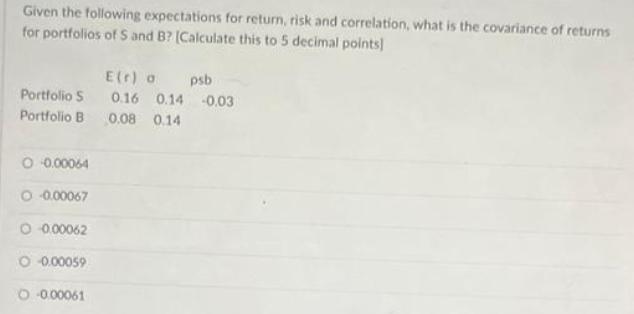

Question: Given the following expectations for return, risk and correlation, what is the covariance of returns for portfolios of S and B? [Calculate this to

Given the following expectations for return, risk and correlation, what is the covariance of returns for portfolios of S and B? [Calculate this to 5 decimal points] Portfolio S Portfolio B 0.08 0.14 O 0.00064 O 0.00067 E(r) a psb 0.16 0.14 -0.03 O 0.00062 0 -0.00059 -0.00061

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step 1 Covariance of return is calculated using followi... View full answer

Get step-by-step solutions from verified subject matter experts