ($ per pair) $59.50 $53.83 +10.5% SIQ Rating (1 to 10 stars) 8.6 6.3 +36.5% Model Availability 499 300 +66.5% Brand Advertising ($000s) 16,500 14,350 +15.0% Rebate Offer (s per pair) 3.00 3.40 -11.8% Delivery Time (weeks) 4 wks 2.8 wks +42.9% Retailer Support (s per outlet) 4,500 4,675 -3.7% Retail Outlets 2,272 1,538 +47.7% Celebrity Appeal 140 111 +26.1% Brand Reputation (prior-year average) 87 76 +14.5% Pairs Demanded 3,129 2,413 +29.7% Gained/Lost (due to stockouts) +32 0 Pairs Sold (000s) 3,161 2,413 +31.0% Market Share (%) 13.1% 10.0% +3.1 pts Based on the above data for your company, which of the following statements is false? Can we eye out wity website ting and contes como voluto Your company's percentage competitive advantages and disadvantages on the 10 competitive factors affecting Wholesale sales and market share resulted in a net overall competitive advantage of a size sufficient to produce an above-average 13.1% market share. Your company had a very sizable S/Q-based competitive advantage of 36.5%, along with an even bigger percentage competitive advantage on number of retail outlets stocking and merchandising your company's branded footwear. Your company's branded sales volume and market share in the Wholesale segment were positively impacted by your company's wholesale price and delivery time. Your company's pairs sold were 32,000 pairs higher than they would otherwise have been because one or more other companies in the region did not have sufficient branded footwear inventories to fill all orders from retailers, thus causing some retailers in the region to place orders with your company. Your company's branded sales volume and market share in the Wholesale segment were negatively impacted by your company's rebate offer and retailer support expenditures