Question: Given the following financial statements, construct the balance sheet for 2016 and answer the questions that follow. Income Statement Sales Expenses excluding depreciation and

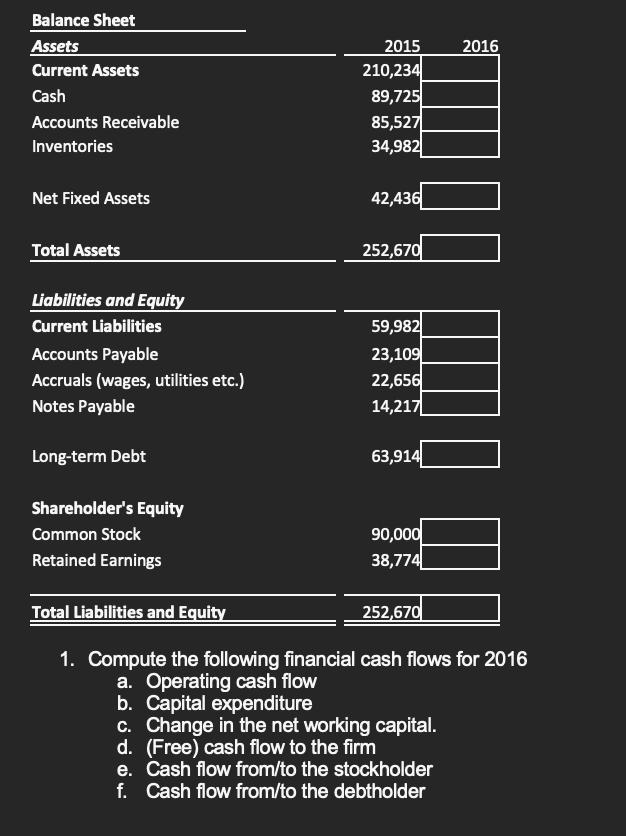

Given the following financial statements, construct the balance sheet for 2016 and answer the questions that follow. Income Statement Sales Expenses excluding depreciation and amortization EBITDA Depreciation and amortization EBIT Interest expense EBT Taxes (20%) Net income Common dividends Addition to retained earnings Cash flow Statement Operating Activities Net Income Depreciation and amortization Increase in accounts payable Increase in accruals (wages, utilities etc.) Increase in accounts receivable Increase in inventories Net cash provided by operating activities Investing Activities Addition to property, plant, and equipment Financing activities Increase in notes payable Increase in long-term debt Increase in common stock Payment of common dividends Net change in cash 20% 2016 655,150 386,878 268,272 7,388 260,884 8,574 252,310 50,462 201,848 12,554 189,294 2016 203,409 201,848 7,388 7,652 7,821 -17,838 -3,462 -32,117 -32,117 12,296 2,500 12,350 10,000 -12,554 183.588 Balance Sheet Assets Current Assets Cash Accounts Receivable Inventories Net Fixed Assets Total Assets Liabilities and Equity Current Liabilities Accounts Payable Accruals (wages, utilities etc.) Notes Payable Long-term Debt Shareholder's Equity Common Stock Retained Earnings Total Liabilities and Equity 2015 210,234 89,725 85,527 34,982 42,436 252,670 59,982 23,109 22,656 14,217 63,914 90,000 38,774 252,670 2016 1. Compute the following financial cash flows for 2016 a. Operating cash flow b. Capital expenditure c. Change in the net working capital. d. (Free) cash flow to the firm e. Cash flow from/to the stockholder f. Cash flow from/to the debtholder

Step by Step Solution

There are 3 Steps involved in it

Balance Sheet Explanation a Operating Cash Flow 203409 Cash Flow from Operating Activities b Capital ... View full answer

Get step-by-step solutions from verified subject matter experts