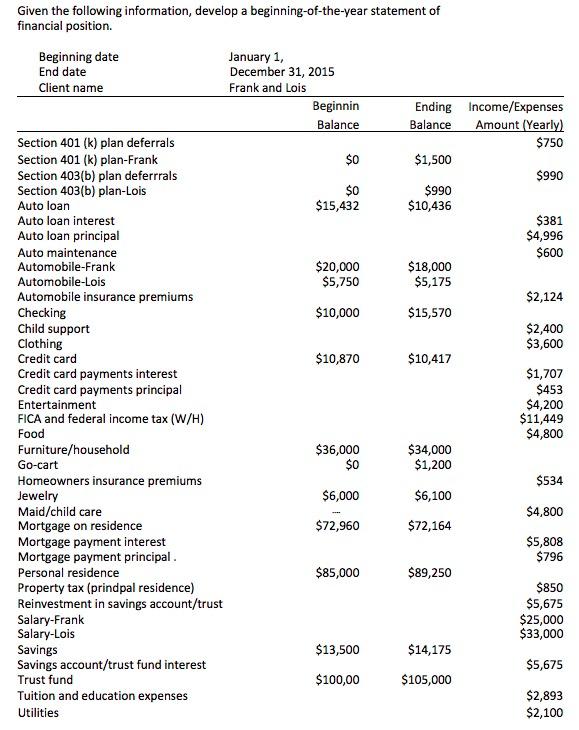

Question: Given the following information, develop a beginning-of-the-year statement of financial position. Beginning date End date Client name Section 401(k) plan deferrals Section 401(k) plan-Frank Section

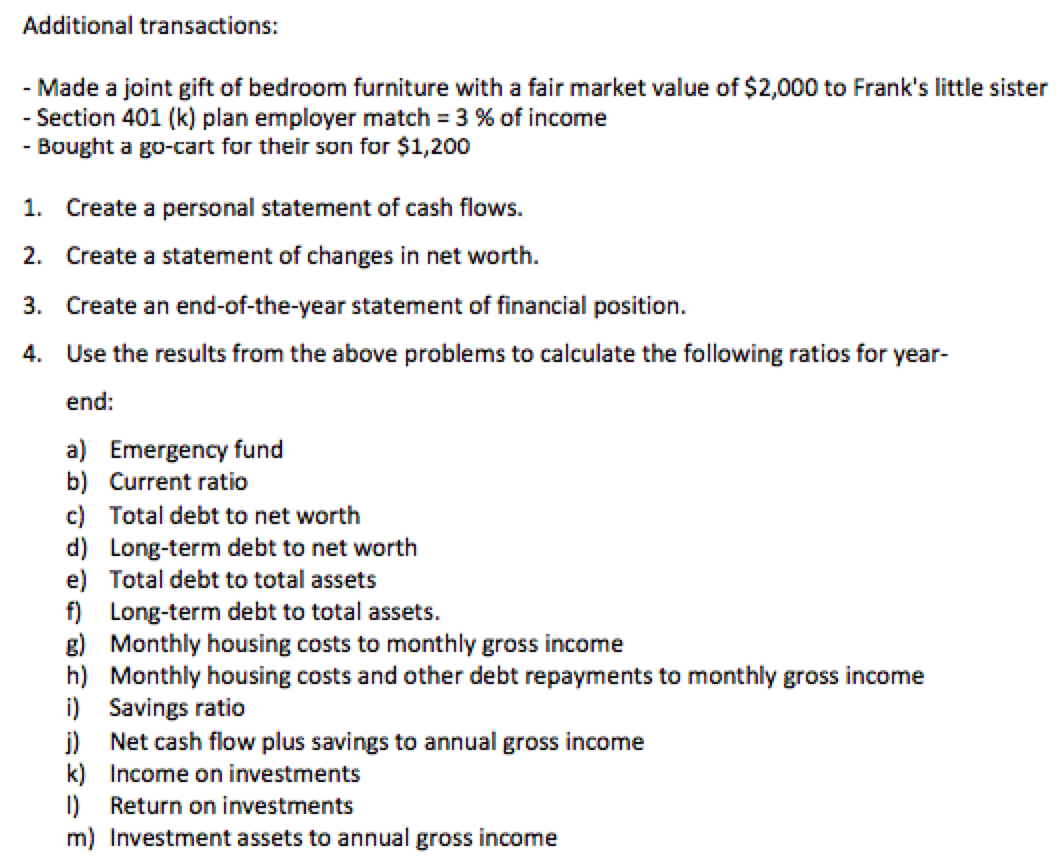

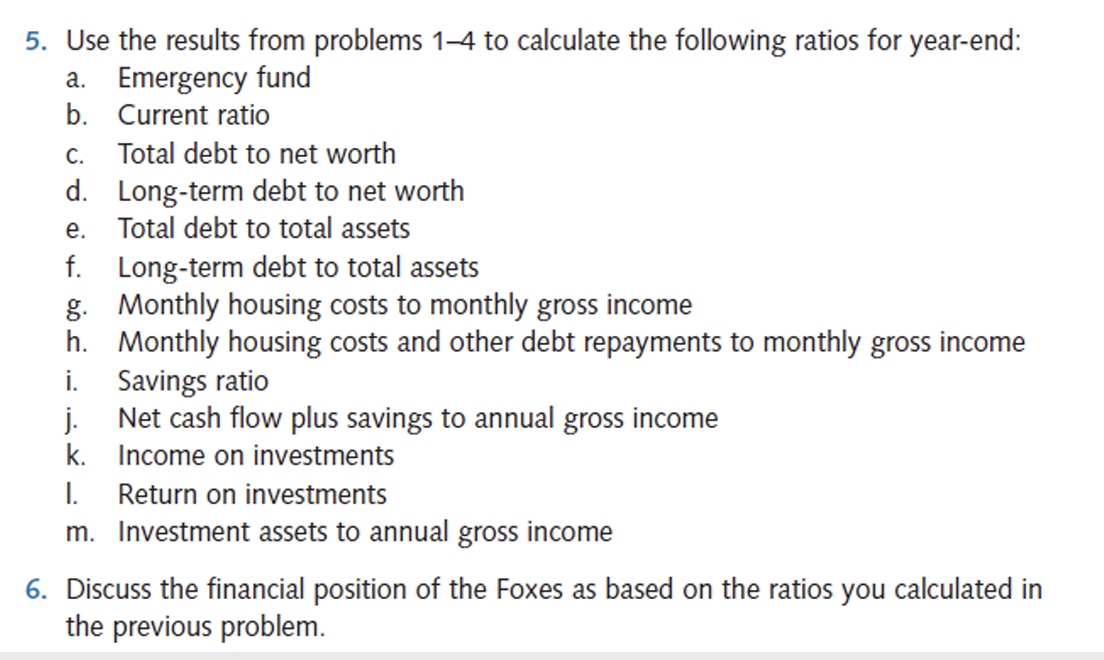

Given the following information, develop a beginning-of-the-year statement of financial position. Beginning date End date Client name Section 401(k) plan deferrals Section 401(k) plan-Frank Section 403(b) plan deferrrals Section 403(b) plan-Lois Auto loan Auto loan interest Auto loan principal Auto maintenance Automobile-Frank Automobile-Lois Automobile insurance premiums Checking Child support Clothing Credit card Credit card payments interest Credit card payments principal Entertainment FICA and federal income tax (W/H) Food Furniture/household Go-cart Homeowners insurance premiums Jewelry Maid/child care Mortgage on residence Mortgage payment interest Mortgage payment principal. Personal residence Property tax (prindpal residence) Reinvestment in savings account/trust Salary-Frank Salary-Lois Savings Savings account/trust fund interest Trust fund Tuition and education expenses Utilities January 1, December 31, 2015 Frank and Lois Beginnin Balance $0 $0 $15,432 $20,000 $5,750 $10,000 $10,870 $36,000 $0 $6,000 $72,960 $85,000 $13,500 $100,00 Ending Income/Expenses Amount (Yearly) Balance $750 $1,500 $990 $10,436 $18,000 $5,175 $15,570 $10,417 $34,000 $1,200 $6,100 $72,164 $89,250 $14,175 $105,000 $990 $381 $4,996 $600 $2,124 $2,400 $3,600 $1,707 $453 $4,200 $11,449 $4,800 $534 $4,800 $5,808 $796 $850 $5,675 $25,000 $33,000 $5,675 $2,893 $2,100 Additional transactions: - Made a joint gift of bedroom furniture with a fair market value of $2,000 to Frank's little sister - Section 401(k) plan employer match = 3 % of income Bought a go-cart for their son for $1,200 - 1. Create a personal statement of cash flows. 2. Create a statement of changes in net worth. 3. Create an end-of-the-year statement of financial position. 4. Use the results from the above problems to calculate the following ratios for year- end: a) Emergency fund b) Current ratio c) Total debt to net worth d) e) Total debt to total assets f) Long-term debt to total assets. g) Monthly housing costs to monthly gross income h) Monthly housing costs and other debt repayments to monthly gross income Savings ratio i) j) Net cash flow plus savings to annual gross income k) Income on investments 1) Return on investments m) Investment assets to annual gross income Long-term debt to net worth 5. Use the results from problems 1-4 to calculate the following ratios for year-end: a. Emergency fund b. Current ratio C. Total debt to net worth d. Long-term debt to net worth e. Total debt to total assets f. Long-term debt to total assets g. Monthly housing costs to monthly gross income h. Monthly housing costs and other debt repayments to monthly gross income i. j. Savings ratio Net cash flow plus savings to annual gross income k. Income on investments I. Return on investments m. Investment assets to annual gross income 6. Discuss the financial position of the Foxes as based on the ratios you calculated in the previous

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts